Aussie Dollar Looks Set to Fall

News

|

Posted 30/05/2017

|

6997

Let’s be clear from the outset. Today’s article is not about the USD spot price of gold and silver. This is a clear heads up about what matters to Aussie buyers, and that is the AUD price of gold and silver. It is a point too often lost on newcomers who just see and hear the USD spot price on the news. This article was penned with the AUD at 74.5c and that is the number you should have in mind, not so much that the USD spot price of gold is $1268. Why?

Bloomberg yesterday ran the article “The Great Aussie Recession-Free Run Is Looking Shaky Once Again” and Fairfax ran “$A set to fall as Australia-US 10-year bond spread hits low”. Take note of both.

Firstly Bloomberg reports that “Weak signals from Australia are forcing economists to revisit their first-quarter growth forecasts. Some are even suggesting a contraction.” This is all due to a much worse than expected (and already poor) residential construction figure (minus 0.7%) and sluggish net exports and household consumption. We haven’t had a recession since 1991 and just avoided one last quarter with a rebound in Q4 of last year after the -0.5% in Q3. Most economists have us at barely above (and some below) zero for this last quarter, and likely only saved by government spending, funded of course by more debt. Such weak growth is of course not only negative for our dollar but casts serious doubt over the Government’s rather bullish budget forecasts and hence our AAA rating. When you have over $1 trillion in foreign debt that is a very big deal…

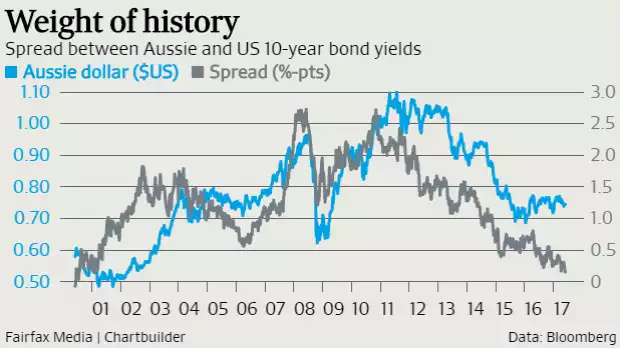

We then look at the story from Fairfax yesterday and along the lines we’ve warned of earlier here. That article spoke in part to the crucial debt yield spread between 10 year US and Aussie bonds. From Fairfax “Last week, the difference between the yields offered on US and Australian 10-year government bonds dramatically narrowed to just 16 basis points, or 0.16 percentage points. The last time the yield differential was that low was in March 2001, when the Australian dollar purchased fewer than US50¢ against US74.4¢ now.”

As a reminder, if the AUD were 50c now the AUD gold spot price would be $2535 instead of the current $1704, a 49% increase without a cent change in the USD spot price.

There is a common link in the 2 stories above and that is China. You see it was China’s stimulus fuelled need for commodities that largely saved us from a recession in the GFC. It is China too that has underpinned our currency. However, and over to Fairfax again:

“Economists point towards the rise of China and the once-in-a-generation boom in demand for commodities as a key force underpinning the Aussie currency.

Australia's economy has generally offered higher interest rates than the United States, because investing in Australia, with its more volatile, commodity-exposed currency and more recently high exposure to China, is seen as a riskier proposition, requiring higher interest rates in order to be attractive.”

As you can see from the graph above, that attractiveness has all but disappeared. Adding to this, China is trying to tighten after creating a globally worst debt bubble and ratings downgrades of their own. The pending result would seem baked in the cake….