Swimming Naked When the Tide Goes Out

News

|

Posted 15/03/2019

|

6367

We wrote recently of the extraordinary levels and declining quality of corporate bonds a couple of weeks ago. If you missed it you should read it (here) as corporate debt is one of the key risks identified by most analysts around what could trigger the next crash. For big corporates, issuing bonds is their main source of debt funding. That market is flashing red.

However the other source of debt funding for smaller businesses is of course banks loans. C&I loans or Commercial & Industrial loan metrics have been an uncanny predicter of recessions over the last 50 years.

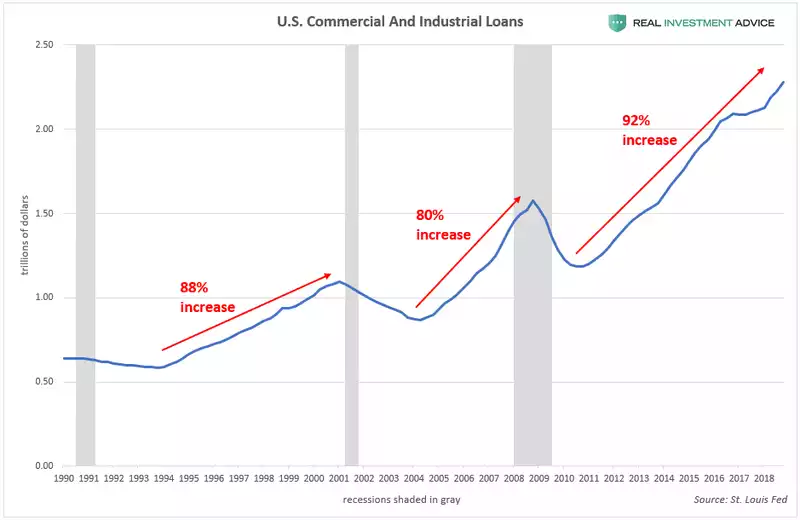

At the moment total outstanding C&I loans in the US sits at around $2.3 trillion. That is up 92% since it bottomed after the GFC. The chart below shows just how extraordinary that is compared to the previous 2 cycles.

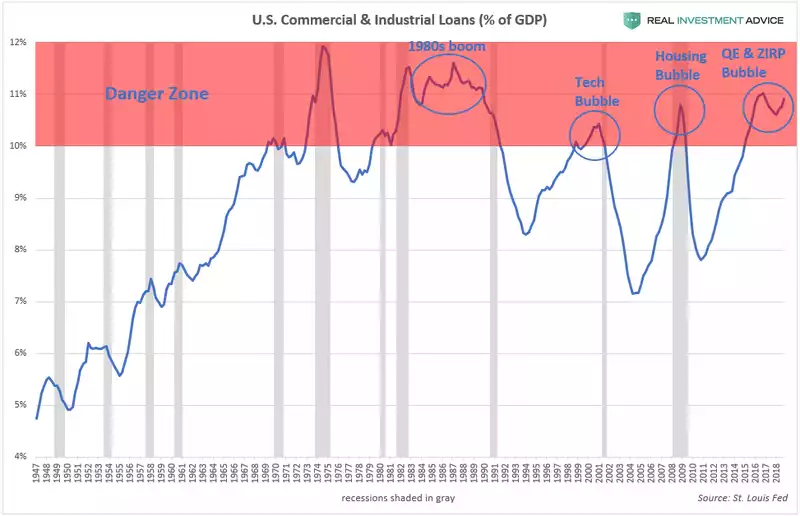

The chart above is in outright terms and doesn’t take into account economic growth, so it needs to be put against GDP for proper context. The chart below, also courtesy of Real Investment Advice, also overlays when this debt exceeds 10% of GDP or what they call the Danger Zone. Each time it does this a recession has ensued. That corporate debt by way of bonds we mentioned earlier…. Its at 46% of GDP. So collectively commercial debt in the US is over half of US GDP. Staggering stuff.

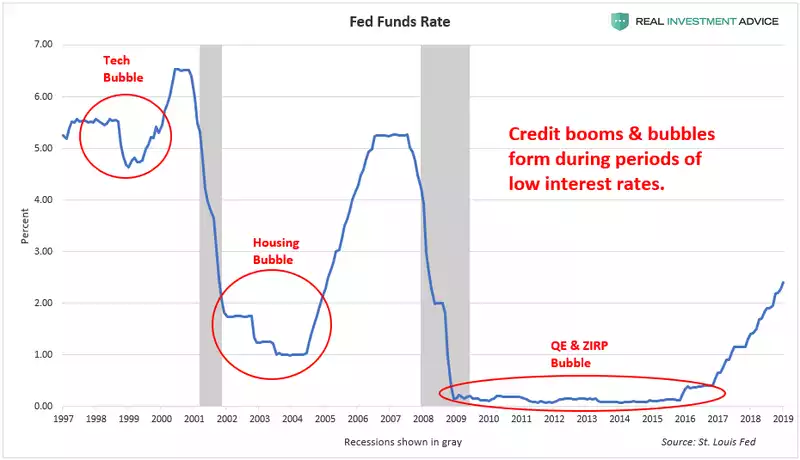

With all the talk about a recession being here or close this probably doesn’t come as much of a surprise to many. However what makes this one more concerning than any previous is the ultra low interest rate environment in which this has grown. Whilst all bubbles are formed off low interest rates, never before have they been off a base this low nor maturing at such a low ‘hiked’ rate.

The former means the entry hurdle is much lower and hence a much higher level of poor investments made that won’t stand the test of a higher interest rate environment or turn in the economy. (That said, the lower base may mean this bubble can last longer than before.) The latter, as we’ve discussed regularly means the Fed has limited ability to stimulate the economy out of trouble when it turns.

Real Investment Advice’s Jesse Colombo penned an article in Forbes titled How Interest Rate Hikes Will Trigger The Next Financial Crisis which you can read in full here. Here’s his closing 3 paragraphs that put the above into further context.

“When central banks set interest rates and hold them at low levels in order to create an economic boom after a recession (as our Federal Reserve does), they interfere with the organic functioning of the economy and financial markets, which has serious consequences including the creation of distortions and imbalances. By holding interest rates at artificially low levels, the Fed creates "false signals" that encourage the undertaking of businesses and other endeavours that would not be profitable or viable in a normal interest rate environment.

The businesses or other investments that are made due to artificial credit conditions are known as "malinvestments" and typically fail once interest rates rise to normal levels again. Some examples of malinvestments are dot-com companies in the late-1990s tech bubble, failed housing developments during the mid-2000s U.S. housing bubble, and unfinished skyscrapers in Dubai and other emerging markets after the global financial crisis.

Though it can be difficult to tell precisely which investments or businesses are malinvestments in a central bank-distorted economy, a quote by Warren Buffett is extremely applicable: "only when the tide goes out do you learn who's been swimming naked." For the purpose of this discussion, "the tide going out" refers to rising interest rates. The mass failure of malinvestments in an economy as interest rates rise typically results in recessions or banking/financial crises.”