Gold & Silver Charts of Truth

News

|

Posted 14/05/2021

|

7679

Today we look at a number of charts painting a clearer and clearer picture of a very bullish construct for gold and silver prices going forward.

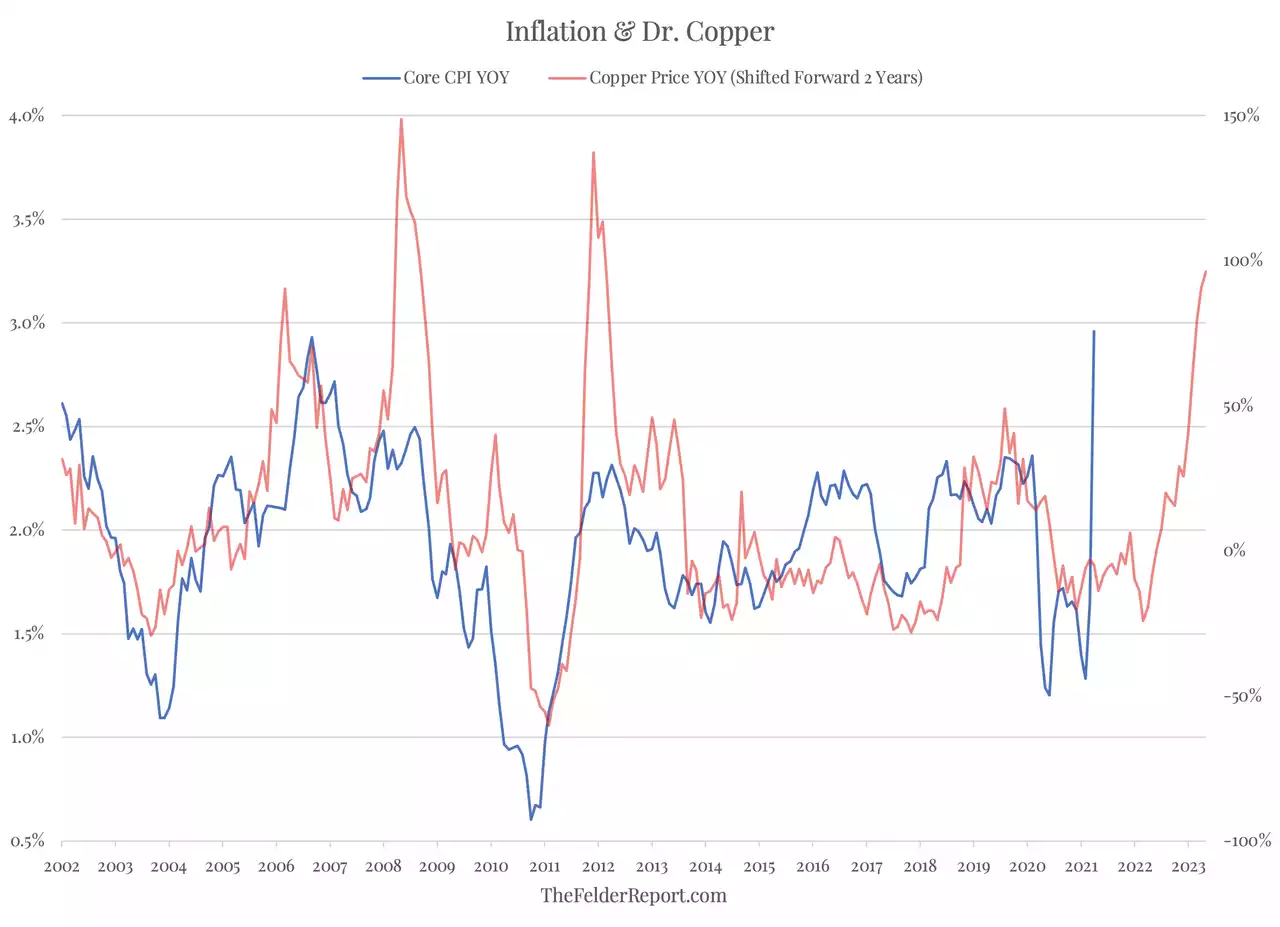

Firstly and following on directly from yesterday’s article about inflation and real rates, the chart below plots the tight correlation between the copper price and inflation with a 2 year lag. They call copper “Dr Copper” as it tends to have a better track record of predicting inflation than its human PhD in Economics counterparts. The chart below tells us not only is inflation coming, but it is not ‘transitory’ as the Fed would like us to believe.

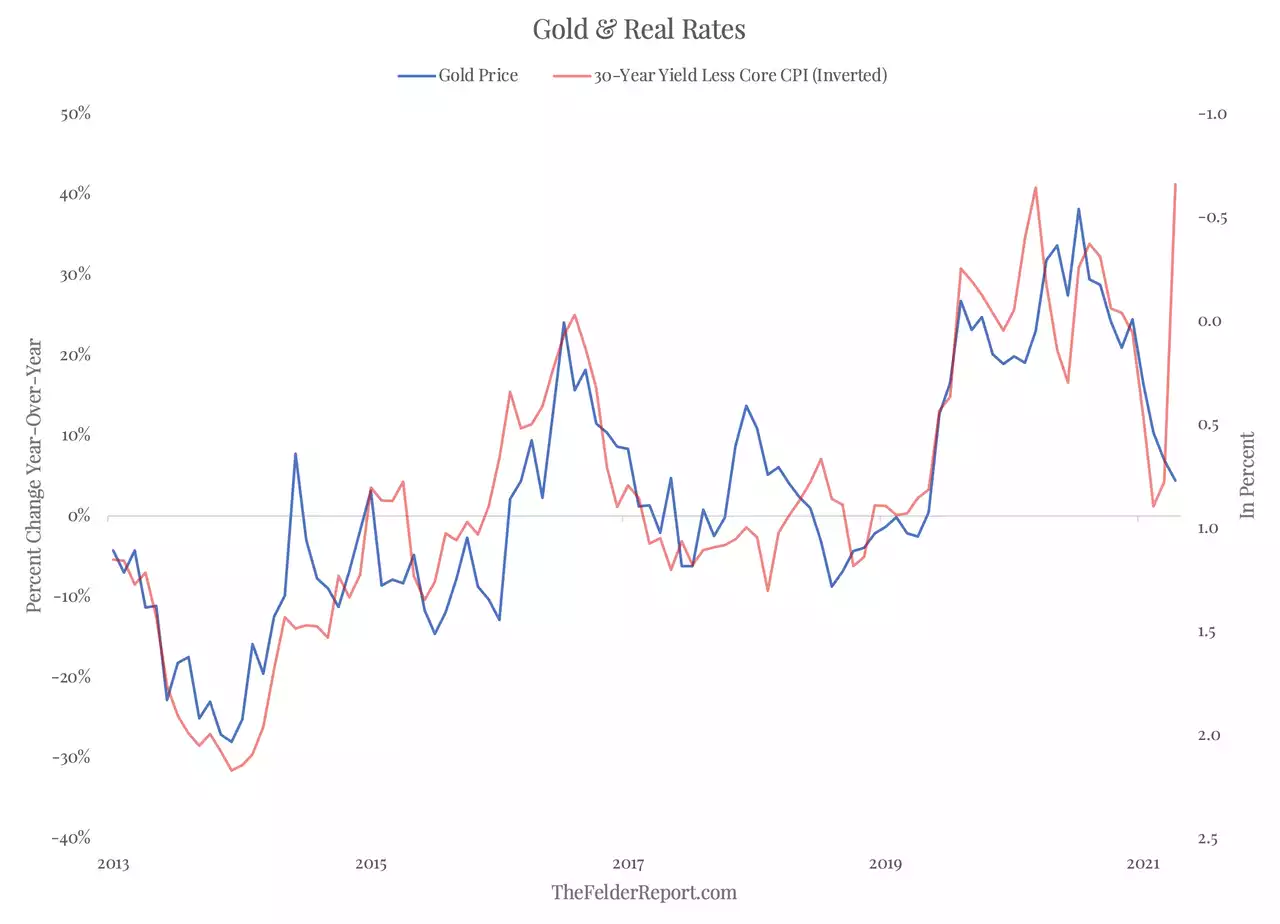

And again as a reminder of the also very tight correlation between gold and real rates, the chart below shows this for 30 year bonds rather than the shorter term 10 year we shared yesterday. As a rule the longer term real yields hold a closer correlation to the gold price than shorter and also look more insightfully past the ‘transitory’ narrative:

Taking the chart above and zooming out a little to bring in the previous peak of 2011/12, we then vey clearly see a classic, so called, ‘cup and handle’ technical chart set up.

For confidence in this set up being ‘in’ we’d need to see the gold price push sustainably through US$1830. It briefly did so earlier this week, almost breaching US$1840 and currently sits at US$1827 at the time of writing. i.e. we appear to be there. Macro Insiders’ Julian Brigden (Raoul Pal’s partner in that Real Vision advisory) has just upgraded his gold call to buy at this level. In March (just before it bottomed) he said to go in with half the position and now is saying fill it up. His short term target is US$2200 before reassessment but his macro framework on gold is very much bullish in the longer term too.

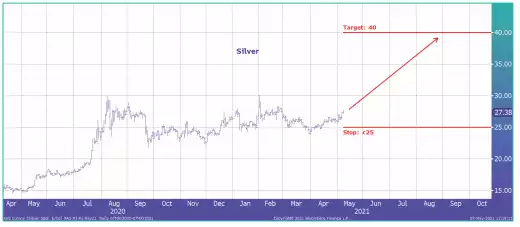

For silver, the falling GSR and commodity / reflation trade makes it look even more alluring right now. Julian has been a proponent of silver as his preferred trade for some time, picking its outperformance of gold these last 6 months perfectly. As you can see below, he is saying it’s now a buy again with a short term target of $40, a 48% return…

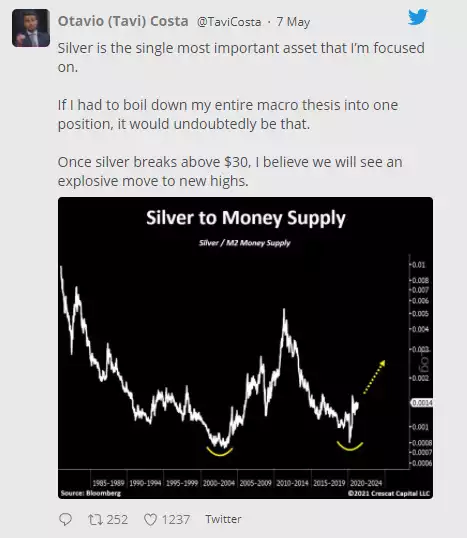

Crescat’s Otavio Costa recently shared a tweet on silver that ties in beautifully with yesterday’s article in regard to ‘money supply’ (Fiat money) and silver (real money).

We will write more fully on the gold silver ratio action next week but just consider that right now silver is still nearly 50% below its all time high in 2011. Gold is just over 10% below its high in August last year. Silver historically lags then shoots past gold in precious metals bull markets. We still look to be in those early days for both but silver looks considerably compelling in comparison.