U.S Mid Terms & How They Affect You

News

|

Posted 07/09/2022

|

6623

Whilst there is a lot of focus on the admittedly quite staggering cost of living pressures in the UK and Europe, maybe a more important barometer to watch is that of the US. We are now less than 2 months away from the US mid term elections and both history and the so called “Misery Index” are pointing to the Republicans taking control of the House. You may be thinking “big deal?” as you sit a few thousand miles away but it likely IS as it affects your investment portfolio.

On the Tuesday after the first Monday of November mid way through a US President’s term America goes to the polls for all of the House seats and around a third of the Senate. History tells us this rarely goes in favour of the sitting President’s party and this time we have a President with one of the worst approval ratings seen in a very long time. The Democrats only hold a five seat majority and Bloomberg Economics are predicting Biden’s Democrats could lose 30 to 40 of their seats in the House but likely retain control of the Senate… just.

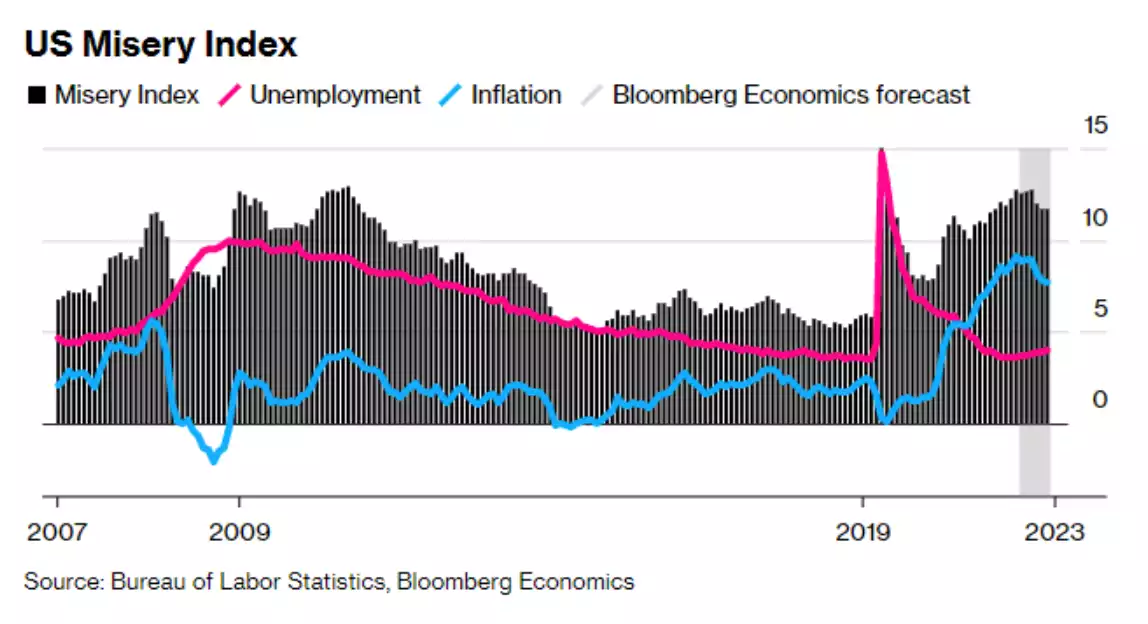

Bloomberg take their cues from the so called US Misery Index - calculated by adding up the inflation and unemployment rates — and projecting it forward through election day.

Whilst headline unemployment is low (keeping the Misery Index lower), the last NFP employment figures saw a massive drop in full-time employment offset by part-time employment and behind the scenes individuals working multiple jobs to keep up. And so whilst the headline numbers don’t show an unemployment problem the sub data shows serious distress. And then we have inflation. From Bloomberg:

“Inflation hit a 40-year high of 9.1% in June, taking the misery index to 12.7%. It likely won’t decline all that much before Americans go to the polls.

Bloomberg Economics projects an index reading at 12% in October. Take away the worst months of the pandemic crisis in early 2020, and that’s close to the highest levels seen for a decade and more -– rivaling the aftermath of the Great Recession, when unemployment hit 10% and Democrats got what then-President Barack Obama called a “shellacking’” in the midterms.”

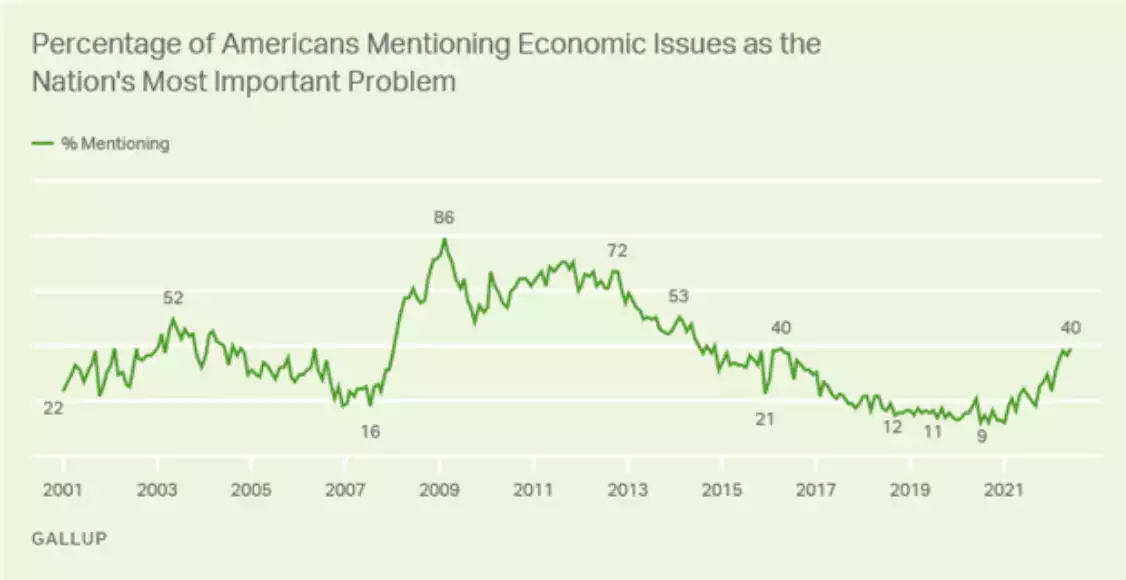

In the myriad of considerations before voters, the US economy is their main concern with 40% of respondents to a recent Gallup poll naming it as the most important problem:

But here’s why this affects YOU. An excellent summation by Daily FX:

“A walk down memory lane is necessary to grasp the potential earthquake coming to US policy – both fiscal and monetary – over the coming months.

In 2010, after former US President Barack Obama and a Democratic majority in the Senate and the House of Representatives passed The Affordable Care Act during the Global Financial Crisis, there was a wave of backlash from voters across the country. To save the banking system, housing market, and automobile industry, several rounds of federal government spending were announced to help stimulate the economy.

But the backlash was fierce as most American households continued to face financial difficulties and a weak labor market. The US unemployment rate was still near double digits as the housing market remained in shambles. The 2010 US midterm elections saw Democrats lose control of the House of Representatives. Gridlock arrived in Washington, D.C., as a divided Congress refused to push forward more government spending.

Gridlock was the defining feature of the next few years. Republicans, emboldened by their gains in the 2020 US midterm elections, demanded budget austerity to reign in government spending. Bickering ensued, leading to budget sequestration and the US losing its AAA credit rating from Standard & Poor’s in August 2011. By 2014, midway through former US President Obama’s second term, Democrats lost control of the Senate.

While the federal government was effectively paralyzed by a divided Congress, and then with a Democrat in the White House while Republicans controlled all of Congress, there was only one game in town to help provide support for the US economy: the Federal Reserve.”

What followed is of course not a surprise to regular readers. Just as now, the Fed had the choice of raising rates into a weakly recovering economy and risk killing it entirely OR.. keep interest rates at near zero and crank the QE money printing presses. They clearly chose the latter. The difference of course now is they are not ‘keeping’ it easy, they are in fact in the throes of aggressively hiking and categorically stating they will continue to do so.

Should the Republicans take control of the House with Democrat Biden in the Whitehouse we are staring yet again at gridlock, no fiscal stimulus, and the Fed carrying the full burden of keeping the patient alive. “Patient” you ask?

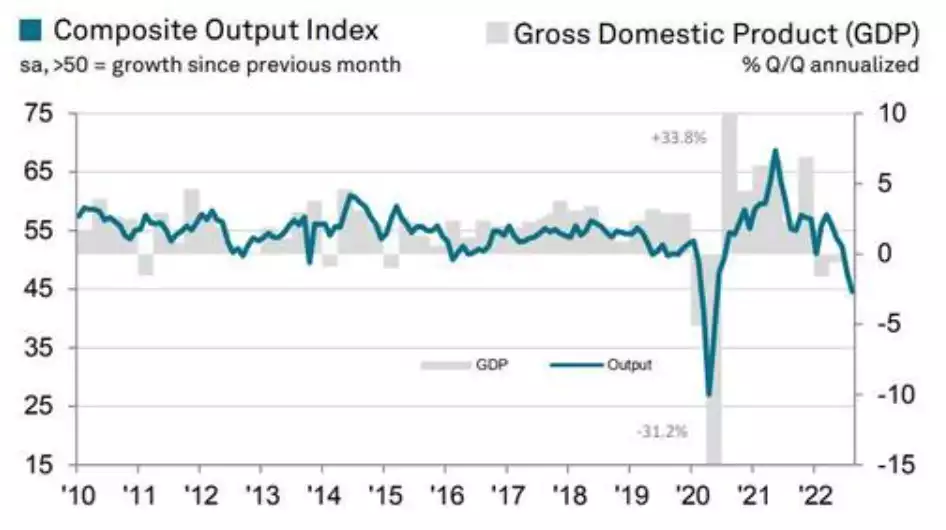

Last night saw the latest S&P Global Services PMI print and it got even worse at 43.7 against 44.1 expected (remembering any sub 50 print is contraction). The Composite PMI printed 44.6, again worsening from 47.7 and its weakest since COVID lockdowns. It also now has the US as the worst of major developed nations.

In the words of the Chief Business Economist at S&P Global Market Intelligence:

"August saw the US economy slide into a steepening downturn, underscoring the rising risk of a deepening recession as households and business grapple with the rising cost of living and tightening financial conditions.

"Businesses are reporting a deterioration in output and order books of a degree exceeded since the global financial crisis only by that seen during the initial pandemic lockdowns.

"While orders are being lost across the board as a result of rising prices and the cost-of-living squeeze, the steepest downturn is being recorded in the financial services sector, reflecting the additional impact of higher interest rates and worsening financial conditions.

"Jobs growth has meanwhile cooled as companies grow increasingly reluctant to expand in the face of falling demand and an uncertain outlook, which will serve to further dampen growth in the coming months.

"One positive form the survey was a substantial fall in the rate of input cost inflation, which should help to moderate consumer price growth in the months ahead, albeit with the rate of increase remaining stubbornly elevated."

Hence “patient”….

And so we arrive back at the Fed’s dilemma. Ease policy (remember they are doing QT as well as hiking rates right now) and exacerbate inflation putting even more pressure on Americans and their populist politicians OR ‘bravely’ continue to tighten, sucking liquidity out of the market, push the US into a major recession and exacerbate the USD wrecking ball exporting inflation to the world. Let us leave you with Daily FX’s take:

“Should US inflation rates subside over the next few months, which would have nothing to do with the composition of the Congress, it means that the Federal Reserve may tack back to preventing a more significant economic downturn, something that is already on its radar now that the US economy has contracted for two consecutive quarters.

If the Federal Reserve does shift gears and move towards interest rate cuts, and at the extreme, reinstitutes asset purchases once more to incentivize investors to change their risk preferences (thereby reducing yields on safer assets, forcing allocation to riskier, growth-sensitive assets) the impact will likely be no different than what happened from 2011 to 2016 or from 2019 to 2020. Such a shift portends a weaker US Dollar; lower US Treasury yields; higher gold prices; higher oil prices; higher cryptocurrency prices; and a float higher by US equity markets.”

We’ve argued previously that both scenarios are constructive for gold as the inevitable economic crash from continuing to tighten into weakness would see the usual flight to safety that is gold.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************