The Better Alternative to Gold ETF’s – The new Gold Standard

News

|

Posted 14/01/2021

|

6304

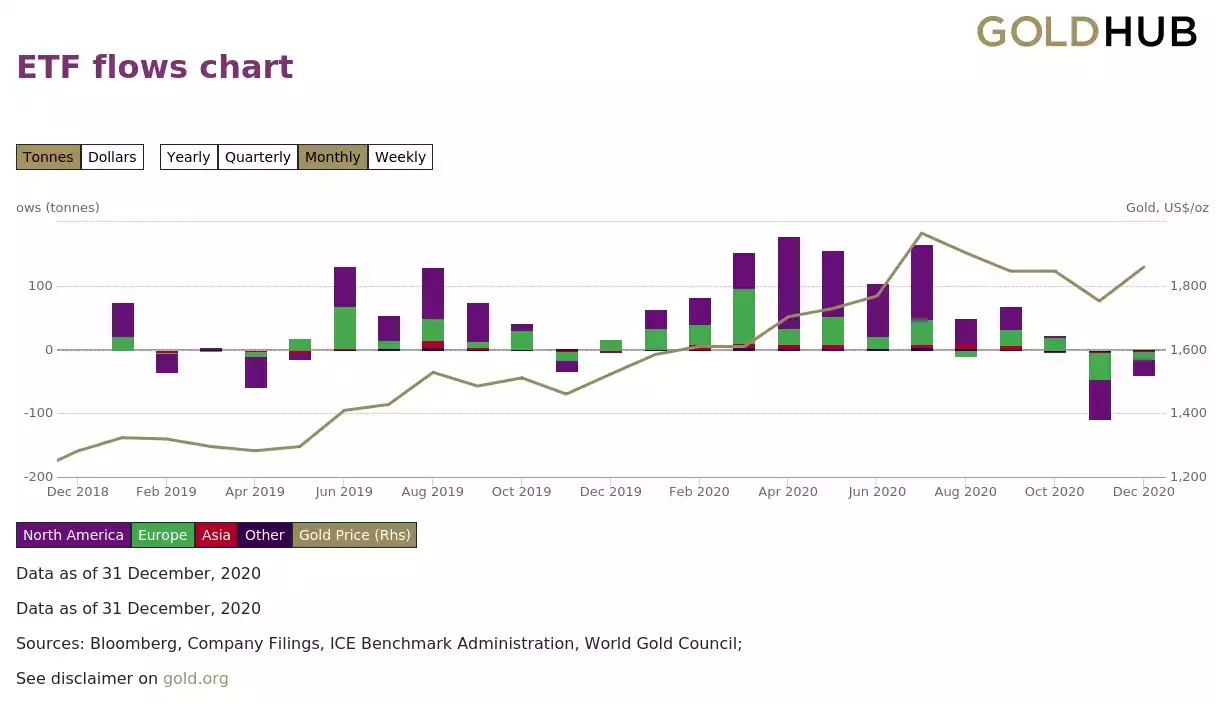

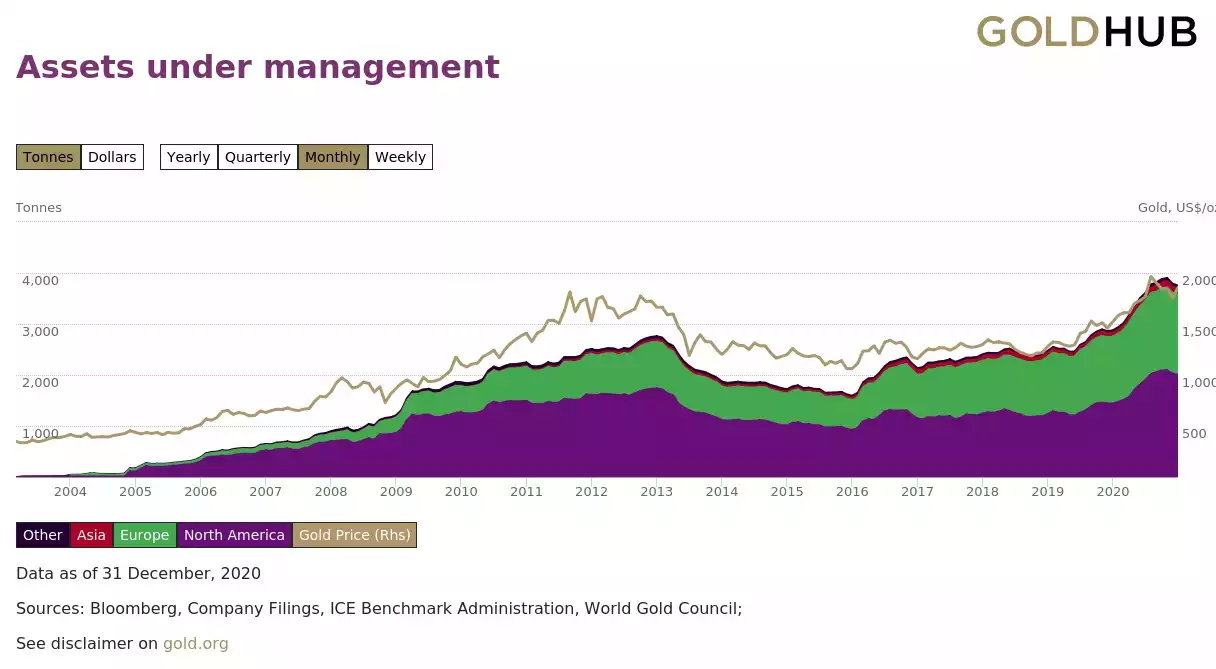

The World Gold Council have released their latest update on global gold ETF holdings confirming 2020 saw record inflows and all time high holdings. As expected though, Q4 of the year did see a reversal with the gold price coming off its all time high and the hope based ‘risk on’ trade we have seen for the past few months. From WGC:

“By any measure, gold-backed ETFs and similar products (gold ETFs) had a remarkable year in 2020. Globally, gold ETFs had record annual net inflows of US$47.9bn, or 877 tonnes(t), collectively increasing their gold holdings by over a third, reaching all-time highs in tonnage (3,752t). Notably, all regions registered significant growth in assets under management (AUM) – more than the foreign reserve holdings of any central banks except for the US and only 15% below the portion of reserves that the US stores at Fort Knox.

While the ultra-low interest rate environment drove inflows in January and February, the global spread and severity of the COVID-19 pandemic from March onwards boosted interest in gold. The heightened risk environment, fiscal and monetary responses to the economic impact of the pandemic, and gold price momentum continued to drive inflows well into H2. The pace of inflows slowed after the gold price hit a new record high – above US$2,000/oz in early August – before correcting to the US$1,900/oz level.

The strength in demand for gold ETFs was further underscored when compared against other forms of physical gold investment. In response to the pandemic, demand for bars and coins was mixed: strength in western markets and weakness in eastern markets (before recovering in Q3). As a result, over the first three quarters of 2020, gold ETFs accounted for almost two-thirds of total investment demand. This is significantly higher than any previous full year. Gold ETF demand was also equivalent to a quarter of the average annual gold mine production over the past five years.

But as investors reduced hedges and increased risk-asset exposure amid positive sentiment following the US election and the announcement of successful COVID-19 vaccines, there were sizeable outflows of 109t in November. And while outflows continued into December, they slowed considerably and were modest by comparison, at 40t.”

Like them or be rightfully wary of them, ETF’s have proven to be an enormous boon for gold demand since their inception. The chart below maps out that huge accumulation of gold:

ETF’s success have come off the back of the convenience and ease with which you can ‘own’ gold. We put ‘own’ in inverted commas for well documented reasons. We have discussed before the very tenuous ownership implied with ETF’s and the extensive ‘vomit clauses’ in their respective PDS’s. You can read further here.

For those looking to own precious metals without the ‘hassle’ of storage and logistics of moving it around, Ainslie have the alternative of storage accounts with us or our Gold Standard and Silver Standard tokens. As opposed to an ETF, anyone can see that we have ALL the metal already locked away in the high security, Australia domiciled, non Government, non Financial Institution, Reserve Vault. At any time you can verify via the blockchain the number of tokens issued and on the goldsilverstandard.com website you can see how much metal is vaulted, each bar’s brand and serial number and where it is vaulted. And so you don’t even need to trust us, those holdings are verified by global assurance firm PKF every quarter, not only for what’s there, its weight and purity, but also (very importantly) that we haven’t moved it since the last audit. The terms prohibit any leasing or other ‘use’ of YOUR gold either. The latter cuts to the core of the allegations of ETF gold being on-leased / rehypothecated and hence confusing who actually ‘owns’ it. It is then also fully insured through the world’s pre-eminent insurer out of London, again a very grey area in an ETF PDS.

And so the metal is secured safely and your digital certificate of ownership is secured in the immutable blockchain using the Ethereum network. That token can be stored easily in a wallet, moved cheaply and safely, and traded 24/7 on a number of exchanges or through Ainslie.

Yesterday we launched the new contract upgrade for these and there are some really important changes that you should be aware of if you missed the emails.

First we have removed the transfer fees from the contract. That means you can move your tokens without losing any of your metal holdings. That also made the smart contract much simpler and hence more efficient. Because it is on the Ethereum blockchain, the absolutely dominant and proven blockchain for digitised assets, the simpler contract now means the tokens are Decentralised Finance ready for use in swap pools, decentralised finance platforms and exchanges nearly all of which use the Ethereum network. The new contract is also ETH2.0 ready.

Secondly, we have restructured the legal framework to provide direct ownership of the metal held by the clean and unencumbered custodian Gold Silver Standard Custodian. The previous structure had each token as a call option for the metal, exercisable at any time. The new structure has a direct ownership and the custodian purely holding the tokenholder’s metal for them. It is unambiguous ownership of fully allocated vaulted bullion and again a mile away from the structures employed by ETF’s.

Finally, ETF’s typically charge 0.4% per year that comes off your (ever diminishing) holdings. There is no charge for Gold Standard and Silver Standard tokens.

If you were an existing holder of the tokens before the change yesterday, whilst there is no required action, this link will help you manage your holdings.

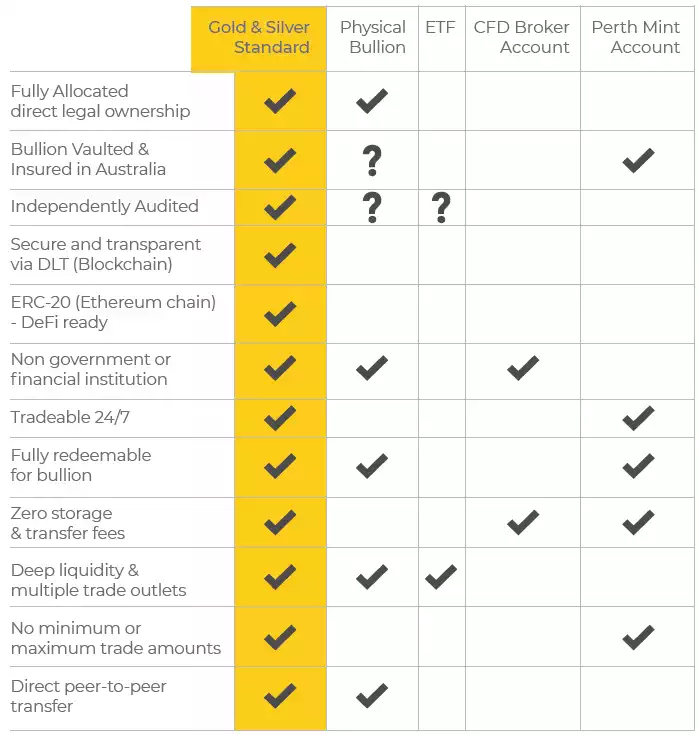

Consider the cost and logistics of storing and moving silver in particular against this alternative. Below is a further summary or go to goldsilverstandard.com to learn more or of course give us a call any time to discuss.