Physical vs Paper – East vs West

News

|

Posted 29/03/2018

|

10594

“Paper gold” is a contractual relationship that can take many forms, giving you exposure to the price but without any actual gold necessarily involved. There are several examples currently traded on the market. A gold future on the COMEX, the Commodity Exchange part of the Chicago Mercantile Exchange, is one instance. So is a gold ETF - GLD is the leader in this space.

With GLD you are not actually buying gold. A lot of people think they are. Instead you are buying a share of stock that trades on the New York Stock Exchange. That share of stock simply entitles you to price exposure. When you sell it, you are not selling it back to the vault, you are selling it to somebody else who wants to buy it.

It's sufficient for many holders because you don't have to go into a bullion shop, pick it up, or burden yourself with secure storage requirements. It doesn't, however, offer the same protections as having the physical metal in your possession. For people who are nervous about the financial system, the fact that they own a derivative when what they really want is payment in fist, can be a big problem.

If you want gold for safety and security, to hedge against financial disaster or whatever else concerns you, buying physical gold is the only viable option. You don't want to have any counterparties. The difference between owning a paper contract or claim on gold versus holding the metal itself, while seemingly trivial, is actually very significant. The idea of owning a paper claim on physical gold, however, is viewed very differently in the West than it is in the East.

After countless episodes of inflation and where debasement of fiat currencies by governments is commonplace, gold is viewed very differently indeed. There is a deeper cultural familiarity with the metal and its unique monetary properties. The difference between the way that gold is viewed across cultures is, at its core, a function of history. For people in the West it has been a very long time since any wealthy developed country has had a major problem with its currency, or a problem with sovereign insolvency. Whereas people in the East have more recently felt the personal impact of issues, specifically with currency depreciation. This has led to a far greater degree of scepticism in the East, and importantly, more practical experience in using physical gold for protection.

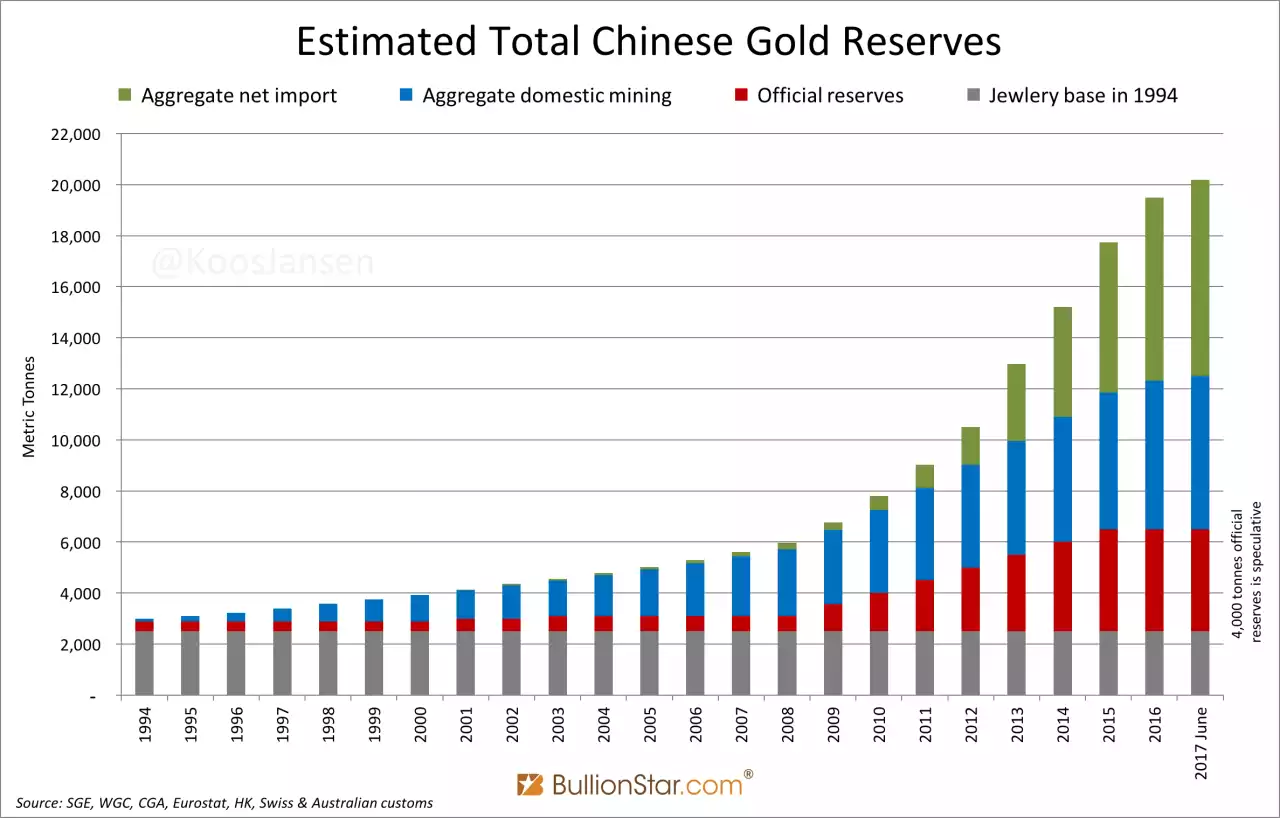

The Chinese throughout this century have been converting this way of thinking into action. They have been accumulating a lot of gold on the back of financial security concerns. They had virtually nothing just over a decade ago, and today they are buying more than, or as much as, the annual production of gold every year. Nobody knows exactly how much the Chinese have, but reasonable estimates come to a figure of around 20,000 tonnes. We can only speculate about the exact split between central bank and private holdings, but they certainly now have more gold than anybody else overall.

In contrast to this, since the first gold futures contract was launched in 1972 there's been a strong move towards paper in the West, and this idea isn't restricted to individual investors. Over the years, even central banks in the West have traded in their physical metal for paper contracts or promises, this time in the form of leasing agreements to the so-called bullion banks.

This preference could potentially come back to haunt individuals and governments if they change their minds upon the realisation that only physical gold can act as the insurance they need for protection against monetary disorder. In that case where you are trying to protect yourself against a financial system, then of course holding your insurance inside that same financial system doesn't make any sense!