Wall St Piles Into Gold

News

|

Posted 12/07/2016

|

5107

It only seems like yesterday that Wall Street considered gold a “pet rock”, unnecessary in a world of easy-money-fuelled financial asset growth.

Coincidence or not, but since the December US rate rise (as discussed in that Pet Rock story) gold has seen 25% price growth (30% in USD spot terms) as the world started seeing the inevitable wobbles one experiences under the weight of all the debt that easy money expansion entailed. Throw in a Brexit and some worrisome Euro banks and it can shrug off even the ‘best’ of news out of the US as we saw Friday night.

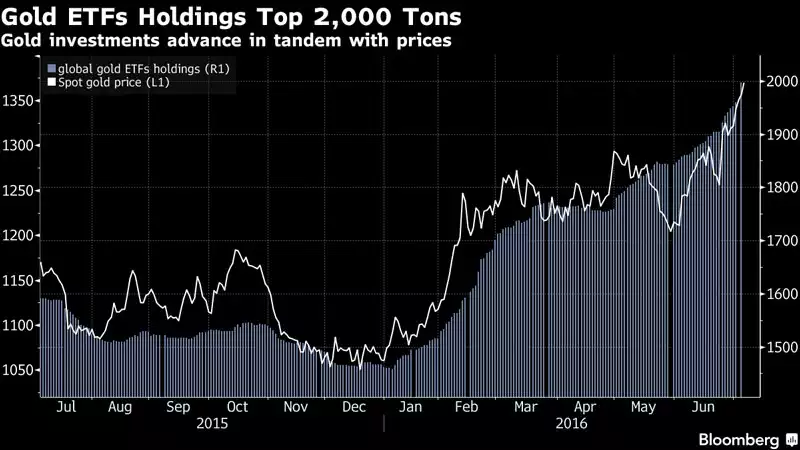

But the real irony of gold’s price surge is that a lot of it is being driven by the Wall St type vehicles of ETF’s (Exchange Traded Funds) and COMEX Futures. As you can see below, the first graph shows aggregated ETF gold holdings exceeding 2,000 tonne for the first time in 3 years. That is a figure greater than China’s reported gold reserves.

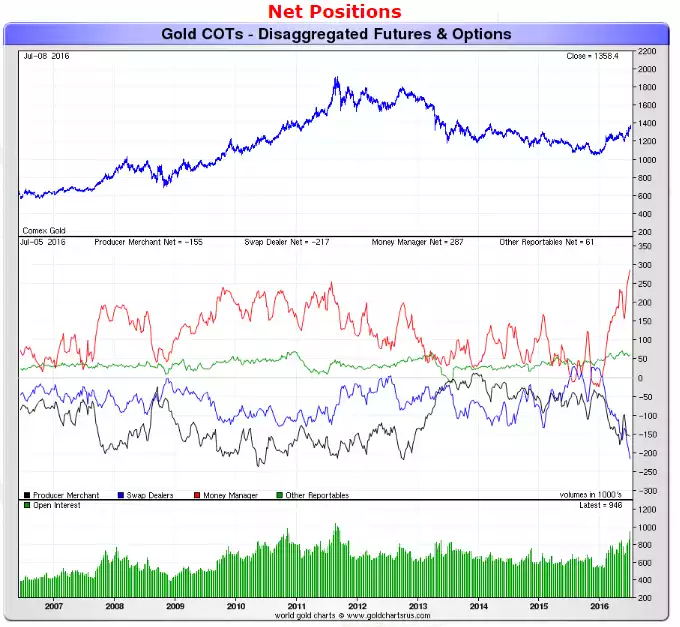

This second graph shows that, yet again, last week saw a new all-time record high for long positions by the Managed Money category in COMEX futures.

There is also a growing chorus of major banks and institutions calling the bull market as in for gold. UBS have called this as the early stages of the next bull run, predicting US$1,400 in the short term and ABN Amro likewise are calling $US1,425 this quarter.

Of course whilst Wall St is comfortable with all these paper claims to gold, we mere mortals can buy the real thing, physical gold with no counterparty risk, and store it for less than the annual ETF charges…