Obama’s Legacy

News

|

Posted 09/11/2016

|

4973

There is a famous quote that “there is no new way to go broke, it’s always too much debt”.

Whoever wins the US election today will inherit a fiscal mess of a scale that makes you wonder why they even want the job. A Bloomberg article titled “Obama’s Successor Inherits Bond Market at Epic Turning Point” spells it all out. Here’s a summary:

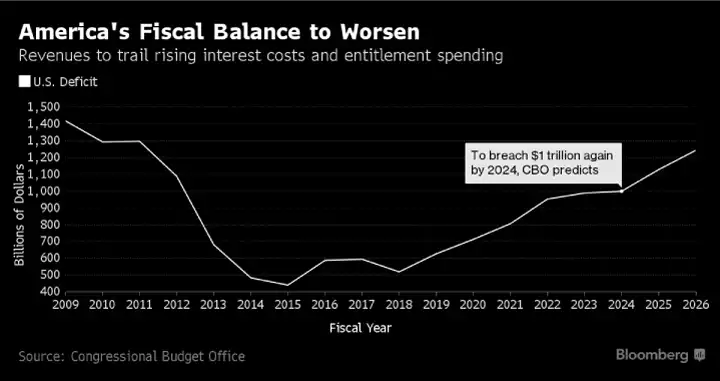

- Obama has sold more US Treasury bonds and at a lower rate than any president in history. (For newcomers, bonds sold by the government are debt that must be repaid together with interest along the way. That debt pays for continual deficits and the interest paid adds to those deficits. At some point the interest burden becomes too great).

- Those low rates were, in part, courtesy of the ‘independent’ US Fed buying an unprecedented amount of US Treasuries. So prolific was this QE bond buying ‘money printing’ program, it soaked up a quarter of the total debt issued between 2009 and 2014, some $1.7 trillion worth, and became the biggest single holder in the world. The US Fed’s balance sheet has ballooned to an incredible $4.45 trillion.

- International demand was very strong, especially China with all its reserves, collectively buying $3 trillion over that period. However foreign central banks have now reduced their stake in Treasuries for an unprecedented three consecutive quarters with foreign holdings shrinking at the fastest pace since 2013.

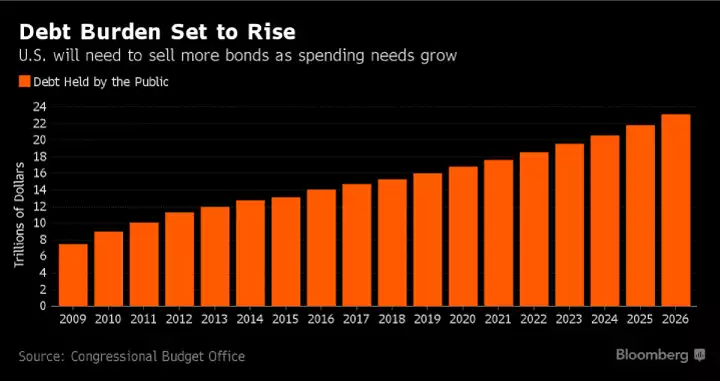

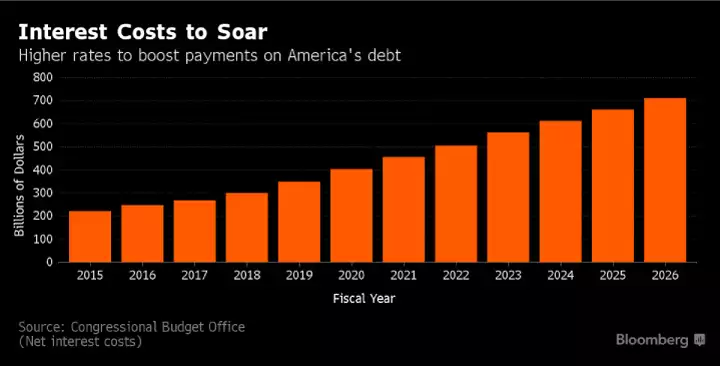

- The government’s marketable debt has more than doubled under Obama to a record $14 trillion (and nearly $20t in total) and that debt burden is about to bite. Despite record low rates, the interest costs are now the highest in 5 years and rates look about to rise as the Fed appears more serious about a rate hike in December, the first in a year.

- Obama enjoyed a “Free lunch” as one analyst put it, but all of a sudden the world’s biggest bond market looks decidedly shaky and the next President will have to deal with that, ironically as both candidates talk up fiscal spending on infrastructure.

- An analyst interviewed put it well: “All these years we’ve been kicking the can down the road, and suddenly we’re seeing a brick wall…. There’s been so much borrowing going on that’s been enabled by extremely low interest rates, one shudders to think what would happen if rates actually ever did go back to normal……The impact on the interest expense would be significant, and could really bring deficit concerns back to the fore.”

- These 3 graphs from the government’s very own Congressional Budget Office tell a scary tale for the next President and the market as a whole….