What happens when QE stops? (pop?)

News

|

Posted 29/09/2014

|

3423

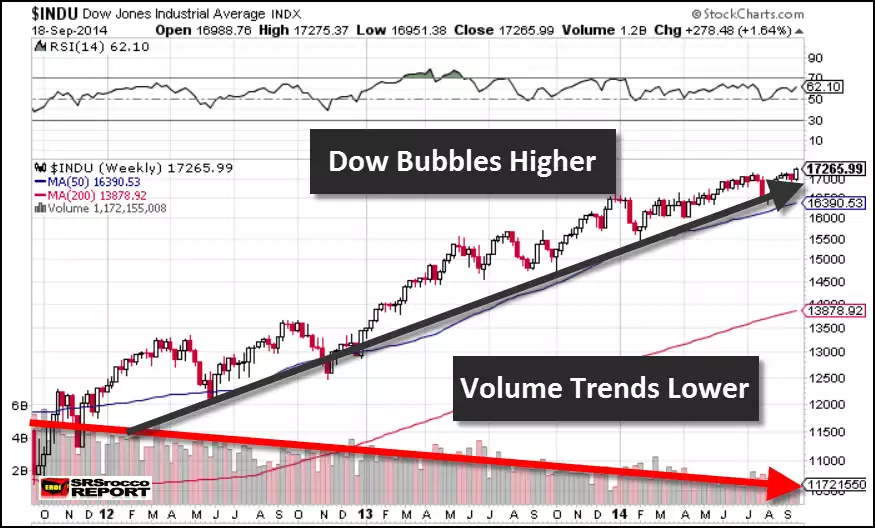

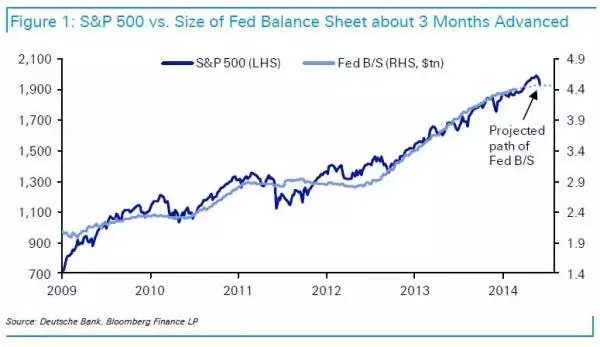

A few months ago we reported on the study that showed central banks had bought nearly half of the shares in global markets with their printed money. It appears to be still happening with Bank of Japan just last week admitting they bought another $1.2b of shares in August. The chart below tells the story of an artificially inflated market with the Dow Jones reaching all time highs last week despite trading volumes at long term lows. i.e. it’s not retail buyers propping up the sharemarket it is money direct from the Fed printing presses. The second graph puts that very very clearly (Fed balance sheet is the running total of the debt created to print the money). Can we just remind you that the US Fed is due to stop printing money (QE) next month….