VLG Break Out – “mother of all short setups”

News

|

Posted 21/01/2019

|

6257

Just as Australia’s sharemarket indices are dominated and skewed by a few banks and miners, so too the world’s biggest and most important sharemarket, the US has indices (S&P500 and Dow Jones Industrial Average) skewed or dominated by the likes of the FAANGS and hence potentially masking the broader story. The Lyon’s Share’s Dana Lyon has produced what he believes is the most important or instructive chart, the Value Line Geometric (VLG) Composition chart. This chart tracks the median US share performance across 1800 companies. The premise is that research says 70-80% of the determinant of the trend direction of any individual share is based on the trend of the overall market.

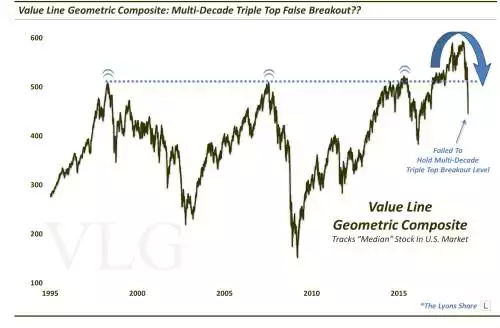

As you can see below, there has been a ‘magic line’ at around 510 where, when breached, saw the dot.com and GFC market crashes over the last 20 odd years. We then saw it breached again in 2015 before we saw that 15% correction in the S&P500 and gold rally to USD1380. But the stimulus of Trump’s claims to Make it Great again and QE in the Eurozone, Japan and China meant the correction was just that, and no recession ensued.

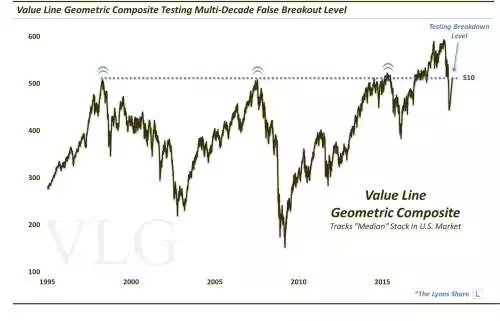

The rally out of that was strong and firmly smashed through the 510 line with gusto. Then late last year we saw the market realise that maybe that wasn’t really real, maybe it was all on stimulus and a short lived tax cut ‘hit’ and the reality of rising rates against all that debt, trade wars and geopolitical tensions and uncertainty saw a big sell off. We then saw the big bounce back since the end of last year, with the market up over 15% in just these first few weeks of 2019. That bounce has put this index back above the 510 line.

So we find ourselves at a very interesting juncture right now. Is the bounce of the last few weeks a false one or structural, to see this index blast through a 20+ year trend and somehow be different? Or are we about to see the sort of correction we saw in 2001/2 and 2008/9 as history would indicate?

As Lyon says: “IF it is the latter, considering the decades of price relevance here, this may be the mother of all short setups.”