We Want MOAR – Fed Spoils Party

News

|

Posted 20/08/2020

|

8079

Last night the Fed released the minutes of its last meeting and the market reaction was harsh. Basically everything sold off barring the USD. Gold and silver were the worst hit, down 3.2% and 4.2% respectively. So what did they say to cause this reaction?

First let’s just look at the language the Fed is using to describe the biggest economy in the world:

“Members agreed that the ongoing public health crisis would weigh heavily on economic activity, employment and inflation in the near term and was posing considerable risks to the economic outlook over the medium term,”

They called the uncertainty surrounding the economic outlook as "very elevated." and said the risks include additional waves of outbreaks and the possibility that the government's fiscal support for households, businesses and state and local governments might not be enough.

Some mentioned that banks and other financial institutions could come under "significant stress" if more adverse scenarios unfold regarding the spread of the virus.

Further, the pace of employment gains "likely slowed" from May and June, they said. And they saw the labour market as "a long way from full recovery even after the positive May and June employment reports."

So in essence, not getting better and indeed plenty of downside risk.

One ‘positive’ was the jump in household spending, recovering around half of its previous decline but even that was caveated as supported by the government handouts being spent.

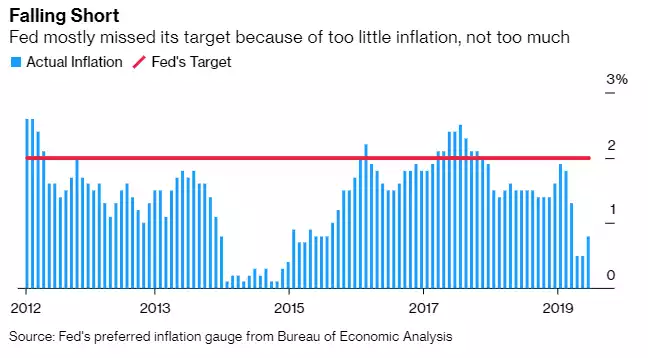

However inflation continues to be nowhere near their 2% target:

There was also no sign of easing up the stimulus train with rates held at near zero and maintaining their $120 billion / month Treasury and mortgage backed securities buy up and no end articulated.

So understandably some semblance of fundamentals in shares falling on confirmation the economy is bad and possibly getting worse, but why would gold, silver and bonds fall??

It seems it is largely due to the Fed not giving more guidance on increased (MOAR) stimulus which many were expecting after comments in the last meeting and also their dismissing the notion of Yield Curve Control (YCC) as the next tool.

So firstly, the Fed, God forbid, have decided not just to not jawbone the market higher with talk of more stimulus, but also start to discuss how on earth they could communicate to the market raising rates when the time comes and how to know when that time had come….

On YCC the minutes revealed:

“Of those participants who discussed this option, most judged that yield caps and targets would likely provide only modest benefits in the current environment, as the Committee’s forward guidance regarding the path of the federal funds rate already appeared highly credible and longer-term interest rates were already low,”

We explained YCC back in June here. Only Japan and Australia are implementing it. The Fed are basically saying they don’t need to as their rates are already near zero bound, and as previously outlined they are still buying up $120b/month without it!

We have reached peak insanity and Fed reliance when a market reacts like this when an already unprecedented stimulus package is not unprecedented enough… Nothing changed last night. We’d argue pretty vigorously that funds haven’t been flowing into gold and silver on the premise of YCC and even more stimulus coming, but rather the amount happening now. We’d also argue just as vigorously that if and when the economy gets worse, the Fed chose its words very carefully to open the flood gates further, and won’t hesitate. And finally don’t discount the notion that Fed Chairman Powell wouldn’t secretly love to see US shares crash leading into November’s election after enduring being Trump’s punching bag for the last couple of years…

When something doesn’t make sense causing a dip, it could be a dip worth buying.