US Fed Raises Rates – Gold rises too

News

|

Posted 14/12/2017

|

6998

According to prophecy the US Fed did indeed increase rates last night from 1.25% to 1.5% despite earlier that day core CPI disappointing at just 1.7%. The Fed indicated they expect 3 more hikes in 2018 (sound familiar?) and that ‘everything is awesome’…

Yet again we saw gold defy predictions of crashing on a rate rise by jumping US$11.40 (0.92%) and silver up 35c (2.2%) as the USD tanked. That tanking USD saw our rising AUD wipe out all the gains in gold and half those in silver.

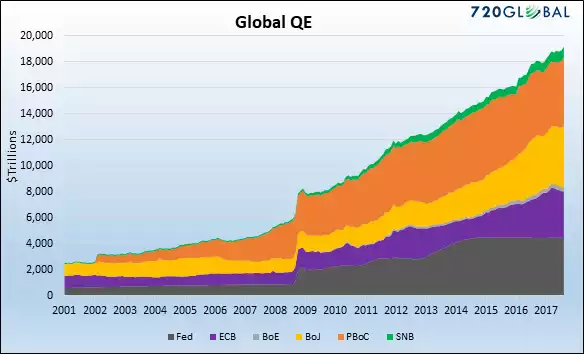

The Fed also said they would increase the unwinding of their $4 trillion balance sheet from $10b/month to $20b/month. Context is important, especially globally, when considering that amount, so lets look at the amount of balance sheet building QE the world has seen since the GFC…

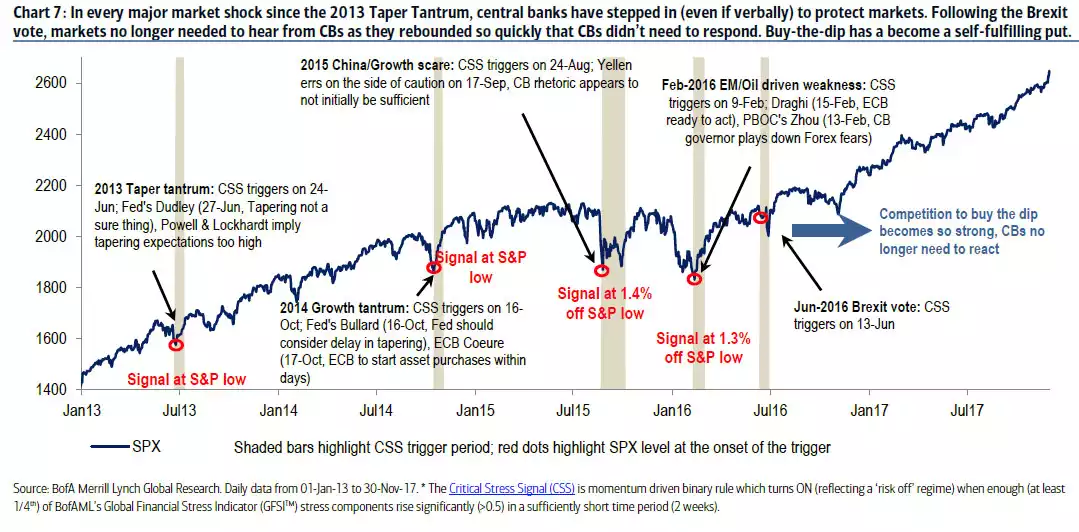

So as markets hit all time highs amongst historically weak real growth and stubbornly weak inflation the Fed is raising rates… Bank of America Merrill Lynch remind us as follows how central banks like the Fed have jumped in on any hiccup since 2013.

The Fed needs to balance raising rates to give themselves room to ease on the inevitable crash they have themselves preordained, whilst doing so quickly as to trigger that very same crash…. Last night was Yellen’s last meeting and we see Jerome Powell take over the chair. She made it clear last night he was part of the 7-2 ‘consensus’ that rose rates last night.

One thing is for sure, it is a precarious set up for Mr Powell to navigate…