Has Canada Marked the “Trudeau” Bottom in Gold?

News

|

Posted 08/03/2016

|

5935

News broke last Thursday night that Canada had sold the last of its gold reserves as it deals with its post mining boom tumbling economy.

Whilst we reported recently that Venezuela had done something similar, it is neither a G20 country nor did they sell it all (less than a third). What Canada has done is more extraordinary for couple of reasons.

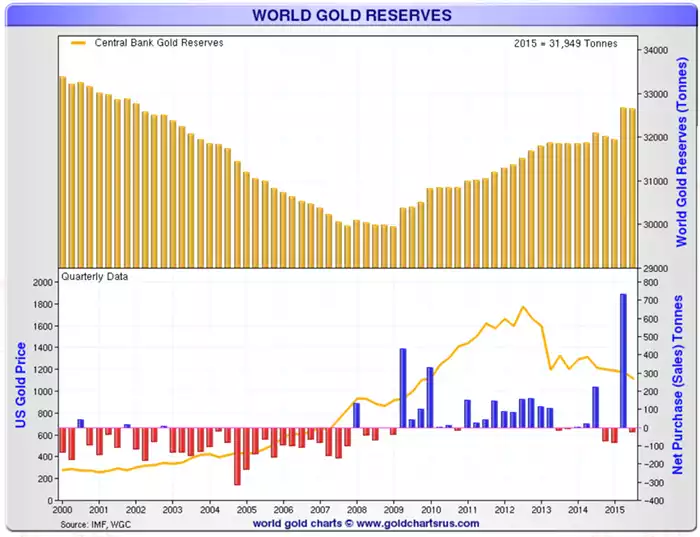

Firstly, as can be seen from the graph below, central banks have been strong buyers of gold since the GFC. Prior to the GFC and post the gold standard dismantling in the early 70’s, central banks were sellers of gold reserves. ‘Who needs it?’ they may have been thinking…. The GFC reminded them of gold’s value in a diversified portfolio (590 tonne just last year as things appear to be unravelling again). This latter point is what makes Canada’s move seem so desperate and ill-considered. They now have close to 60% of their reserves in the USD. Hardly balanced, and against responsible central bank ‘policy’ (eggs and baskets).

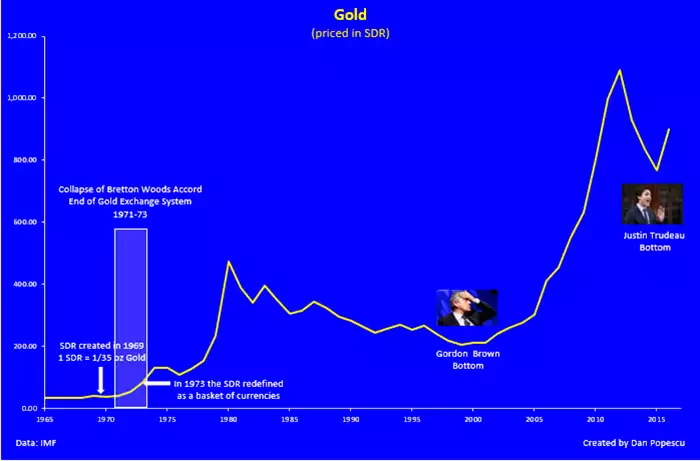

Whilst gold is up 20% this year, it has really only just recently bottomed in this last cycle. That of course is prompting comparisons of what Canadian Prime Minister Trudeau just did with what British Prime Minister Brown did in 1999 when he sold around half of their gold reserves at the very bottom of that cycle (see the chart below). That lowest price in 20 years is affectionately called the Brown Bottom. Who knows, maybe we just witnessed the Trudeau Bottom…?

Another lesson in this news is the beauty of gold’s liquidity. As with Canada at a macro level, at a micro level we as individuals don’t always get to choose when we need funds. The beauty of having gold and silver is that it provides choice on a number of levels. Firstly, when you need to liquidate an investment for cash it is nice to have a diverse portfolio so you can choose to liquidate that asset that is currently performing best. Secondly, as opposed to property, you can liquidate just part of your gold or silver holding, selling just a few bars/coins as needed, and can do so immediately rather than waiting for your property to hopefully sell.