Gold Defies the Shorts

News

|

Posted 15/07/2015

|

3740

We’ve spoken a little lately about the gold price amongst all this turmoil. The quote below from economic commentator Greg Canavan (of the excellent The Daily Reckoning) summarises it nicely and gives you an independent (non gold biased) take on it:

“For now, the crisis is ‘solved’. Markets are in celebration mode. But we await the backlash. Capital may be amoral but it is also fickle and will turn on a dime.

The only certainty is that the crisis is not over. The only certainty is that this, which started out as a financial crisis, will soon morph into an economic, social and political crisis of massive proportions.

In terms of asset allocation and risk tolerance then, don’t let your guard down. The storm has not passed.

As an aside, did you see how gold performed on news of the ‘crisis resolution’? It fell sharply initially and then even further in early US trade, only to bounce back.

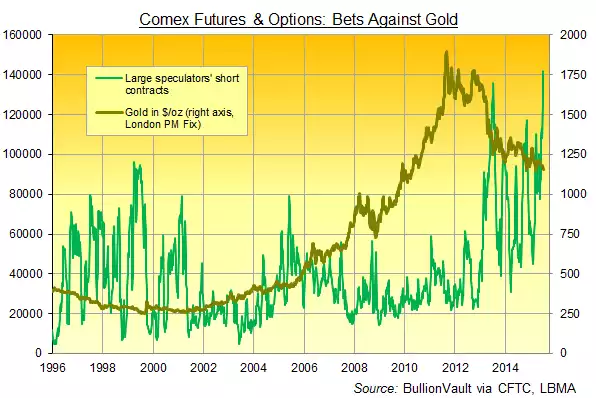

The failure of gold to break through the March lows around US$1,145 could prove ominous for those betting on more price falls over the next few weeks. As the below chart from Bullionvault shows, speculative short positions in the gold futures market (that is, bets on the gold price falling) are at an all-time high.

That a record number of short sellers have failed to push gold to new lows would be of concern to the bears. At some point, you’ll see a large number of these positions bought back, which will provide the fuel for the next rally.

If gold can hold onto current levels without breaking to new lows, there’s a good chance the bottom may be in. That’s in US dollars terms at least. As I pointed out earlier this week, in Aussie dollar terms the gold price is very strong. It’s currently trading over $1,560 an ounce.

Let’s see what the next few weeks bring.”