Contrarian’s Delight – Oh What a Night

News

|

Posted 16/08/2018

|

7304

Wow what a night on global markets! The only thing not to get hammered was the USD, US Treasuries and….wait for it… crypto, all of which ended stronger. How’s that for a turnaround for the books lately? But seriously it was a brutal night for gold and silver in particular, with silver down 4%, hitting a 9 year low and the gold silver ratio hitting a 2 ½ year high over 81. That this happened on a Wednesday means we won’t even get to see it in the CoT report as that closes on Tuesday’s each week. You can bet quite safely however that the falls were courtesy of further short positioning by the Managed Money on COMEX Futures markets.

The turmoil was courtesy of Turkey and broader EM ruptures, China’s Yuan tumbling even further (and their sharemarket), and the ECB issuing a warning about Euro banks’ residential property loans sending EU banks down again 21% down for the year.

Globally shares tumbled to 6 week lows and commodities were smashed across the board with the so called “Dr Copper” (in reference to its history as a barometer of economic health) officially in to a bear market.

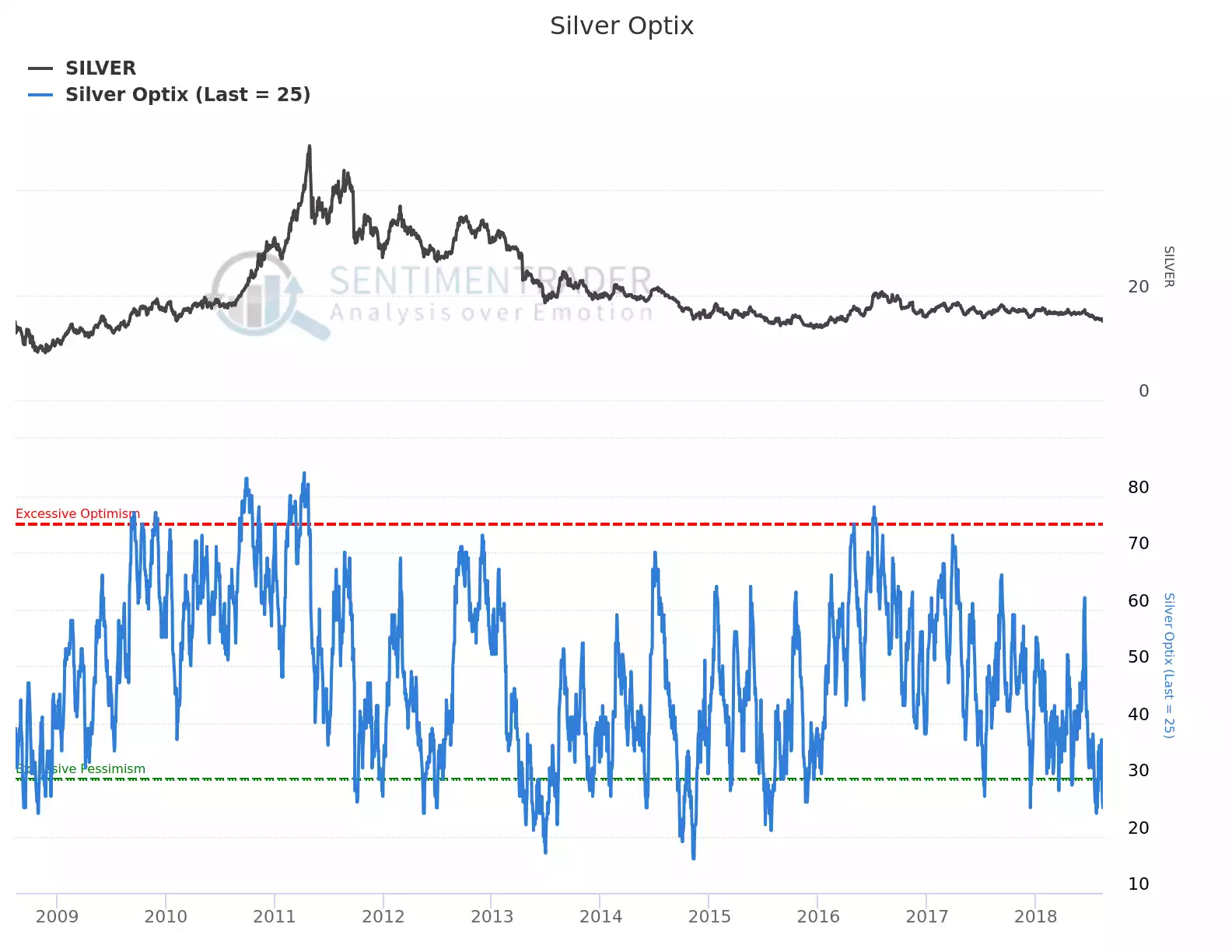

It would be flippantly simplistic to say this is just like 2008 which saw everything drop (including gold and silver) before financials dropped precipitously (halving by the end) and gold and silver surge (gold doubling by the end). We have no idea if this is just a short term blip in financials and gold and silver are victims of the usual ‘everything’s awesome’ euphoria. In this regard the chart below is telling. It is the 10 year look back on the sentiment index for silver (note this is BEFORE) last night’s action which will only add to the poor sentiment.

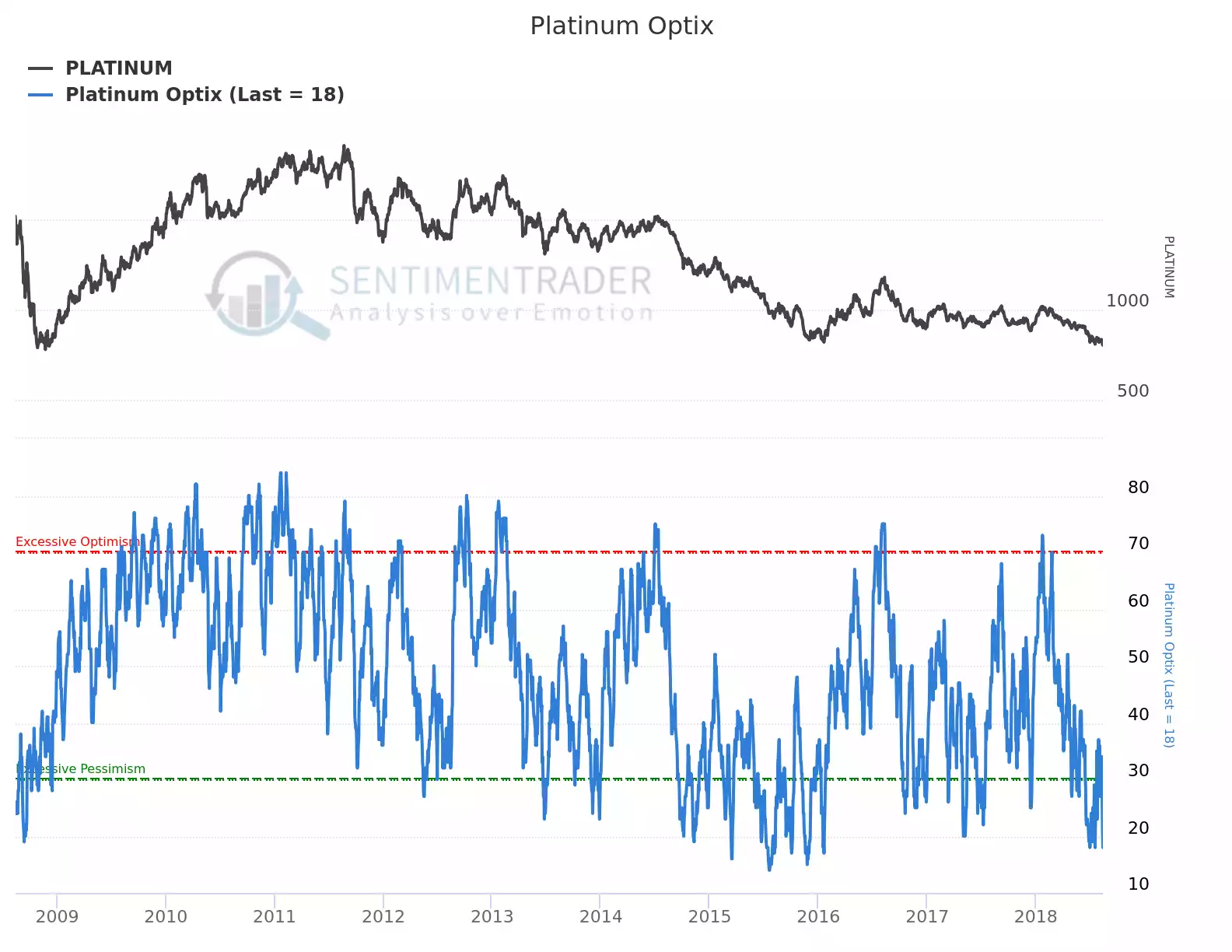

You wouldn’t be surprised to see us nudging 20 again with the price falls last night, such is the nature of human emotions. Gold and platinum are in similar territory though even worse…

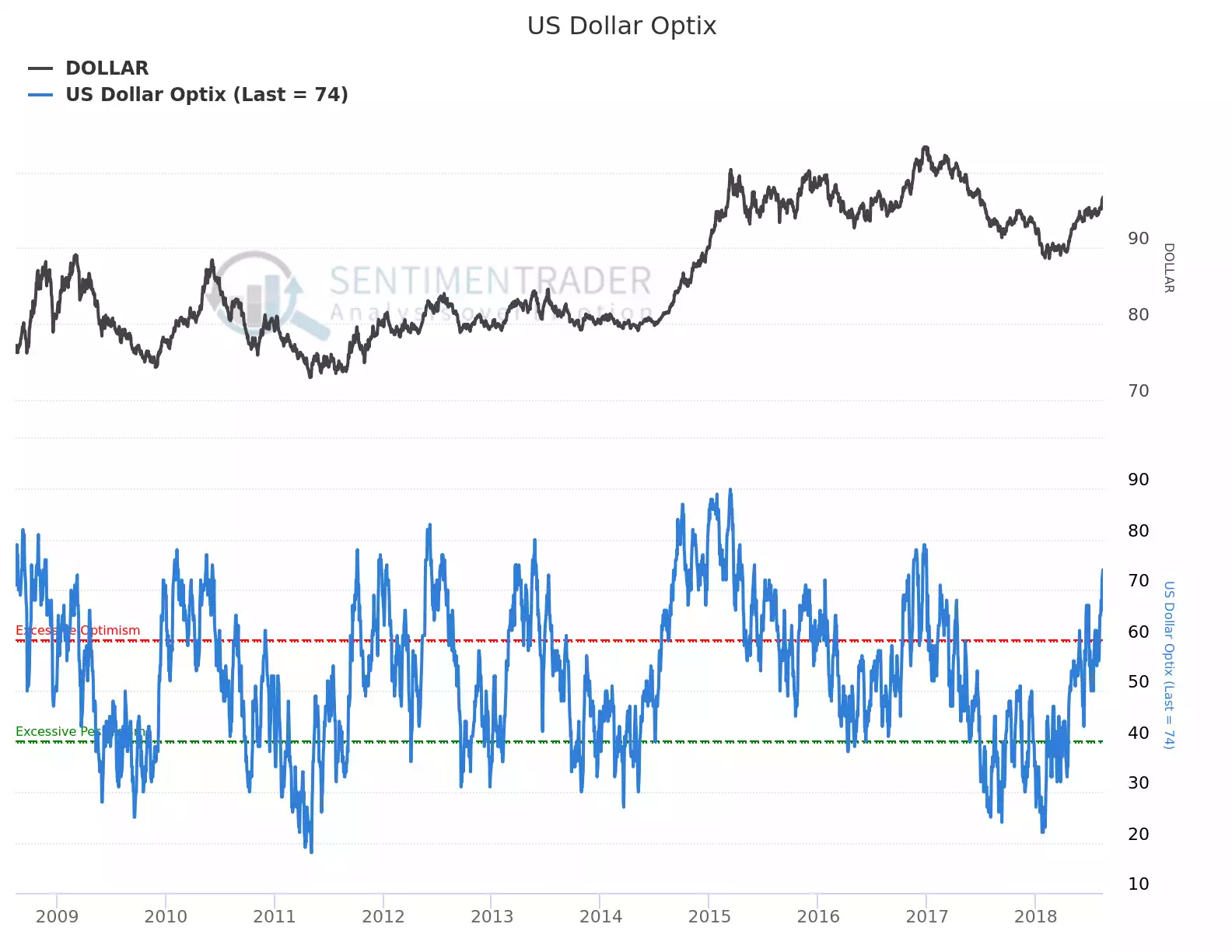

A very large contributor to, or symptom of, this action is full faith and buy up of the USD. You know the USD yeah? It’s the world’s reserve currency, fully Fiat since we left the gold standard in 1971, backed by a country that printed $4.5 trillion of it to bail everyone out of the GFC, who has over $21 trillion of debt that its own Congressional Budget Office is projecting to grow substantially from here, whose Treasury bonds are being sold hand over fist by economic giants of China, Russia and now Turkey, and has a sharemarket heavily overvalued on nearly every accepted metric. So how do people feel about it?

Awesome! Just like before the GFC…. What could possible go wrong from here? Contrarian investors are right now licking their lips at the prospect.