China’s PPI Near All Time Record

News

|

Posted 10/06/2021

|

7935

China just sent a shockwave warning of potential trouble ahead with the worst PPI (Producer Price Index) or so called ‘factory gate inflation’ print since the GFC. Coming in above already high expectations of 8.5%, the 9.0% print was also just shy of the all time record of 10% during the GFC. However, the kicker was that CPI only rose by 1.3% which was less than expectations of 1.6%. The difference between PPI and CPI is the greatest since 1993.

And so this means Chinese factories and manufacturers have been absorbing these input price increases without passing them on to the consumer… yet.

The external pressures on China are rising with their being the recipient of a lot of the free money being created by the world’s central banks finding its way to buying their wares and putting these sorts of pressures on pricing.

Their sharemarkets are also among the worst performing of late and the yuan too is losing value more than any other in Asia. Last week saw their 10 year PBOC bond yield surge the most in 6 months. Perfect timing for another announcement about banning crypto maybe???

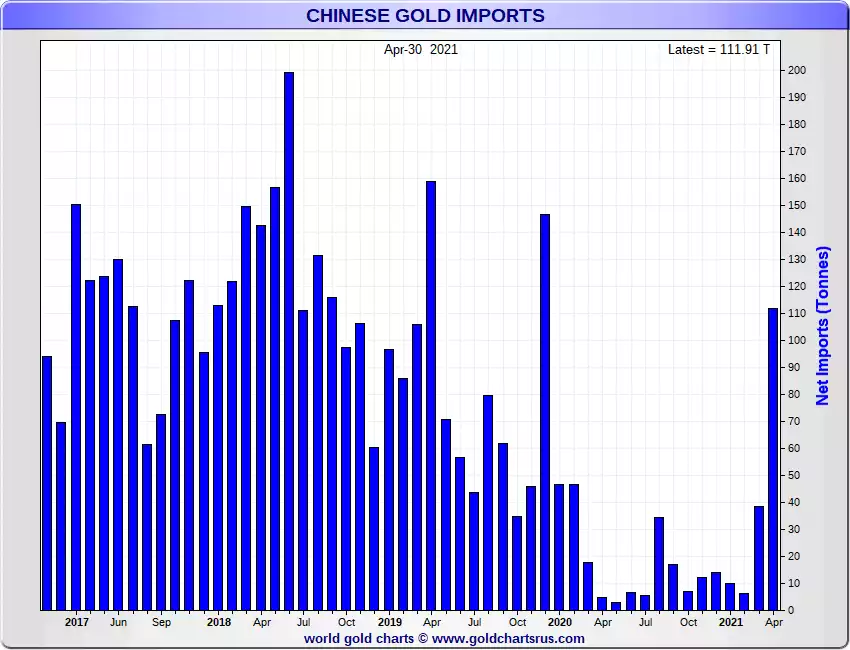

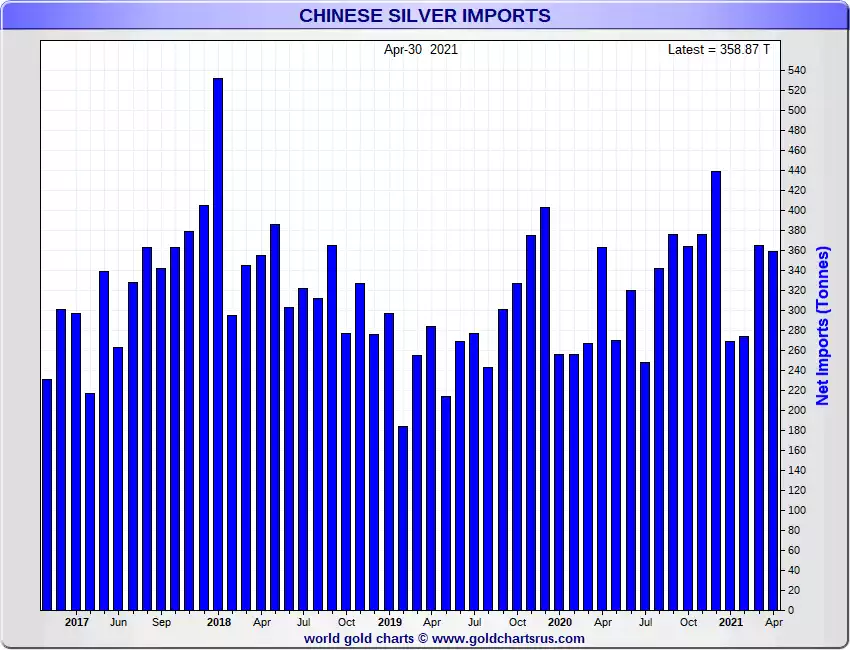

So what does the world’s 2nd biggest economy do with all this money coming in to the country? As you can see they have bought more gold via imports in April, 112 tonne, than any time since November 2019 and near highs in silver as well at 359 tonne.

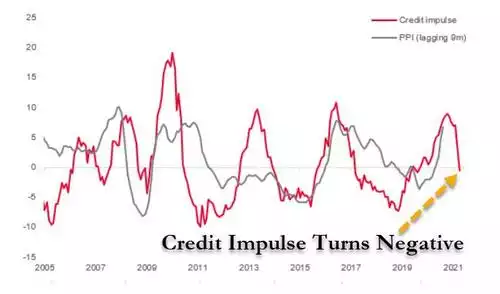

As a reminder it was only a few weeks back that China’s credit impulse print turned negative, sending a shock to analysts about the health of the Chinese economy. The chart below shows this with a 9m lag charting of the PPI which just got worse….