The Global VIXen…

News

|

Posted 16/09/2016

|

4775

As explained in today’s Weekly Wrap, last night saw US shares rally 1% on the back of a number of awful economic data prints leading punters to the view the September rate hike is now off again and indeed the chances of any rate rise in 2016 dropped to just 50%. Surprise surprise… bad news is good news…

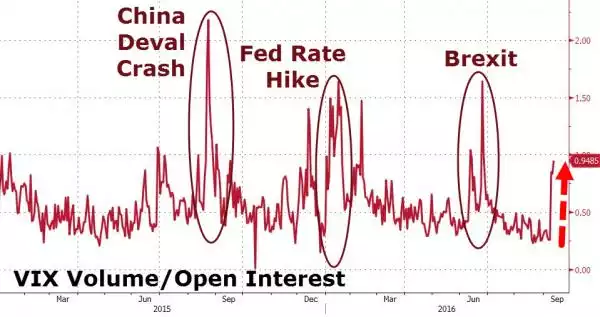

The volatility in markets is in stark contrast to the ‘everything is awesome’ record low VIX we saw just a couple of weeks ago as we discussed here and here.

Indeed this week saw a new record break where the VIX ETF (yep, there is pretty much an ETF / derivative for anything nowadays), VXX, see a higher volume of trade on Tuesday than even the most traded stock on the S&P500, as the VIX spiked after Friday night’s turmoil. As we reported Monday, the VIX went from its lowest in 45 years to the highest since Brexit…

This volatility is in the week before that of both the US and Japanese central banks meeting on 20/21st. After last night one would think the US Fed raising rates next week is off the cards, but the last week showed how wildly that view can change. The BoJ have put many a mixed signal out this week and could have just as much effect on the market as the US Fed.

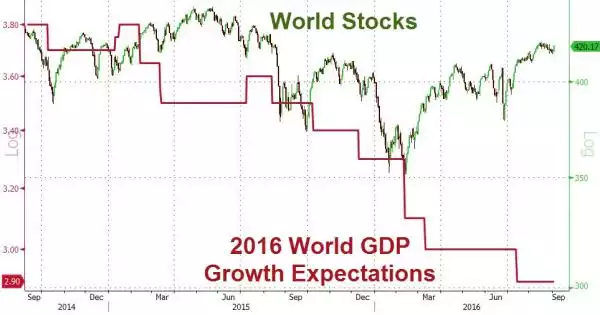

These are the 1st and 3rd biggest economies in the world. Their actions affect world markets. We are certainly not immune as we’ve seen this week, in terms of our sharemarket, bond market and currency. Last night’s economic data saw most economists slashing the GDP forecast for the US as their shares rallied. What many forget is they are not alone. The graph below is self explanatory…. This is a global issue, not a US and Japan issue.