Gold Miners to be hit in $3.5 trillion Spending Package

News

|

Posted 24/09/2021

|

7052

Capitol Hill Democrats are taking aim at U.S based mining projects with an 8% royalty fee on existing mines and 4% on new mines. The royalties are on precious metals as well as base metals such as copper and lithium. This added drag on mining would act as a headwind to already struggling metal supplies.

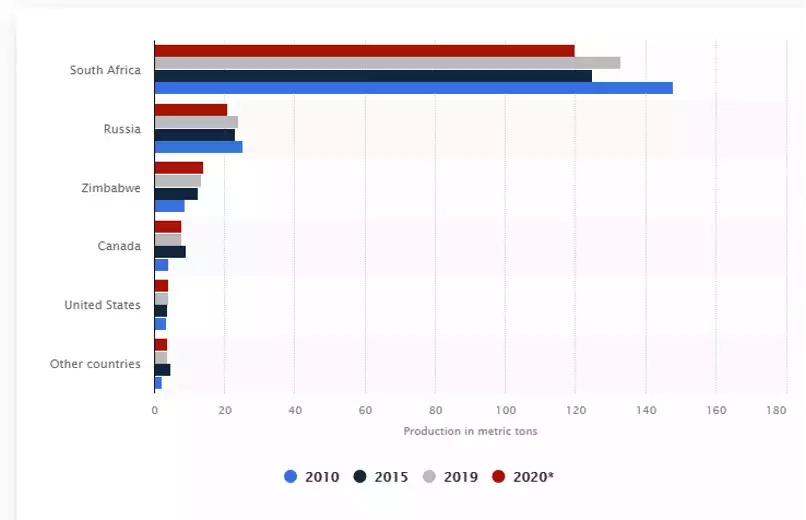

Mining executives have already hit back, arguing that Biden’s goal of having 35% of generating of the U.S electricity grid from solar, is all but impossible without investing in new mines. For those seeking to invest the millions of sunk costs into getting a new mine online, the mere announcement of additional taxes is likely to give executive boards reason to pause. Both in the U.S and globally, Platinum group metals have been in a decade-long supply draw down.

With spot prices on life support, silver production has been in structural decline for the last five years, leaving almost no pure-play silver explorers or miners solvent. The pipeline for increasing silver production is thin at best and anemic at worst. But as they say, the cure for low prices is low prices.

For less profitable mines that are already in production, these taxes may be the straw which breaks the camel’s back, leading to further reduced supply. Adding new tax arrangements on projects that companies have already spent close to a decade getting approvals for and building out is what you would expect from failed states that see foreign miners as an easy target. They may reap a short term windfall in the short term, but who would want to invest in new projects in that kind of jurisdiction?

If these changes go ahead, they would be the most-substantial changes to the law that has governed U.S. mining since 1872. The 1872 law was designed to incentivise exploration and development of more than 350 million acres in the western United States. Perhaps predictably, miners advocate for the maintenance of the status quo. Perhaps even more predictably, environmentalists argue that miners should pay more in royalties for the privilege of extracting the minerals from tax-payer owned land.

Realistically, metals, not just the precious variety, are an essential component in almost every aspect of life. There’s a reason why economists refer to “Dr. Copper” as a barometer of the economy’s overall health. Rising input costs due to reducing supply are only going to accelerate already problematic inflation prints.

Amidst a global shift toward electrification, base and precious metals are critical. Rich Nolan, head of the National Mining Association has argued along these same lines, making the point that metals and mining “needs to be incentivized, not stalled." The new taxes are predicted to raise $2 Billion over 10 years for the U.S government. One wonders what the net effect would be if they do go ahead given that the government is one of the major purchasers of metals for their infrastructure. If new taxes serve to drive up prices on the very commodities they are buying, it would at best be “robbing Peter to pay Paul”. Consumers paying more taxes, going further into debt and facing increased costs on everyday consumption may well be some of the not-so-happy byproducts of government intervention.

While we don’t know what will ultimately be included in the aptly named $3.5tr Spending Bill, it does highlight some of the challenges that precious metals miners face. As a general rule of thumb, precious metals miners are considered to be an effective way of leveraging a metal position, a small change in the spot price can improve profit margins significantly, but a move in the opposite direction can render a producer insolvent. These proposed changes are a good example as to why people often prefer to simply hold the metal itself. As successful as miners can be, they are subject to poor management, new taxes, nationalisation of mines by failed state governments desperate for short term revenue and the list goes on.

In precious metals, individuals have the only truly independent form of wealth with no counter-party risk of any description.