Possible Markets of Crypto

News

|

Posted 08/10/2020

|

6340

Cryptocurrencies are geared towards one or more addressable sectors of the finance industry. Investigating these target markets can help us put everything into perspective when it comes to evaluating cryptocurrencies and analysing their price.

Medium of Exchange and Unit of Account

A medium of exchange is an intermediary instrument or system used to facilitate the sale, purchase, or trade of goods between parties. For a system to function as a medium of exchange, it must represent a standard of value. Using a medium of exchange allows for greater efficiency in an economy and stimulates an increase in overall trading activity. In a traditional exchange of goods system, trades between two parties can only happen if one party has a commodity that another party wants, and vice versa.

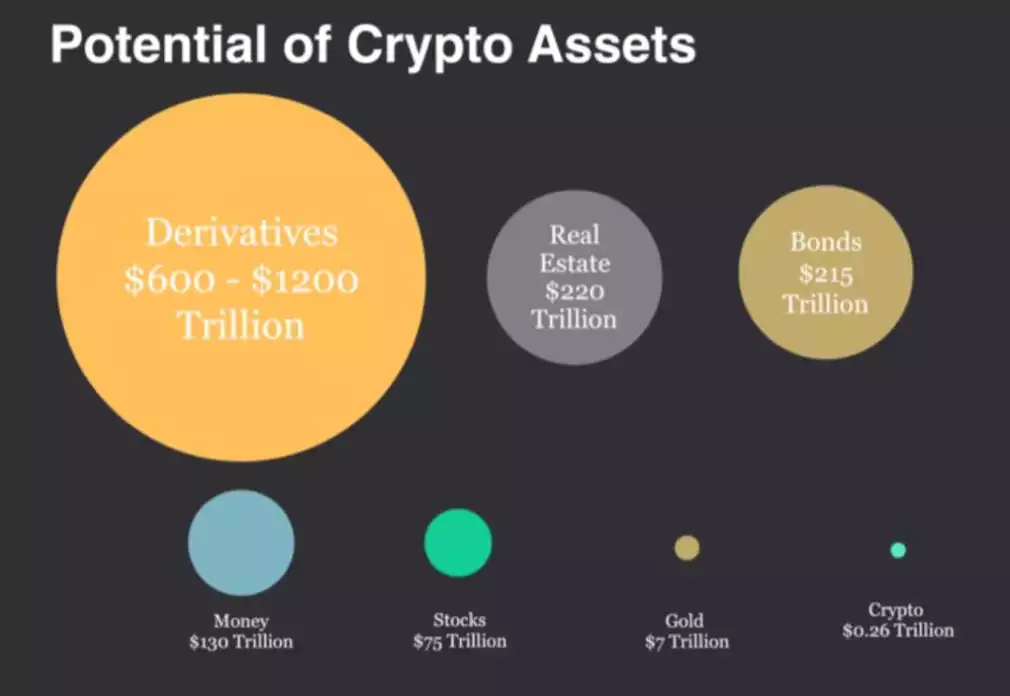

The unit of account and medium of exchange markets are currently estimated to be around US$126.8 trillion. It could also be argued that all of crypto is technically and theoretically a medium of exchange with Bitcoin being the primary “reserve” cryptocurrency. This gives us a present market penetration of 0.13% if we include all of the BTC currently being used as a medium of exchange.

(Crypto Market Research)

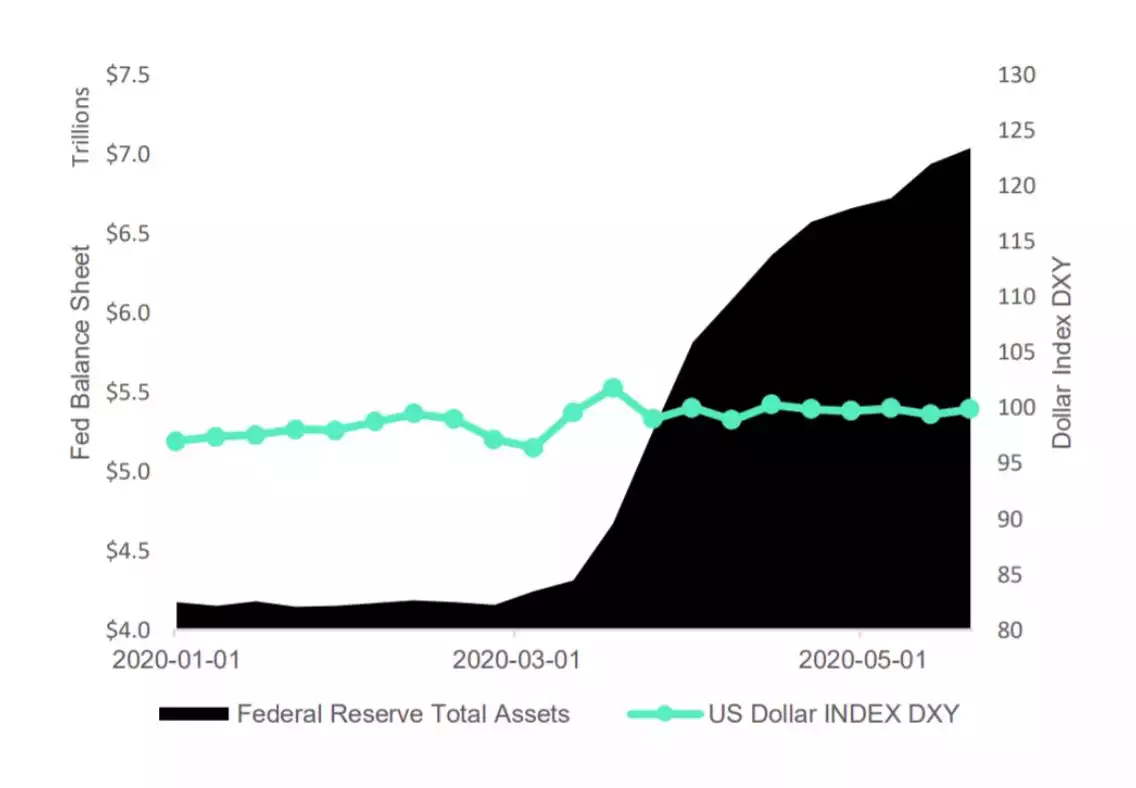

The US dollar index (DXY) has barely changed amid unparalleled quantitative easing, trillions of short-term credits to the repurchase agreement market, and dropping interest rates to zero. This means that, before it begins to devalue against other fiat currencies, the dollar may take even more abuse from the printing machines. Also, the US dollar's 5-year forward inflation forecast is at a low 1.43%. This means that, despite the large US dollar decline, investors expect inflation to be below the target of the Federal Reserve of 2%. Fed Chairman Powell knows that he should, and will most certainly, print more.

Fortunately, the cost of moving between currencies has been minimised by blockchain technology and tokenisation.

In the future, people will be able to hold portfolios of tokenised currencies in their bank account and on their phone, and they will easily be able to exchange currencies by pressing a few buttons. When the Turkish lira is losing value, they will be able to switch into a safe haven stable coin like a tokenised Swiss franc. When Turkish banks offer high-interest rates to draw money, to earn higher interest rates on their deposits, individuals will be able to quickly turn back to the Turkish lira to get that yield. Thanks to the dollarization of public blockchains, this is already inevitable.

Reserve Currency

International currencies held by central banks are reserve currencies. Central banks don’t put the currency in general circulation when acquiring reserves. Instead, the central bank parks the reserves. The reserves can be acquired through trade, with the acquiring country selling goods in exchange for currency.

By helping countries and companies execute transactions using the same currency, reserve currencies thus grease the wheels of foreign trade, a much easier job than settling transactions involving various currencies. Their prominence is easy to see: The amount of currency kept in reserve grew by more than 730% between 1995 and 2011, from about $1.4 trillion to $10.2 trillion.

Established, prosperous countries usually issue reserve currencies. The US dollar, which, according to the International Monetary Fund (IMF) accounted for almost 62% of the allocated reserves at the end of 2012, is the currency most widely kept as a foreign exchange reserve. Other currencies kept in reserve include the euro, the yen of Japan, the franc of Switzerland and the sterling pound. Although the dollar is still the most commonly held reserve currency, the euro has delivered increased competition. The euro has grown from slightly less than an 18% share of allocated reserves when it was introduced into the financial markets in 1999 to 24% at the end of 2011.

Both allocated reserves are stated by the IMF, meaning that the currencies kept in reserve have been defined by a government and total foreign exchange holdings. Over the years, the average proportion of total holdings assigned to reserves has decreased slowly, from 74% in 1995 to 55% in 2011. Changing foreign exchange reserves in emerging and developed countries may explain much of this move. In 1995, about 67% of total foreign exchange reserves were kept by advanced economies, with reserves allocated to 82% of these. By 2011, the image had turned on its head: 67% of total assets were kept by emerging and developed countries, with less than 39% allocated. Emerging countries currently have a reserve currency of about $6.8 trillion.

Reserve currencies currently stand at approximately $11.7 trillion and no central bank has publicly admitted to keeping any cryptocurrency in its reserves.

Store of Value

The target addressable market for value stores, as seen in the image below, is more than $7 trillion. This figure comes mainly from gold's global market capitalisation. Individuals still store value in fiat currencies, however. The US dollar alone has a $3.8 trillion market capitalisation, which is 20 times higher than the market capitalisation of Bitcoin.

People also store their money in stocks and bonds and real estate, so $7.07 trillion is a lower-bound cryptocurrency goal on the highest goal addressable market. The go-to cryptocurrency seems to be Bitcoin when it comes to protecting money. If we take into consideration that store-of-value seekers often don't even move their bitcoin, we can see that in almost a year about 11 million BTC has not moved. It is worth noting that some missing or ‘lost’ private keys are included in this number. Currently, this accounts for around a 1.4% penetration.

(Crypto Market Research)

Some critics of cryptocurrencies claim that as a value store, cryptocurrencies are not appropriate. They claim that cryptocurrencies are only used for day trading and speculation. The "age" of each coin is a reasonable indicator of whether coins are used as a store of value or for short term speculation. For more than 5 years, an average age of 20% of all current bitcoin has been maintained reinforcing the growing ‘store of value’ proposition.

The majority of bitcoins have been held for more than 6 months, further offering proof that bitcoin investors do not use bitcoin for day-to-day trading, but rather retain long-term appreciation. Scarcity, transparency, global availability, pseudonymity and immutability are factors fostering crypto use and acceptance as a store of value.

The fact that most digital currencies have a limited supply, resulting in scarcity, is one of the factors leading to an increase in popularity. Currencies regulated by central authorities, especially in emerging economies, are often subject to arbitrary inflation. In Bitcoin futures, Paul Tudor Jones, who runs the Tudor BVI fund, holds a low single-digit percentage of its assets due to large fiscal spending and bond purchases by central banks to battle the coronavirus pandemic. By his calculation, over $3.9 trillion of fiat currency, the equivalent of 6.6% of global economic output, had been printed since February 2020. To most, this is an obvious play against the risk of hyperinflation and wealth debasement.