Bitcoin & Ethereum Foundations Strengthening

News

|

Posted 17/11/2020

|

6249

As we head into the end of the year, the crypto market cycle has shifted back towards BTC with the favourable macro backdrop. The election's end - and perhaps its reminder of the fragility of political governance - has reinforced the value of Bitcoin.

When the “old world” wobbles, the new one seems safer by comparison. The price of the cryptocurrency rose to over $22,000, breaking again the US$250 billion market capitalisation barrier – and now pushing on to above US$300 billion.

However, despite the slight pullback in alt-coin prices, Ethereum has been hitting all-time highs across many important, fundamental metrics. The cooldown period is also marked by a slight sell-off from ETH miners in late October and lower gas prices across the board.

Major decentralised finance (DeFi) categories continue to push forward with BTC on Ethereum recently topping $2 billion, roughly $20 billion in decentralised exchange (DEX) volumes in October, and the aggregate stable coin market cap reaching $22 billion. There’s almost 9 million ETH locked in DeFi and Grayscale’s Ethereum Trust (ETHE) continues to gobble up ETH, now holding roughly 2.4 million ETH worth over US$1.1 billion.

This is the cutting edge of everything. It is even possible that the Ethereum ecosystem in due course is worth more than the bitcoin ecosystem, just due to the scalability of its application. Again, it doesn’t compete with bitcoin but complements it. It is not an either/or game but an all-together game.

A vast majority of today’s most popular protocols and decentralised applications (“dApps”) are built on top of Ethereum. While ongoing debates imply a wave of competition on the horizon, none of today’s “Ethereum killers” are anywhere near the same developer mindshare or fosters the same kind of united, borderline-tribal community as today's smart contract platform incumbent.

Crypto's run-up remains solid, supported by strong on-chain and off-chain fundamentals. Raoul Pal covers this in perfect detail in his most recent Deep Dive:

Public blockchains offer analysts unparalleled accessibility to usage trends. For example, the percentage of BTC supply that has not moved in the last 12 months continues to climb and is now sitting at a record high 63%; this metric tends to precede bullish price action.

% Bitcoin Supply Unmoved in the Past Year vs. BTCUSD

We’re also watching BTC’s market-value-to-realized-value ratio (MVRV), which tends to mark key turning points at its extremes.

Market-Value-to-Realized-Value* (MVRV) vs. BTCUSD

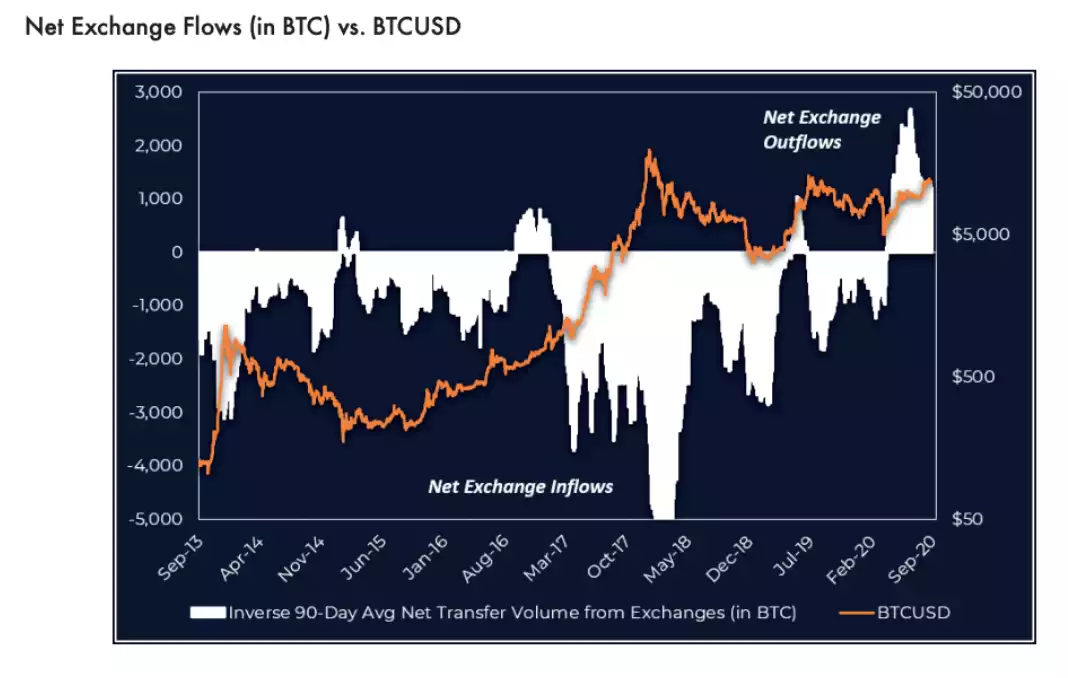

Net exchange flows indicate significantly more BTC is being taken off-exchange than is being sent. Net outflows tend to suggest a stronger holder base while net inflows can indicate investors are positioning to sell. We are seeing similar exchange activity with ETH holders as well.

What is more important than watching price action is to understand that crypto developments are moving rapidly behind the scenes and that an alternative financial architecture is heading our way fast. To a casually interested observer, crypto can seem bafflingly complex, peripheral and highly speculative. As the fiat money system creaks under the weight of its overindebtedness and the exit has MMT written all over it, the attractiveness of a system built on collateral that is immutable will rise. It is early days and bitcoin’s market capitalisation is a drop in the ocean next to global bond and equity markets, but the tide is rising… fast.