Shares to Fall 30%, Gold & Silver Up - Brigden

News

|

Posted 20/01/2022

|

6680

Equities markets have painted red all around the world these last couple of days and again it was the tech ‘growth’ shares that faired the worst. The NASDAQ is now down more than 10% putting it into a technical correction for the first time since the COVID plunge in March 2020. Growing fears around central banks removing support are spreading. So why have gold and in particular silver surged? Simplistically investors have been dismissing the seemingly nonsensical valuations of these hand full of tech growth shares (that also completely dominate indexes) on the basis that “fundamentals don’t matter”. The story goes that fundamentals don’t matter because all the new money being injected into the system had to be put somewhere right? So it makes sense then that when said free money is being withdrawn or more expensive to get, that people start to think about fundamentals again…

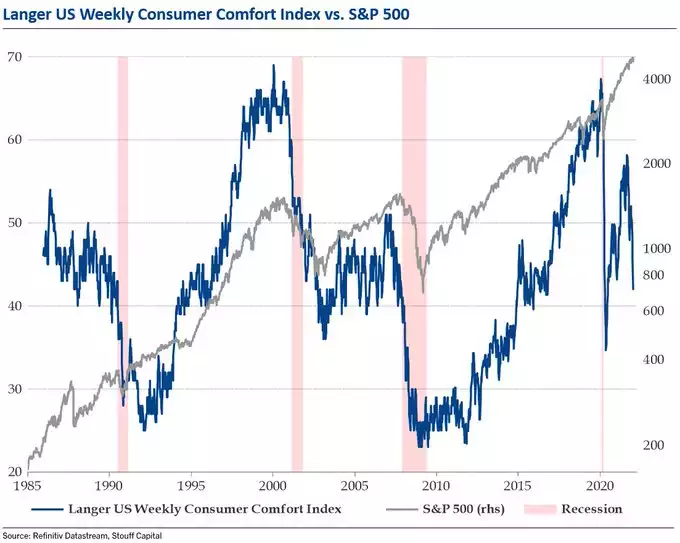

On the face of it, fundamentals did appear to be getting stronger. Economic growth appeared to be getting stronger, employment tighter and credit conditions more robust. But then along came Omicron, the effects of negative wage growth amid NON transitory inflation and of course the prospect of the Fed removing the gear from the junky. Stagflation is firmly back on the table. Right now a bunch of indicators are rolling over with GDP reverting off it’s base effect highs, the January US Empire State Manufacturing Survey collapsing to a -0.7 print, its 3rd biggest drop in history and unsurprisingly the Consumer Comfort index is plummeting. The chart below shows how this has preceded every US sharemarket crash and recessions since the late 80’s…

Bring that back here to Australia and apply your own observations on the impacts of Omicron right now. Supply chains everywhere are a mess, cities and shops are empty, everyone is hunkering down. The wealth effects of a (now) buoyant property market are the only juice flowing as inflation outstrips wage growth…. More debt.

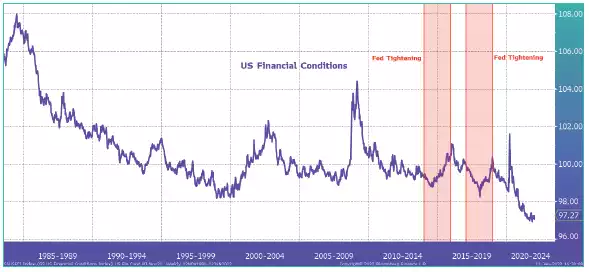

And so as talk turns to tightening it is timely to be reminded just how ‘easy’ financial conditions are right now in the US. The US Financial Conditions index comprises a weighted bag of financial variables such as various types of bond yields, FX, and sharemarket indices. It’s a multi-faceted measure of where the Fed is placing the economy. No surprises we are coming off an all time low (easiest) base. Macro Insiders’ Julian Brigden’s latest In Focus report talks directly to this in his typical insightful way. Firstly he illustrates the correlation between the Financial Conditions index and US GDP since the GFC.

“I often highlight financial conditions because, as I have discussed on numerous occasions, these (and not the Funds rate per se) are ultimately how policy changes impact the broad economy. They are simply too loose. Indeed, if we generously assume that a sustainable trend in GDP growth is as high as between 3-3.5%, i.e. half the current rate, then using the chart above, financial conditions need to revert to levels last seen in late 2017 or pre-pandemic 2020.

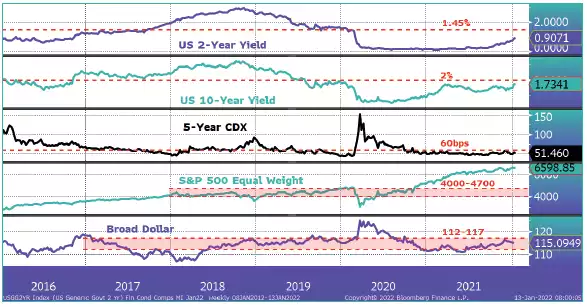

The real question is, how is that achieved? In theory, if the pressure is equally spread across all the typical components of a financial conditions index, then you’d need higher yields across the curve, a stronger dollar, wider credit spreads and lower stocks. However, the real world is rarely that simple, and if we look at current levels versus late 2017 or pre-pandemic 2020, it is clear where the “mispricing” exists. Yes, we’d need higher rates with 2-yr yields at around 1.45% and 10-yr yields about 2%. But the biggest correction would have to occur in US stocks, where the equally weighted S&P (SPW) would conservatively need to fall 30%!”

The point is, nothing can happen in a vacuum, devoid of fundamentals forever. The sharemarkets are reading this right now and these repeated, heavy red days on sharemarkets, so absent for so long, may be the start of the sort of correction Julian is talking about.

Some of this will be covered in a rotation from tech heavy growth shares so dominating indices into value shares, particularly commodities shares. But the sheer scale of over valuation in growth would still mean big falls in the indices that are so passively invested.

Julian concludes as such:

“my bias is for a bearish growth/value rotation and I fully expect year-end developed market stock prices (especially US Tech) to be materially below where they are now. USD will be lower, and Gold and Silver will be higher. Bonds will go down (up in yield) first and up later with a vengeance as the Fed becomes pro-cyclical.

This roller coaster of a year has only just begun.”

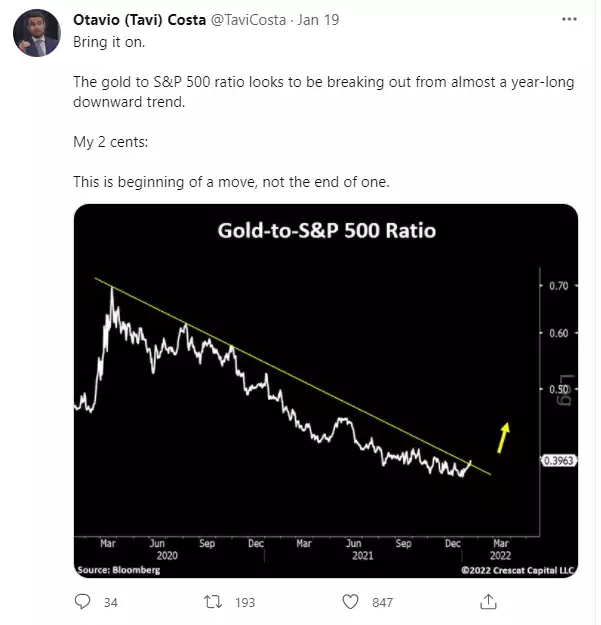

Let us leave you with this tweet from Otavio Costa: