The Deepest Phase of A Bear Market

News

|

Posted 14/06/2022

|

13496

With Bitcoin prices selling off to the low-US$20ks, a number of macro indicators suggests the market is entering the deepest phase of this bear cycle. Fundamentals have declined, and even Long-term Holders are now realising significant losses. These instances are rare and historically short-lived.

Bitcoin and digital assets have experienced yet another chaotic week of downside price action, losing the open of US$31,693 and trading down to a new multi-year low of $22,200 (at the time of writing).

Macro headwinds remain a large-scale driver, with the latest US CPI print of 8.6% being above expectations and another 2y-10y US Treasury Bond yield curve inversion occurring in the early hours on Monday. This has been met with a large rally in the DXY, as Bitcoin closes with its 10th red candle in 11 weeks.

In the current market, we have seen one month with an Accumulation Trend Score north of 0.8, signifying high positive balance changes across the market. This is a notable shift from the intermittent accumulation before the LUNA sell-off and may suggest an improved investor perception of value at prices at and below $30k.

The RVT Ratio compares the Realised Capitalisation against the daily volume settled On-Chain, this provides insight into the daily utilisation of the network (On-Chain volume) relative to its intrinsic value (Realised Cap). A general framework for the interpretation of the RVT is:

- High values and uptrends indicate poor utilisation and a slow-down in-network utilisation.

- Low values and downtrends indicate high utilisation and an uptick in network utilisation.

- Stable sideways values indicate that the current utilisation trend is likely sustainable and in equilibrium.

The red band denotes an RVT ratio of 80 or above, suggesting the network valuation is now 80 times larger than the daily value settled. This is indicative of a barren on-chain activity landscape, which is historically a result of extended bearish price action, flushing cost-sensitive participants from the network.

In past bear cycles, an underutilised network has provided correlation with bear market bottoms. Should network utilisation increase and RVT manages to break lower, it may signal improving fundamentals. However, with the RVT ratio currently at its highest value since 2010, a continued break higher would enter the somewhat uncharted bearish territory, where network valuation is even more 'overvalued' relative to network activity.

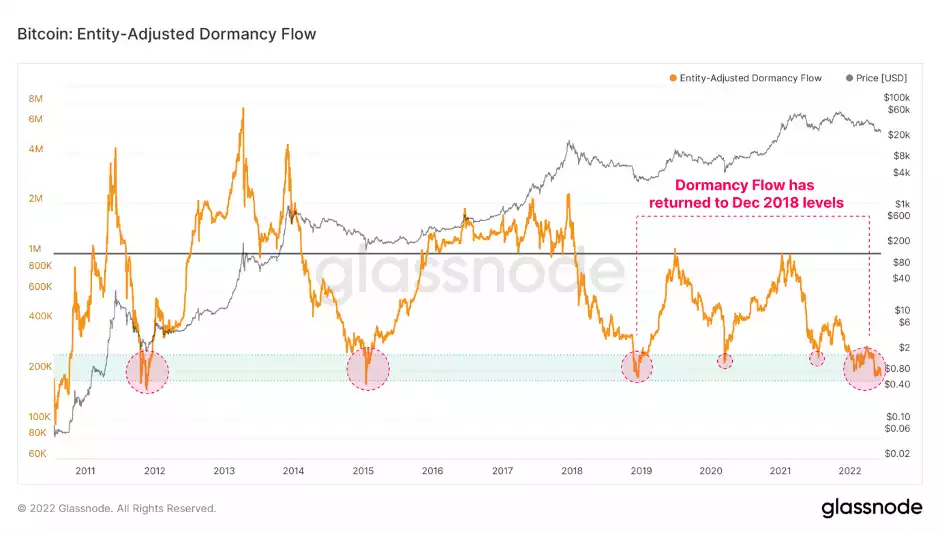

The Entity Adjusted Dormancy Flow model can also be used to compare Market Valuation to network utilisation from the perspective of the average coin age being spent in the network. Dormancy measures the average amount of Coin Days Destroyed on a per coin transacted basis. Dormancy Flow then compares the Market Capitalisation to Dormancy (in USD terms), thus capturing deviations in spending behaviour against the market valuation.

Dormancy Flow continues to trade at historical lows, suggesting that the market valuation is low relative to the time-weighted on-chain transaction volume. Previous instances of Dormancy flow at these levels have typically coincided with bear market capitulation events and periods of maximum pain.

In line with the weakening Liveliness and HODLer performance, this aligns with a condition where even the oldest Bitcoin holders were purged from the network.

To summarise what’s happening in the crypto market right now, he Bitcoin market has entered a phase coincident with the deepest and darkest bear cycles of the past. Prices barely hold above the aggregate cost basis as captured by the Realised price, and on-chain volume fundamentals have deteriorated further.

Long-Term holders are currently spending coins with a higher cost basis than Short-Term holders, and their cost basis is barely more profitable than the aggregate market.

All eyes are on the conviction and support provided by the Bitcoin HODLer class now. Just remember that market bottoms correlate to maximum pain – something which is certainly occurring in the crypto markets right now. Take advantage of the pain in the market…