Gold ETF’s Hit All-Time High

News

|

Posted 10/10/2019

|

7184

Gold ETF’s Hit All-Time High

Demand for gold remains strong with the World Gold Council reporting the highest ever ETF holdings in September and China continuing its buy up of the safe haven metal.

From the WGC’s latest update:

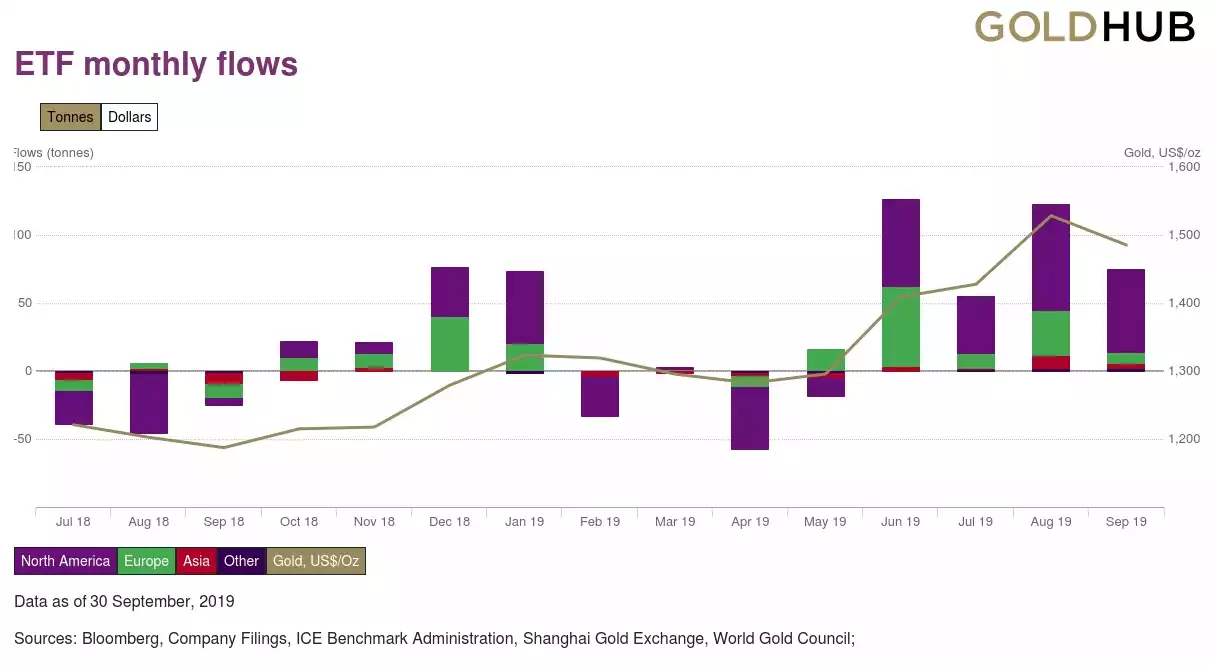

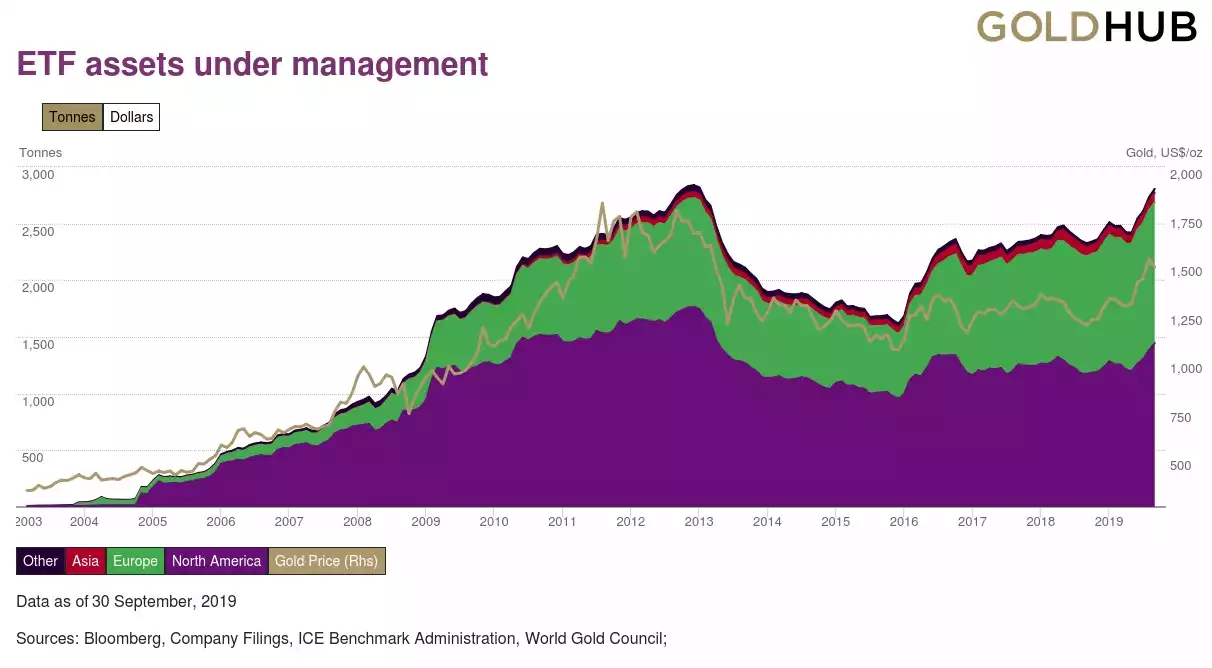

“In September, global gold-backed ETFs and similar products had US$3.9bn of net inflows across all regions, increasing their collective gold holdings by 75.2t to 2,808 tonnes(t), the highest levels of all time. Holdings surpassed late 2012 levels, at which time the gold price was near US$1,700/oz, 18% higher than current levels. Notably, the gold-backed ETF landscape is vastly different than in 2012 when two-thirds of global holdings were concentrated in North America. Today, North American- and European-listed funds make up 52% and 44% of global holdings respectively, with the remainder coming from funds listed in Asia and other regions.

North American funds led September’s global flows, adding 62.1t (US$3.1bn, 4.5% of AUM), or 83% of net inflows. Low-cost gold-backed ETFs‡ continued to grow, accumulating 2.9t during the month and bringing their collective holdings to 61t, worth US$2.9bn. European-listed funds brought in 7.7t (US$586mn, 1.0%), mainly in the UK, as investors positioned for an impeding 31 October Brexit decision. Funds in Asia had another month of strong inflows at 3.9t ($187mn, 4.6%), driven by Chinese funds.”

China also got some headlines this week with their PBOC surpassing 100 tonnes in purchases this year to their reserves after adding another 5.9 tonne in August. Whilst few serious analysts believe that is the full extent of the Government’s purchases (with their more opaque SAFE reportedly buying much more than PBOC) it shows intent if nothing else. From Bloomberg:

““Given strained relations with the U.S., China needs a hedge against its large holdings of the dollar, and gold serves that function,” said Howie Lee, an economist at Singapore-based Oversea-Chinese Banking Corp. “As China becomes a superpower in its own right, I expect more gold-buying.”

The PBOC’s run of bullion-buying has come against the challenging backdrop of the trade war with the U.S. and a marked slowdown in growth at home. While high-level negotiations are set to resume in Washington this week, Chinese officials are signalling they’re increasingly reluctant to agree to a broad deal.”

For a great interview on gold and markets check out this interview of finance industry legend Grant Williams with our good friend Alex Saunders of Nuggets News.

https://www.youtube.com/watch?v=GXXBT-Fi5UE