Silver Smashes Record – GSR Reverting

News

|

Posted 08/02/2021

|

6568

Last week was one many will never forget for silver. We wrote at length last week on the drivers and outcomes (here, here and here). We now have full visibility of the extent of the record inflows into ETF’s, COMEX and mutual funds and not only was it the highest on record, an eye watering 68.3 million oz, it was the highest by a margin of nearly 50%. In addition, there are no end of stories about shortages for physical silver, particularly in the US. (we still have plenty of stock of most core items… for now.)

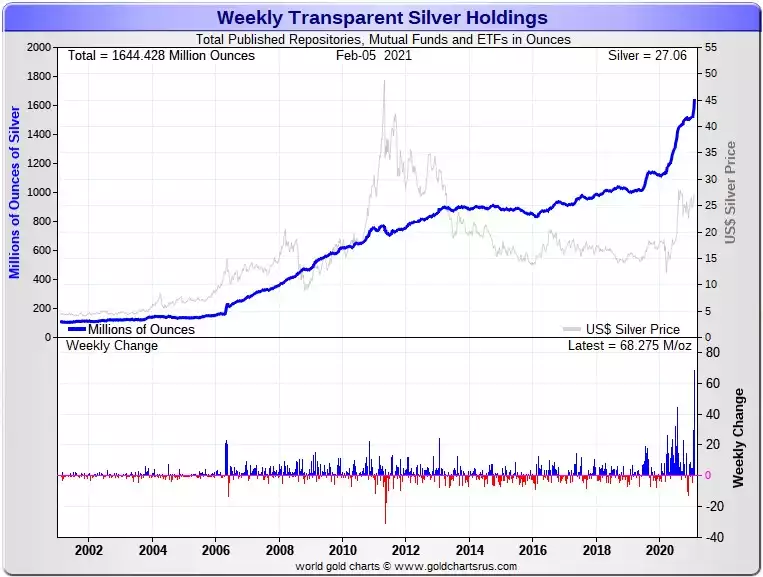

The chart below shows the extent of those inflows with the far right blue bar showing the near 70m oz inflow compared to the previous record last August when silver surpassed $40.

The chart above is notable not just for that huge blue bar on inflows. The total holdings for these derivative vehicles now sits at 1,644m oz. That is over 51,000 tonne! For context that is nearly double global mine production.

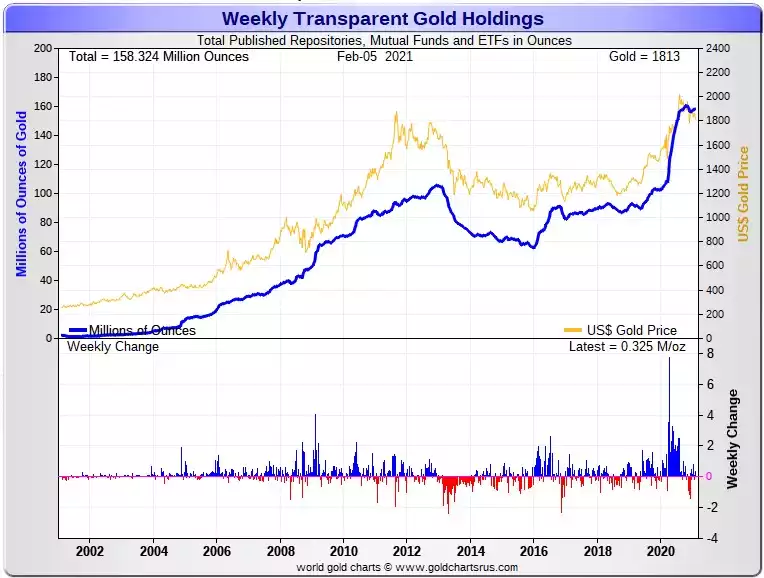

Consider in the chart above the correlation between the price of silver and total holdings, well, the lack of… Now compare that for gold:

The contrast is obvious and stark. In 2011, the silver price clearly overshot any correlation, the Gold Silver Ratio (GSR) dropped to just 30 and the price hit US$50. The correction was huge and again overshot (to the downside) the correlation again. With demand booming and the price starting to rise, this looks very much like a coiled spring. That behaviour, by the way, is very typical of the dynamic of the GSR. As the gold price structurally firms the GSR tends to revert to the low side and silver belatedly takes off to outperform gold.

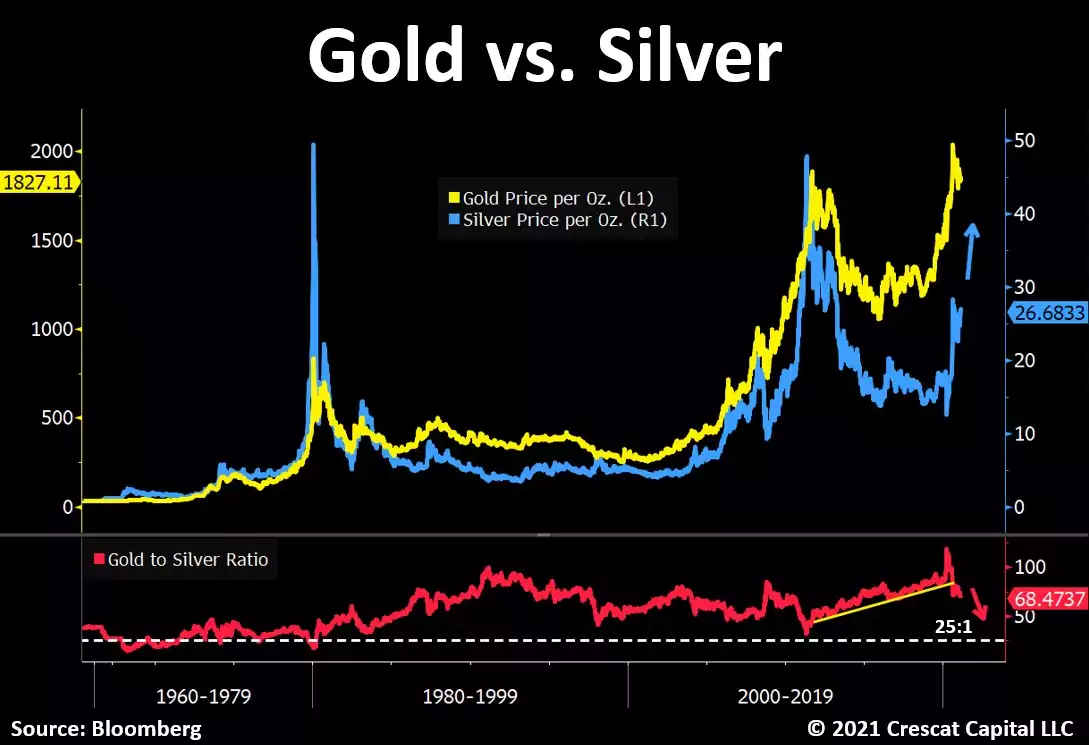

Crescat’s Keven C. Smith tweeted to this over the weekend in regard to the chart below:

“Silver ratios and targets based on current gold price:

25:1 - Ag to Au in earth’s crust: $73

15:1 - 1792 Coinage Act: $122

9:1 - Current global silver to gold mining production: $203

Supply/demand imbalances today could easily lead to Ag 100+ in this cycle.”