The Yellen & Powell Cash Tsunami

News

|

Posted 30/11/2020

|

8774

Gordon Gecko declared “greed is good” and certainly at the moment blind greed is going well.

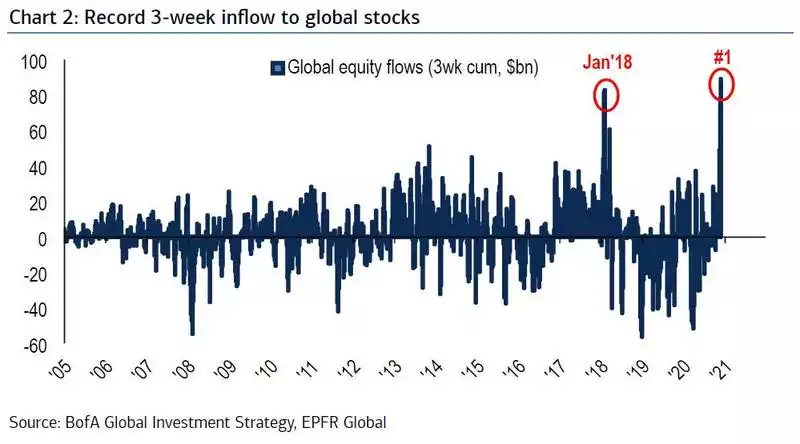

The sheer weight of stimulus money sloshing around the system and the ‘everything’s awesome’ ultra low VIX (volatility) has seen the 3rd biggest November in history on Wall St and biggest 3 week inflow in global shares:

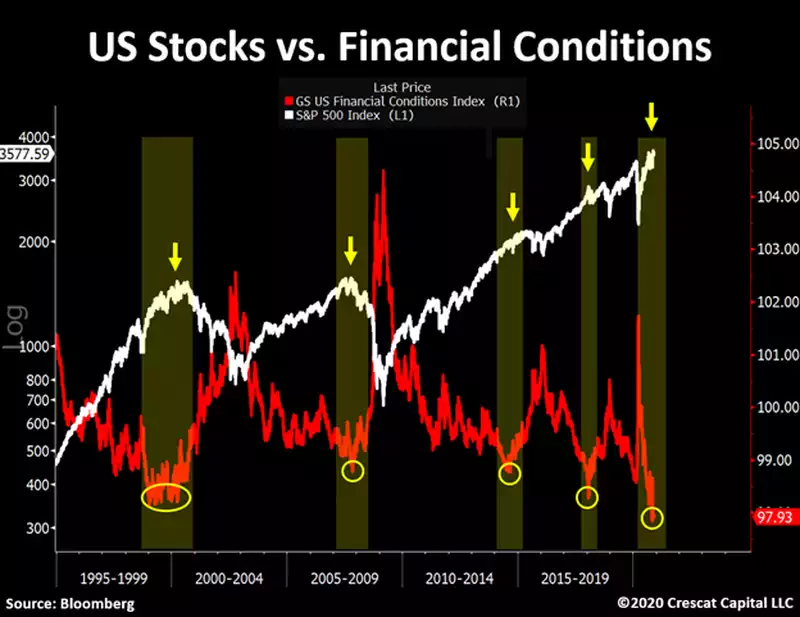

We are now at an all time extreme confluence of record high valuations and leverage and easiest/loosest monetary conditions… ever:

Conversely, as we reported last week, gold has now dipped below its 200 DMA after further falls Friday night:

Whilst silver has stayed relatively stronger dancing around its 50 DMA:

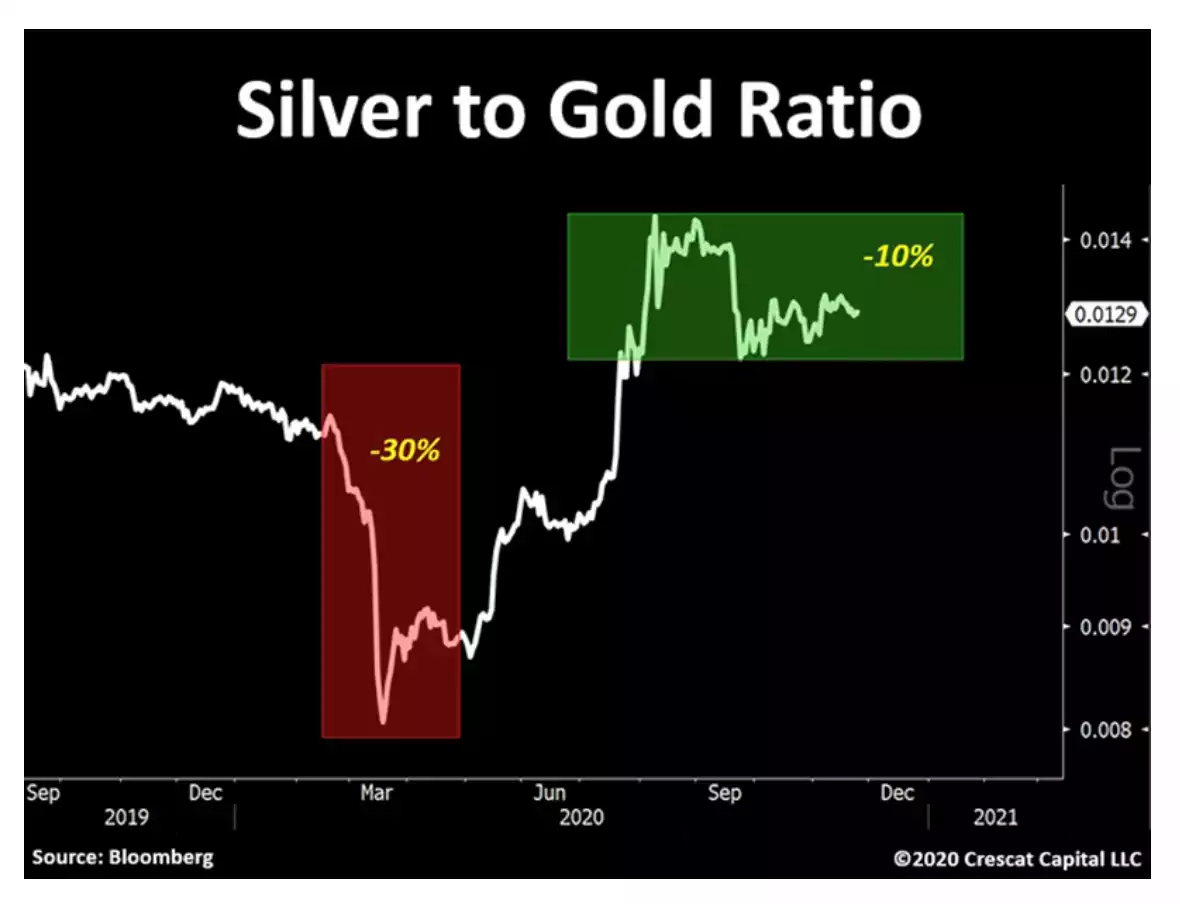

Speaking to this divergence, Crescat noted in a recent report:

“This time, there is a major difference in market behaviour indicating a still early-cycle macro environment for gold and silver. Rather than leading to downside in this pullback, silver has been holding up incredibly well. In fact, the silver to gold ratio is only down 1/3 of the move it had back then.”

The chart below illustrates this very clearly:

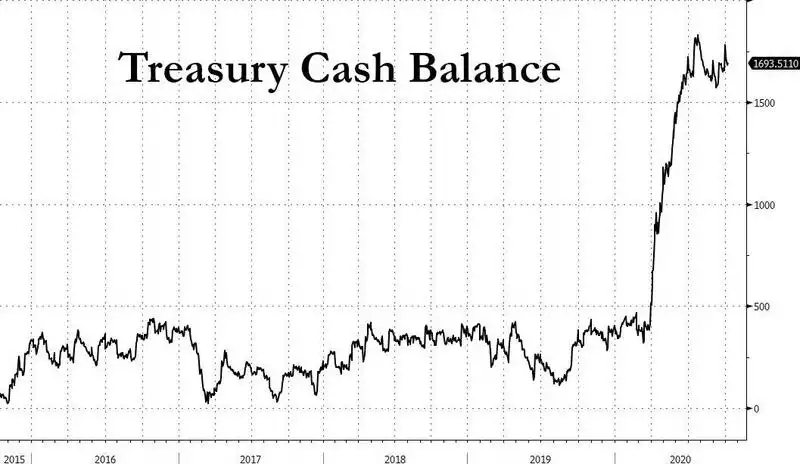

Biden has appointed ex Fed Chair Janet Yellen as his Treasury Secretary. Yellen is what is known as a ‘dove’ (as opposed to a hawk) and predisposed to loose monetary stimulus as a tool to fix things. She certainly didn’t hold back when at the Fed and has inherited a record account balance in the Treasury General Account (TGA) of nearly $1.5 trillion given no stimulus package could be agreed between the Dems and Republicans.

Not only is she predisposed toward stimulus, and now has control of the fiscal side of things whilst Powell controls the central bank side, there is a little known law around the debt ceiling next August that says she has to reduce it to $200b before then. So in the coming 8 months where the Fed is anticipating $120b per month QE ($1 trillion), Yellen needs to unleash $1.3 trillion of liquidity from the TGA. That this is all happening amid a narrative of “everything is awesome” clearly must be sounding warning bells of bubbles, unprecedented currency debasement, and an impending inflationary whiplash.

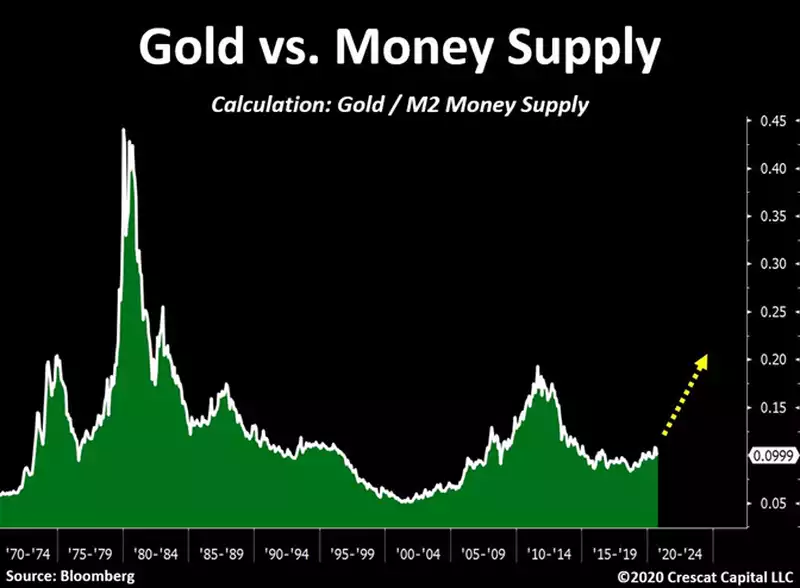

As Crescat said in relation to the chart below – “the price of gold relative to M2 money supply still looks historically attractive with significant upside likely ahead.”

The other new monetary asset to benefit from this currency debasement is Bitcoin and already it is bouncing strongly off its correction last week.