The Grand Scale of China

News

|

Posted 10/06/2015

|

4158

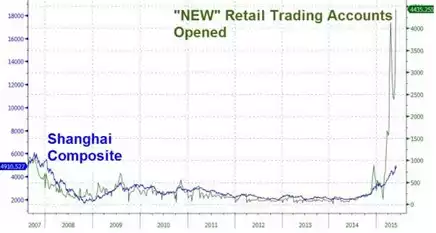

People often speak of the mind boggling scale of China’s population and its move from low to middle class. We’ve seen to incomprehensible scale of construction to house them in new cities, we’ve seen China over take India as the world’s largest consumer of gold, and now we’ve seen what happens when the Government “invites” its population to speculate in its languishing sharemarket. So whilst its economy dishes out the worst economic data in 3 decades off declining exports, real estate on the other side of its bubble and (as Australia knows too painfully well) construction relatively halted we get the Shanghai Stock Exchange shooting up 140% since the first PBOC rate cut less than a year ago. It now has a market cap of around $10 trillion, twice that of Japan’s and over 13% globally. There are a couple of takeways for gold – firstly it is another clear illustration of the power of China’s increasingly affluent population, a population that dearly loves gold. Secondly this is setting up another epic asset bubble (in a world full of them) that upon it bursting will see a flight to the safe haven of gold. This graph is breathtaking….