Macquarie Calls Gold Up & AUD Headwinds

News

|

Posted 21/06/2017

|

6312

Macquarie Bank’s latest Global Macro Outlook warns that the global economy’s growth has peaked and combined with China’s tightening bias ‘propagating a destock cycle through the manufacturing chain’, they are particularly concerned about commodities:

"hopes for accelerating global growth and accompanying healthy reflation are fading. The industrial recovery cycle has matured, and is providing less global impetus….. things were too good to be sustainable earlier in the year, with many commodities trading out of cost curves. Cyclically, that means commodity positioning should be generally defensive, with even those commodities having raw material constraints under pressure. But as the reflation tide goes out, it gives an opportunity to discern which commodities genuinely have strong fundamentals. Structurally, it is a time to start picking longer-term winners.”

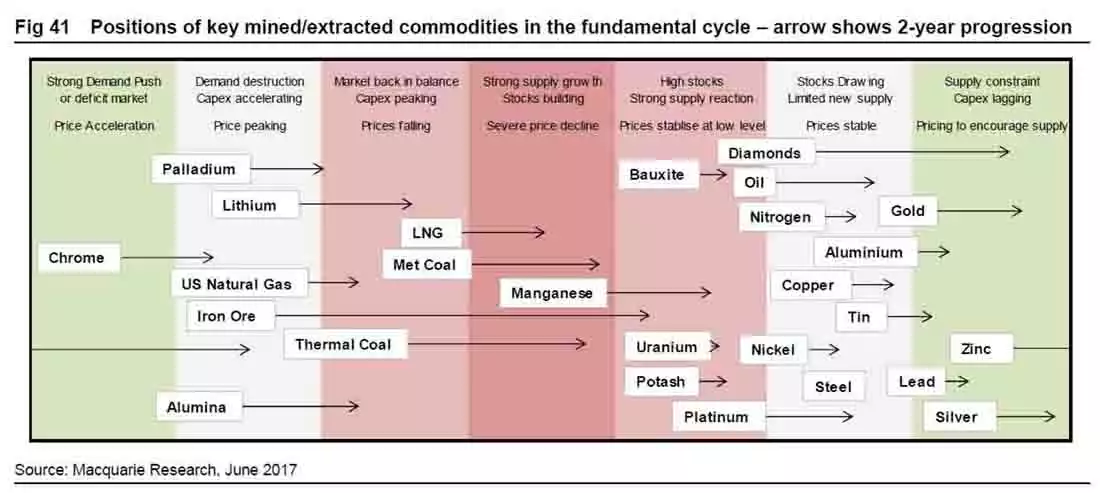

To do this Macquarie revert to the fundamental ‘commodity cycle’ rule of demand leading, followed by supply reacting but with a lag; all facilitated by price.

They believe 2017 has provided “another classic example of this” playing out. Visually that looks like this:

Whilst maybe not immediately apparent, the above cycle diagram (the cycle restarts at the left when you run out on the right) has double implications for Aussie gold and silver holders.

As you can see they have both metals coming off the bottom of the cycle and heading into strength. Specifically on gold they said:

“The external environment for gold has given mixed messages so far in 2017. The US economy has been disappointing, but Fed rate expectations have remained solid. The dollar is down, but mainly because the euro is up. US political risk has risen, but in Europe it has fallen. This has meant investor interest has been relatively light, and what gains the price has made seem largely down to an improving physical balance. But investors don’t stay on the sidelines for long in the gold market and while short-term we remain cautious – the Fed is going to raise rates – long-term we think the US economy is near full capacity, potential growth rates are low and long-term yields will peak far lower than the market expects. This is setting up a positive gold price performance in 2H.”

Now check out Australia’s biggest exports all sitting in the ‘red zone’. That’s not good for our economy and Aussie dollar in particular. A dropping AUD adds even more gains to the USD spot price increases they predict. There are some encouraging sectors for us though in copper and uranium but the ‘big ones’, and our reliance on China don’t bode well. Here is their conclusion:

“Over the coming months, commodities as a whole look set to face slightly more headwinds than tailwinds. We would avoid those most exposed to Chinese construction, given it is currently so strong that the next move is likely to be lower. This means further pressure on iron ore, metallurgical coal and manganese. In contrast, we expect upside to gold and silver over the coming months as the market refocuses from healthy reflation to deflation potential. We also believe the wider market has become too sanguine to weather risks in agricultural markets, where we feel risk/reward is skewed to the upside.”

“On a longer-term view, we like exposure to copper, silver, gold, chrome and, eventually, oil. We also believe that uranium and potash are at the start of a long crawl off the canvas after a tough couple of years.”