The Super Australia Dilemma

News

|

Posted 30/05/2018

|

6972

We did an interview yesterday with Nugget’s News on the back of the front page of every paper yesterday talking about the Productivity Commission’s review of our super. That will likely be published later this week and we will give you the link then. We wrote recently about the flaw in the “$200,000” minimum guidance to have your own SMSF. That commission report yesterday talked of that now being $1m! In the context of $2000 in SMSF costs against even a $100,000 balance being 2% when the average return of the best industry super funds was 6.8% over 10 years you can see it is indeed significant. But that relies on another 10 years of economic expansion when we are already in the 2nd longest in history in the US and Australia riding a 26 year long property bull run… Whilst the world was in turmoil last night over Italy let’s bring it back home and look through some charts that might make you reconsider 2% costs against the potential losses of being in an equities heavy super fund…

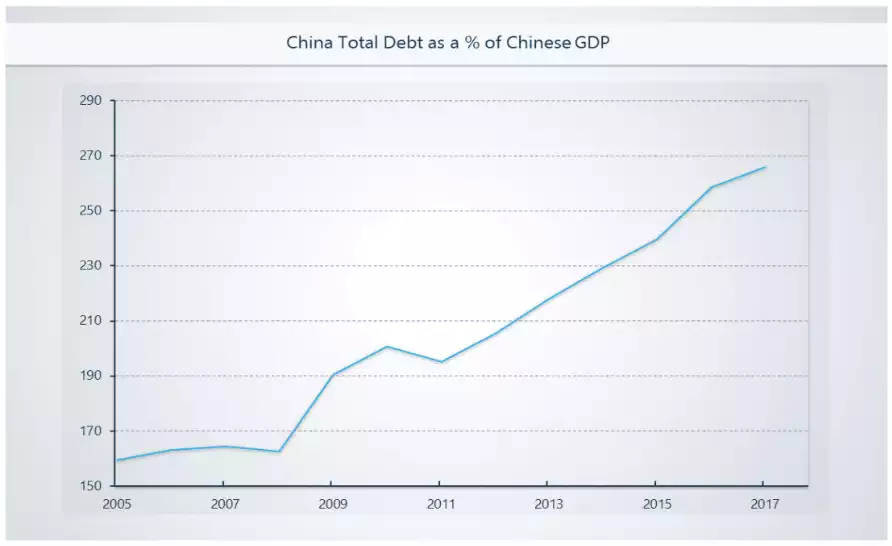

Firstly we all know how completely reliant we are on China. China has had an incredible run. Let’s face it, China and China alone saved us from the GFC. But it is all built on debt. A debt pile nearly 2.7 times its total GDP!

But there are now signs of things tightening considerably. The clearest insight is money supply via M2

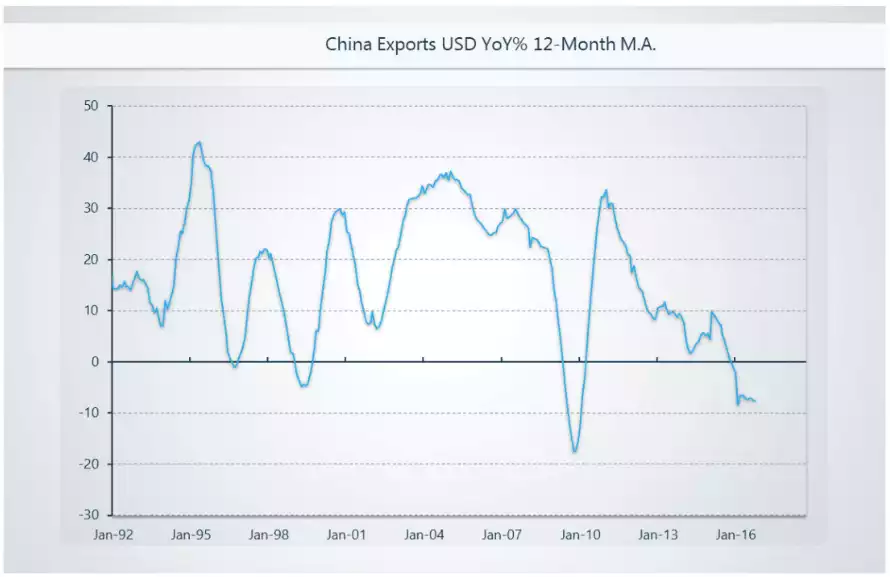

Exports, China’s mainstay, are another indicator…

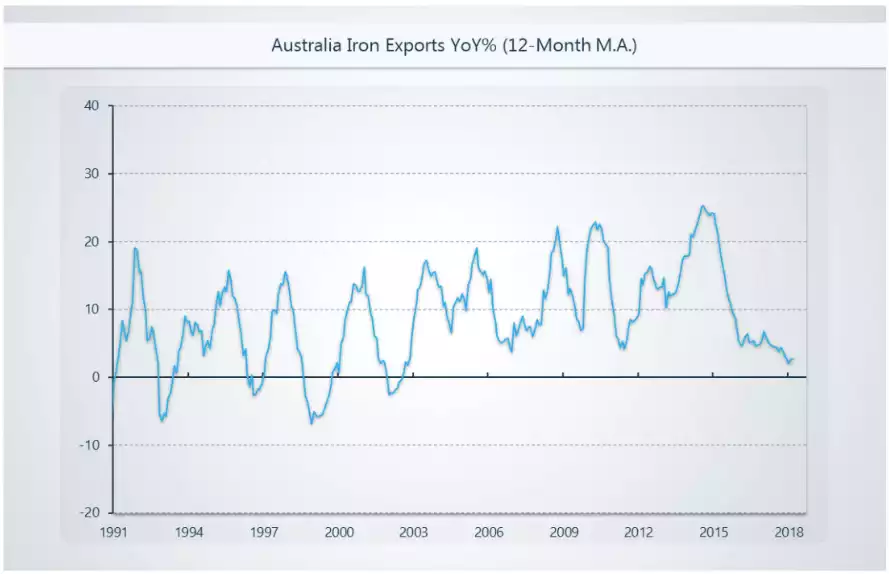

That’s not great news for Australia. Our biggest export and wealth creator in this country is iron ore, predominately to China. So how’s that going? A 15 year low...

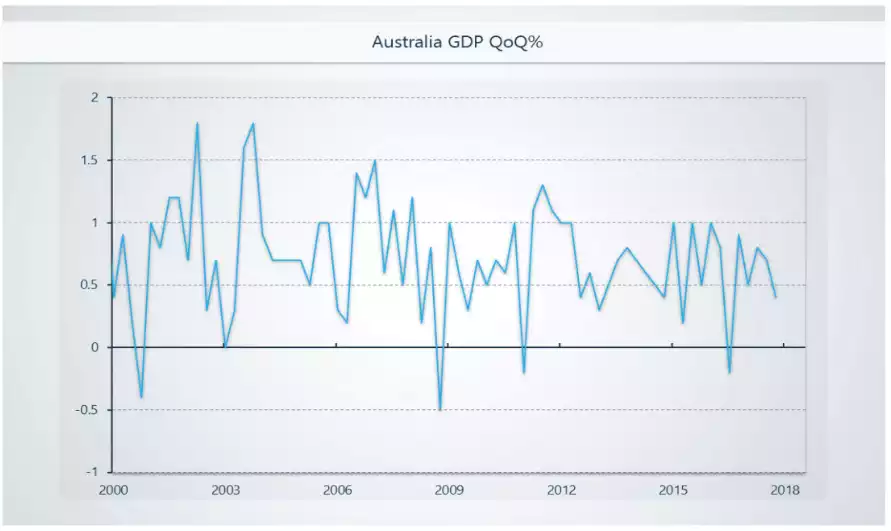

It’s already being reflected in a downward trend of GDP

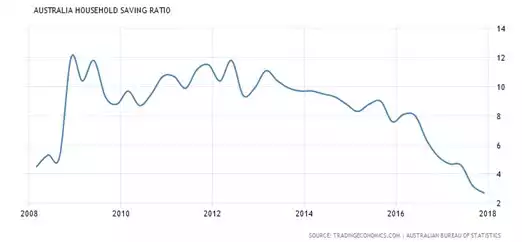

With the shock of the GFC we all stopped using the wealth ‘created’ in our houses to spend (off redraws on our mortgages) and live large, and actually started saving more. As you can see below we have forgotten that lesson and diving back into the smashed avo on toast…

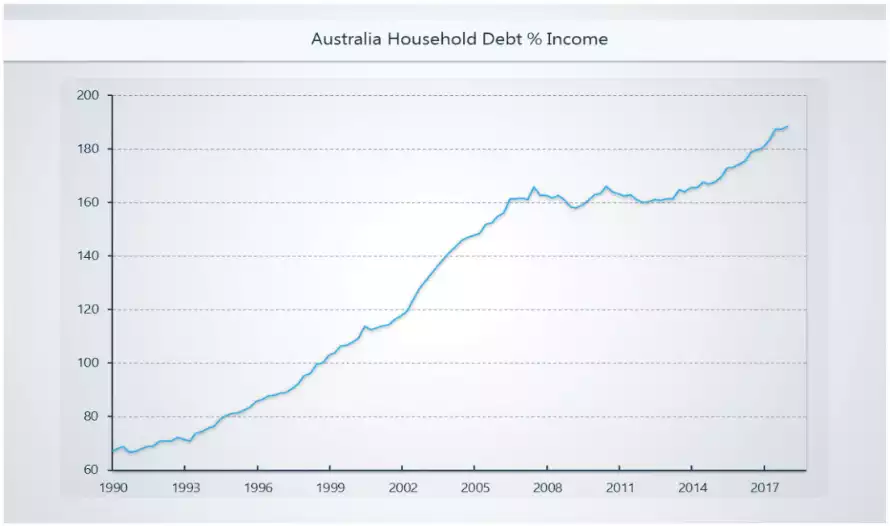

The impact of that of course is…. more debt!

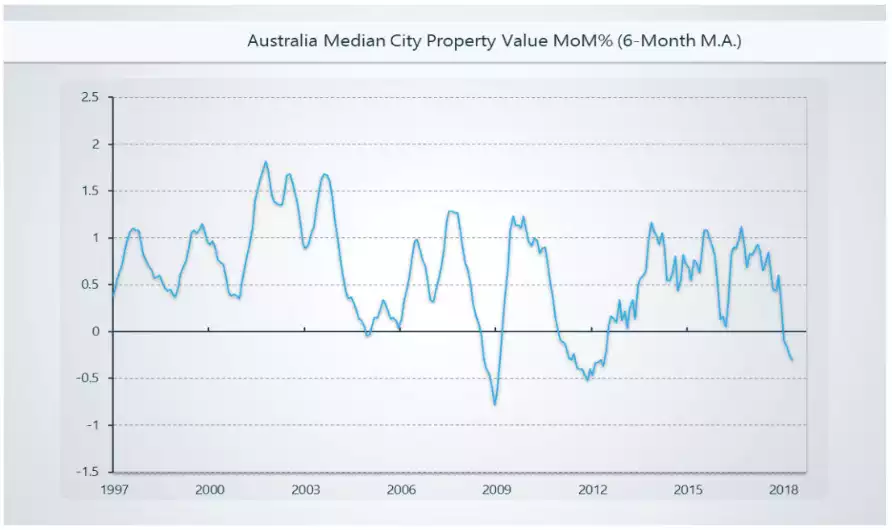

A very large portion of that debt is in property. 26 years has lead us to believe it never goes down so we can comfortably just keep drawing off those mortgages safe in the knowledge that the house price growth will always finance that. Except we are now seeing some concerning signs reappear..

This becomes more concerning when we consider it is happening in an environment of the lowest wage growth we have seen in a generation. Whilst unemployment is relatively low at 5.6%, it is on the rise and more tellingly for that income piece is that underemployment is at record highs. i.e. people want and need more work than they are getting. We already have 963,000 households officially in ‘financial stress’.

So we have a potentially toxic mix of record high debt, the lowest savings rate since prior to the GFC, falling asset prices underwriting that debt, low wage growth trying to service that debt, and interest rate rises on the horizon to increase the interest payments on that debt. Yes Australia’s cash rate is ‘only’ 1.5% but unlike before the GFC, this time Aussie banks have around $1 trillion in foreign debt they bought up to sell to you when it was ‘on sale’ in the US and Europe for 0% after the GFC. That is now changing and rate rises seem certainly on the way.

So again, does taking control of your super, albeit at a 1 or 2% cost, and diversifying into uncorrelated assets make a little more sense than the headlines give it credit?