The “Smart Money” Is Worried

News

|

Posted 09/02/2017

|

5625

There is a growing trend of billionaire investors voicing concern over what lies soon ahead. Yesterday Larry Fink, the head of the world’s biggest asset manager Blackrock ($5.1 trillion in assets) said the US economy is in the midst of a slowdown and financial markets could see a significant setback, because of uncertainty over global trade and the Trump administration's plan to cut taxes. Speaking at the Yahoo! Finance All Markets Summit he said “I see a lot of dark shadows….The markets are probably ahead of themselves." He also warned there will be ‘huge tension' between the Fed and Trump.

We’ve just learned too that Stanley Druckenmiller, arguably one of the most respected hedge fund managers on Wall St (and who we’ve written about here and here) loaded up on gold again in December and January after famously offloading at the election result price peak in November. He loaded back up on the realisation prompted by concerns expressed by both Yellen (US Fed) and Draghi (ECB) that economic growth could be derailed by Trump’s policies.

Fink and Druckenmiller are not alone, recently fellow billionaire Wall St legends Ray Dalio, Jeffrey Gundlach and Bill Gross have issued similar warnings.

It would seem an issue of timing. Trump’s potential positive stimulus through tax cuts and infrastructure spend are on ice but his moves on border controls and trade are likely more immediate – so you get the bad before the good at a time when the market is based on nothing more than hope. Hope can evaporate very quickly compared to fundamental strength. There is also the issue of a certain debt ceiling expiring mid next month…

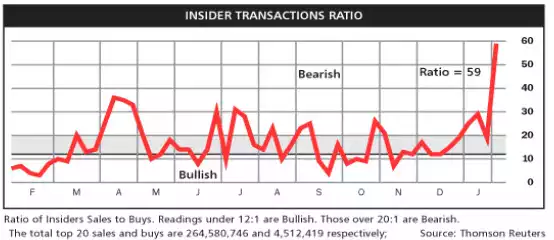

The exodus from the market by the big banks, hedge funds, and importantly executives within these companies, etc, the “Smart Money”, is well documented this year. Bank executives have unloaded literally $100’s million since the election and the following chart speaks volumes as corporate insiders (those really in the know) have unloaded their own shares at an alarming rate:

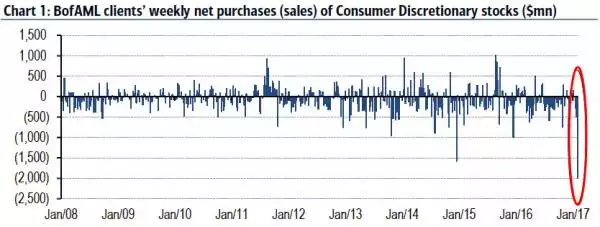

Finally Bank of America Merryl Lynch regularly publish client net purchases. They had this to say:

“All three client groups (hedge funds, institutional clients, private clients) were sellers of Discretionary stocks last week, where this sector has seen among the weakest results and guidance this earnings season. Clients also sold stocks in Tech, Real Estate, Materials and Utilities.”

This graph says it all: