The Price of Risk

News

|

Posted 20/08/2014

|

3769

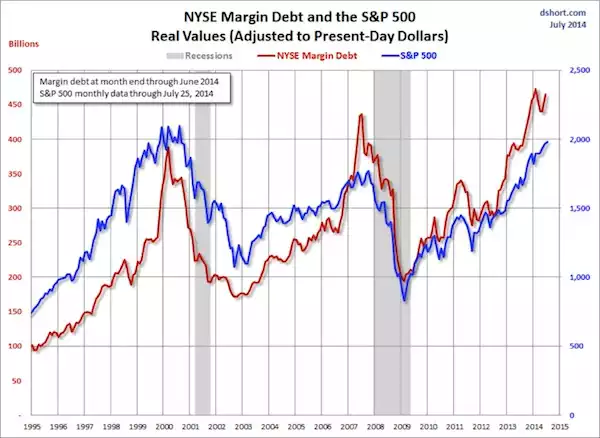

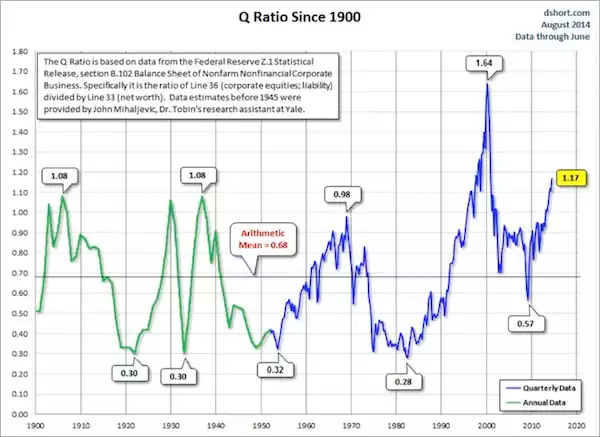

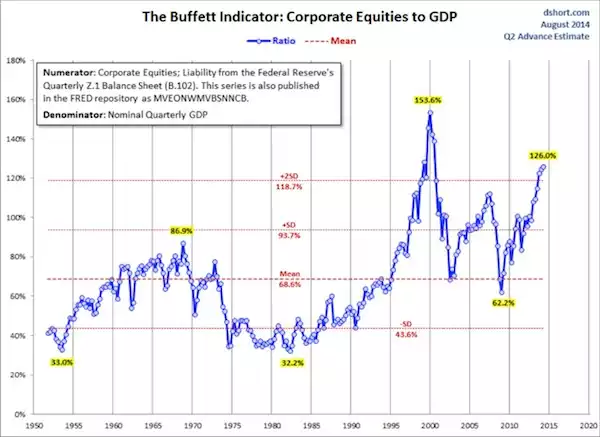

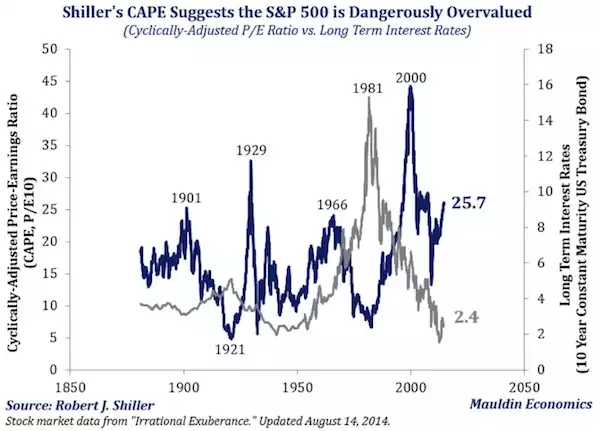

Yesterday we discussed the anomaly of a soaring US sharemarket and ultra low US treasury yields. One of the key reasons people are entering the sharemarket is a search for yield or risk. As Dr John Hussman describes: “Every long-term security is nothing more than a claim on some expected future stream of cash that will be delivered into the hands of investors over time. For a given stream of expected future cash payments, the higher the price investors pay today for that stream of cash, the lower the long-term return they will achieve on their investment over time.” So as the US Fed (and most other Central Banks) drives interest rates to zero and has been buying up US treasuries suppressing those yields, investors have flocked to shares for perceived returns. However it appears to have gone too far. He estimates the market is double its historical valuation norms and “estimate that the S&P 500 will achieve zero or negative nominal total returns over horizons of 8 years or less”. That disconnect from sense is called a bubble. The following 4 graphs illustrate this exactly.

Oh, and the relevance for Australia? We’ve all heard the adage “The US sneezes and we catch the cold”. Moreover a crashing US sharemarket inevitably sees a flight to gold and silver, and that’s a good thing if you already own it.