Chainlink Up 800% & Now available at Ainslie

News

|

Posted 21/08/2020

|

9334

Ainslie Wealth is excited to announce a new crypto offering – Chainlink (LINK). Cryptocurrencies as a whole have had a strong year but Chainlink has outperformed the rest by leaps and bounds. Chainlink is now available in-store, online or over the phone through Ainslie Wealth. LINK can be loaded onto any ERC20 compatible wallet – meaning we can put it on your already existing cold ETH Ainslie Crypto Wallet's or any other ETH wallet you may have. LINK is also available to our crypto storage account customers. For more info about Chainlink and the story behind their success, read below.

Chainlink (LINK) is the hottest coin in the crypto space at the moment. Since the start of the year, LINK has been on fire, gaining over 800% and rocketing its way into the top 5 largest cryptocurrencies (by market cap). So, what is Chainlink and what is the hype all about?

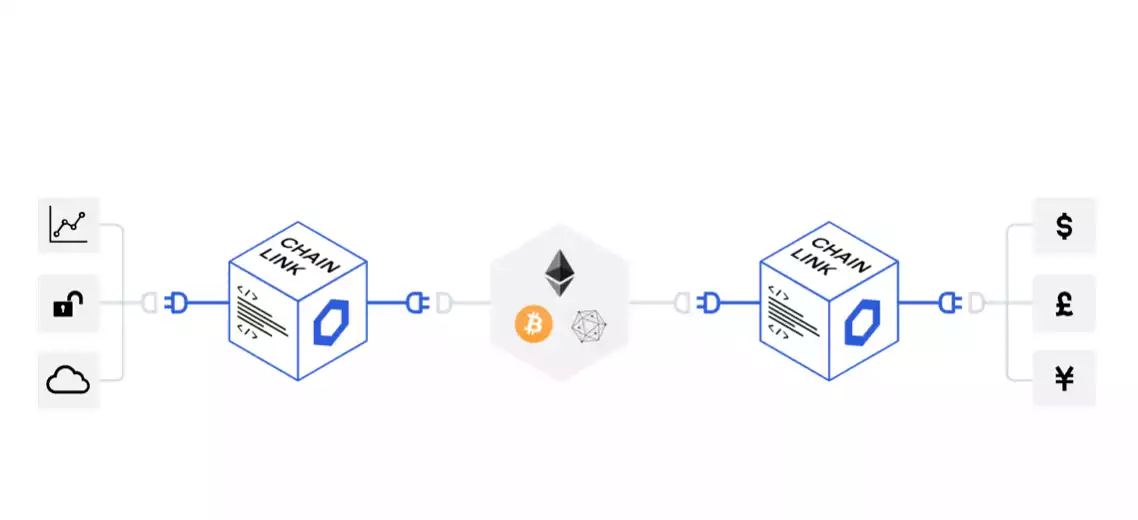

Chainlink is an Ethereum-based token that powers a decentralised network designed to connect smart contracts to external data sources. Chainlink is on track to function as [the decentralised web3's] de facto security layer for all transactions of meaningful value.

In theory, LINK will track the value of the smart contract platform it is securing, meaning the long-term market cap of LINK should eventually be larger than Ethereum's current market cap today.

Chainlink has been boosted in recent months by a surge of interest in decentralised finance (DeFi)—the idea that blockchain entrepreneurs can use bitcoin and crypto technology to recreate traditional financial instruments such as loans and insurance as more and more people and enterprises are looking to move away from the traditional banking and insurance offerings and all their shortcomings.

Before a more detailed explanation below, in basic terms, Chainlink will act as the middleman which will allow the world’s current infrastructure to communicate with the blockchain. Up until now, truly decentralised finance (DeFi) was not possible because a centralised party needed to gather outside information and verify transactions themselves, defeating the original goal that Bitcoin set – to allow every person to be their own bank. With current technology, blockchain and the traditional system simply cannot speak the same language without using Chainlink. Chainlink will power decentralised lending and decentralised insurance – the result being fairer financing and significantly cheaper insurance premiums since traditional banks and insurance providers won't have the stranglehold on the sector they have had up until now.

As it stands, blockchains are unable to speak in a trustless way with real-world data, meaning they require some sort of blockchain abstraction layer that lies between the blockchain and the outside world. Chainlink’s utility has become more apparent as billions of dollars have been locked up in DeFi products reliant on smart contracts. Since early June, the total value locked in DeFi protocols has risen from around US$1 billion to almost US$6.43 billion, according to data from DeFi Pulse.

The problem: smart contracts can't access data on their own.

When developers implement their chosen smart contract, they encounter a connectivity problem. Their smart contract is unable to connect with key external resources like off-chain data and APIs. This lack of external connectivity is due to the method by which consensus is reached around a blockchain's transaction data and is a problem for every smart contract network.

Centralised oracles are a point of failure.

Connecting smart contracts to data inputs through a single node creates the same problem that smart contracts themselves seek to avoid, a single point of failure. With a single oracle node, your smart contract is only as reliable as that one node.

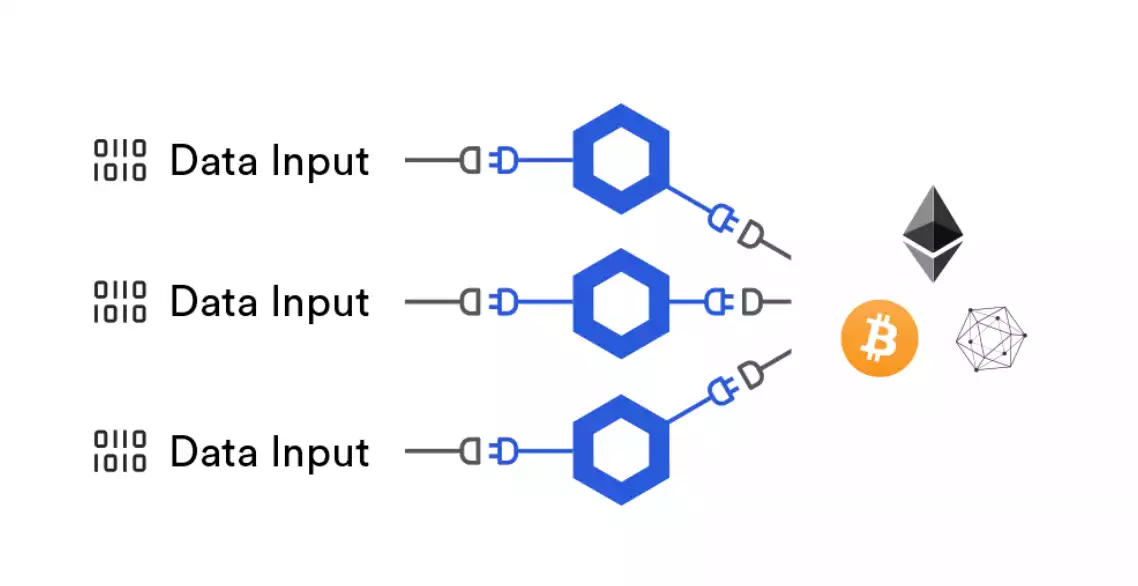

The solution: a highly reliable decentralised oracle network.

Chainlink’s decentralised oracle network provides the same security guarantees as smart contracts themselves. By allowing multiple Chainlinks to evaluate the same data before it becomes a trigger, it eliminates any one point of failure and maintain the overall value of a smart contract that is highly secure, reliable, and trustworthy.

“The Chainlink network provides reliable tamper-proof inputs and outputs for complex smart contracts on any blockchain.”

Chainlink’s protocol connect to any external API, easily connecting smart contracts to the data sources and APIs they need to function and send payments anywhere (from the contract to bank accounts and payment networks).

So what kicked off its meteoric rise?

About a year ago, Chainlink announced that Google was integrating Chainlink into their approach to smart contract adoption on how users could use Chainlink to connect to BigQuery, one of Google’s most popular cloud services.

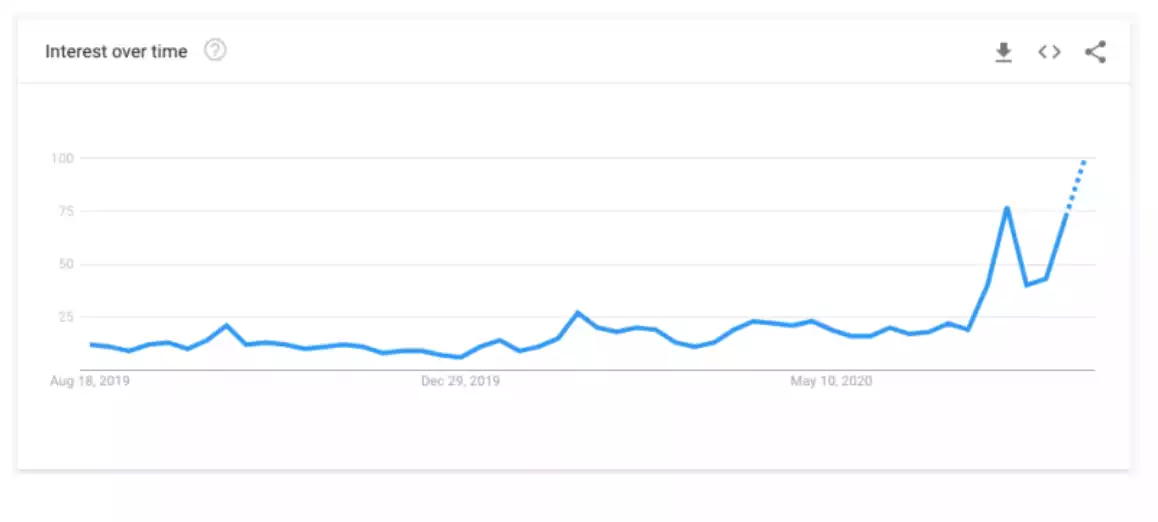

Since then, the price rise has been accompanied by a surge in investor enthusiasm: Searches for Chainlink on Google are at an all-time high and its trading volumes have soared past that of Bitcoin's.

One significant factor is how altcoin markets have been heating up in recent weeks, particularly around projects in the blooming decentralised finance (DeFi) sector.

That said, as the influx of interested traders comes in, people look to take positions in promising projects. LINK’s status as the largest ERC20 token by market cap, as well as Chainlink’s technical and social advances around Ethereum and other smart contract platform communities, has seemingly made the coin a prime target for energised crypto traders, particularly in the last few months.

Additionally, Chainlink partners with projects small, medium, and large, but a lot of the fresh excitement around the oracle network is a result of how the project has aptly positioned itself to serve the ongoing DeFi surge we’re seeing in the crypto-economy.

For example, Chainlink has become the oracle provider for major rising blue-chip DeFi plays like Synthetix and Aave, which are respectively 4th and 3rd in tracker site DeFi Pulse‘s rankings of the largest DeFi projects per total value locked.

In this sense, the success of these projects and others like them are Chainlink’s successes, too. They validate Chainlink’s thesis that many projects won’t want to roll out their own oracles, and they show there's a real and growing demand in the DeFi arena for the services Chainlink has to offer.

Chainlink is one of the most exciting projects in the crypto space presently. Where the project goes from here is anyone’s guess but there’s no question that traders have been piling into LINK lately because they think Chainlink can still rise much farther from here and has real-world applications that will create more demand for the token in the future. In the process, a new crypto juggernaut has been created and one that again highlights the opportunity away from centralised traditional banking to trustless, decentralised DeFi, or ‘new banking’.

To celebrate the launch of LINK on Ainslie Wealth’s platform, until 4pm today we are reducing fees to just 2%. Minimum $2000, maximum online $100,000 (higher over the phone).