Taper Tempered & Surprises Surprise – Why More are turning to gold

News

|

Posted 06/09/2021

|

5263

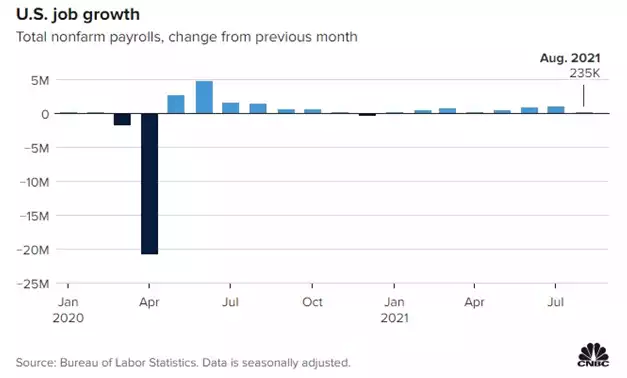

Friday night’s US NFP employment numbers dished up a major miss with only 235K new jobs added in August (the weakest print since January) against market expectations of 725K and a massive drop from July’s 943K.

The following chart illustrates this in the context of the April 2020 plunge.

And the chart below reminds us they are still over 5.3m jobs short of the pre pandemic employment numbers:

The print saw many questioning whether the Fed would indeed maintain their QE taper talk which saw the USD fall and gold surge on the result, up $25 and around US$1830/oz. The stronger AUD off that USD fall took some shine off for Aussie gold holders but it was still a very strong night.

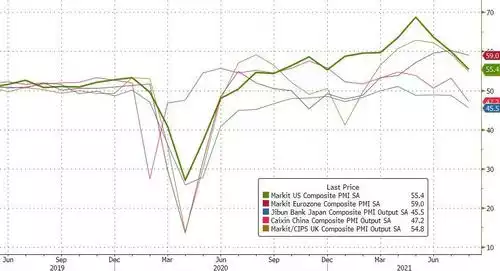

Interestingly the usual ‘bad news is good news’ trade on shares didn’t really happen. As we discussed Friday, stimulus appears to be the main driver of financial markets and tapering of that stimulus the major immediate threat. That this bad news was neutral to shares and gold surged may be a sign that more people are starting to understand the reality before them. It wasn’t just the employment figures painting a concerning picture. We also saw poor Markit PMI prints in both manufacturing and services. The composite PMI as shown below is joining a rollover across the globe:

That analysts are continually underestimating poor prints is showing through in the so called ‘economic surprise’ indices where they are underestimating inflation and over estimating PMI’s. In other words, a weaker than expected economy and stronger than expected inflation equalling the dreaded bogey – stagflation:

The aforementioned waning faith in the ‘everything’s awesome’ narrative ultimately comes down to faith in the monetary system. At some stage the spectre of rampant money printing losing its effectiveness and then the effects of all that freshly printed, chronically debased currency flooding the system inevitably leads to the same result presented throughout history. Germans are arguably attuned to this more than most. Not surprisingly then German demand for gold bullion increased 35% in H1 of this year over the already strong previous half according to the World Gold Council. The rest of the world saw an increase of a still robust 20%.

Whilst the Fed hog the Central Bank limelight, the ECB has on many levels been even more aggressive and Germany has been in a negative interest rate environment now for several years including negative yielding 2 and 5 year government bonds consistently since 2015, and billions in QE. From the WGC:

“German investors have an acute awareness of the wealth-eroding effects of financial instability. Hyper-inflation in the 1920s lingers on in the collective memory but, perhaps more importantly, German investors have seen fiat currencies come and go: in the past 100 years, Germany has had eight different currencies. It should come as no surprise that, when faced with such an unsettling economic backdrop, German investors turned to gold – which during our field research one investor described as an enduring currency – to protect their wealth.”

The US, as the world’s reserve currency, may still be in denial that its hegemonic status could ever be challenged but history tells us otherwise. Jim Rickards recently shone a light on this:

“The greatest paradox in foreign exchange markets today is the U.S. dollar (USD).

U.S. fiscal responsibility is in ruins. In the past two years, the U.S. has authorized $11.5 trillion of new deficit spending and increased its base money supply by over $4 trillion. The U.S. debt-to-GDP ratio now stands at 130%, comparable to Lebanon, Italy and Greece, among the most profligate countries in the world.

Meanwhile, U.S. growth is slowing rapidly.

The Atlanta Fed GDPNow forecasting tool showed projected annualized growth slowing from 13% in April to 11% in May to 7.5% in June. The actual GDP growth figure for the second quarter of 2021 was 6.5%.

Third-quarter growth is now projected at 5.1%.”

As the economic surprise indices highlight, this is almost certainly going to be too high. Reality is coming. Some will be ready, some won’t.