Silver Momentum Set for Breakout

News

|

Posted 12/04/2018

|

6943

Last night, on the back of escalating sabre rattling over Syria, gold spiked to $1364 and silver to $16.86 before hawkish Fed minutes saw a partial retraction. The market is clearly nervous and these nerves come at a time, particularly in silver, coinciding with structural price pressures.

Momentum Structural Analysis (MSA) looks at the market from a somewhat different point of view. Rather than focusing on price, something that virtually everybody does, MSA tracks momentum and in doing so reveals trends that have been building for a long time, with much more depth to them and staying power. Recently they turned their focus towards silver, identifying the potential for significant gains in the months ahead.

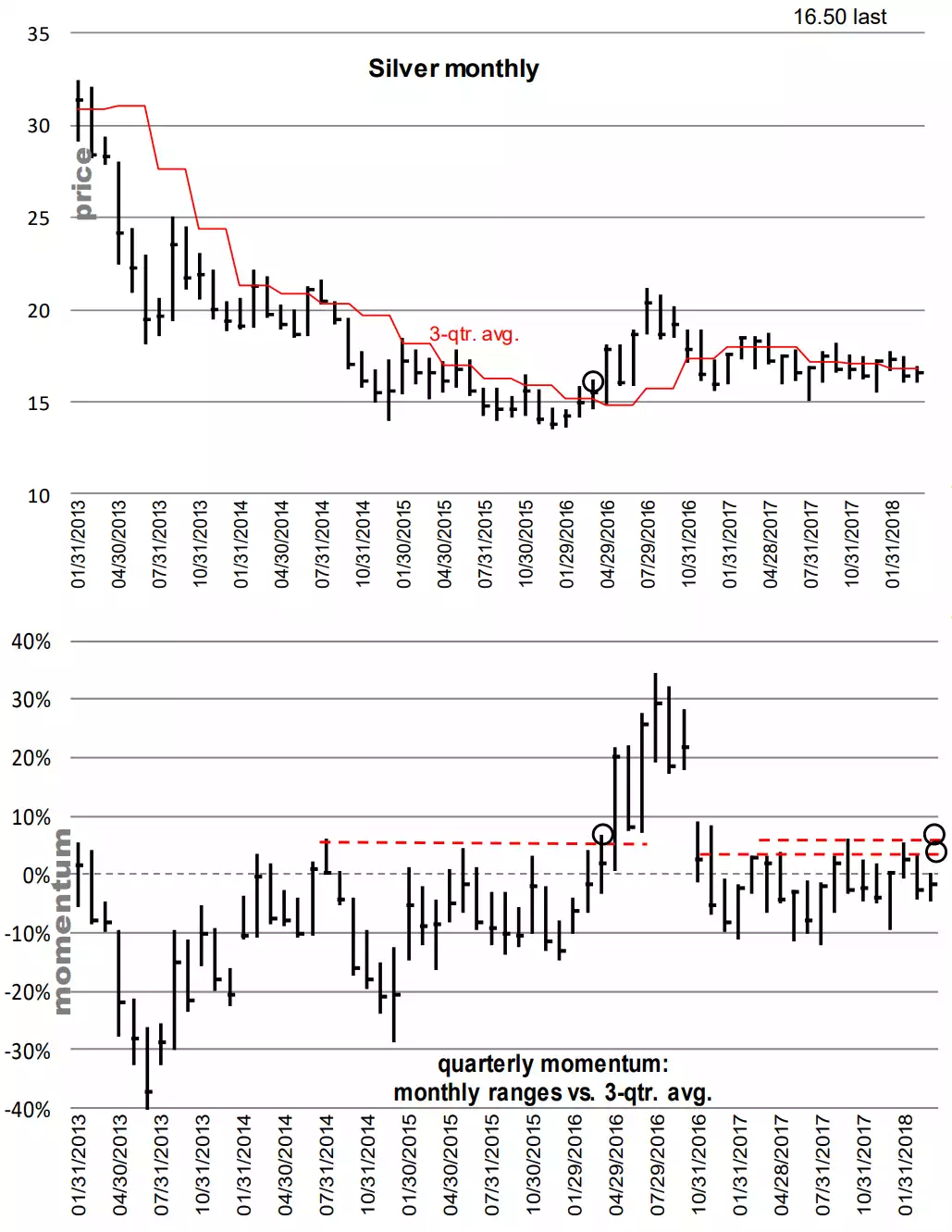

Quarterly Momentum

Unlike gold, which has been clustered near the top end of the past few years’ price range, silver has remained dormant in the middle of its range between the 2015 low and the 2016 high. It would not take much for this situation to change however, and silver to outpace gold.

There are two specific levels MSA identified that will be important for this next breakout in silver to occur. The first is quarterly momentum. A monthly close over the lower red line on momentum action would take out all monthly closing readings of the past year and a quarter. MSA estimate that for Q2 a monthly close at $17.22 (USD) would be sufficient.

The second level worth watching is intramonth. A trade in Q2 up to $17.72 (USD) will take out the upper red line across highs of the past year on momentum. This is a similar momentum structure to the one that established itself in 2014 and 2015, with the breakout following in early 2016, as can be seen on the chart.

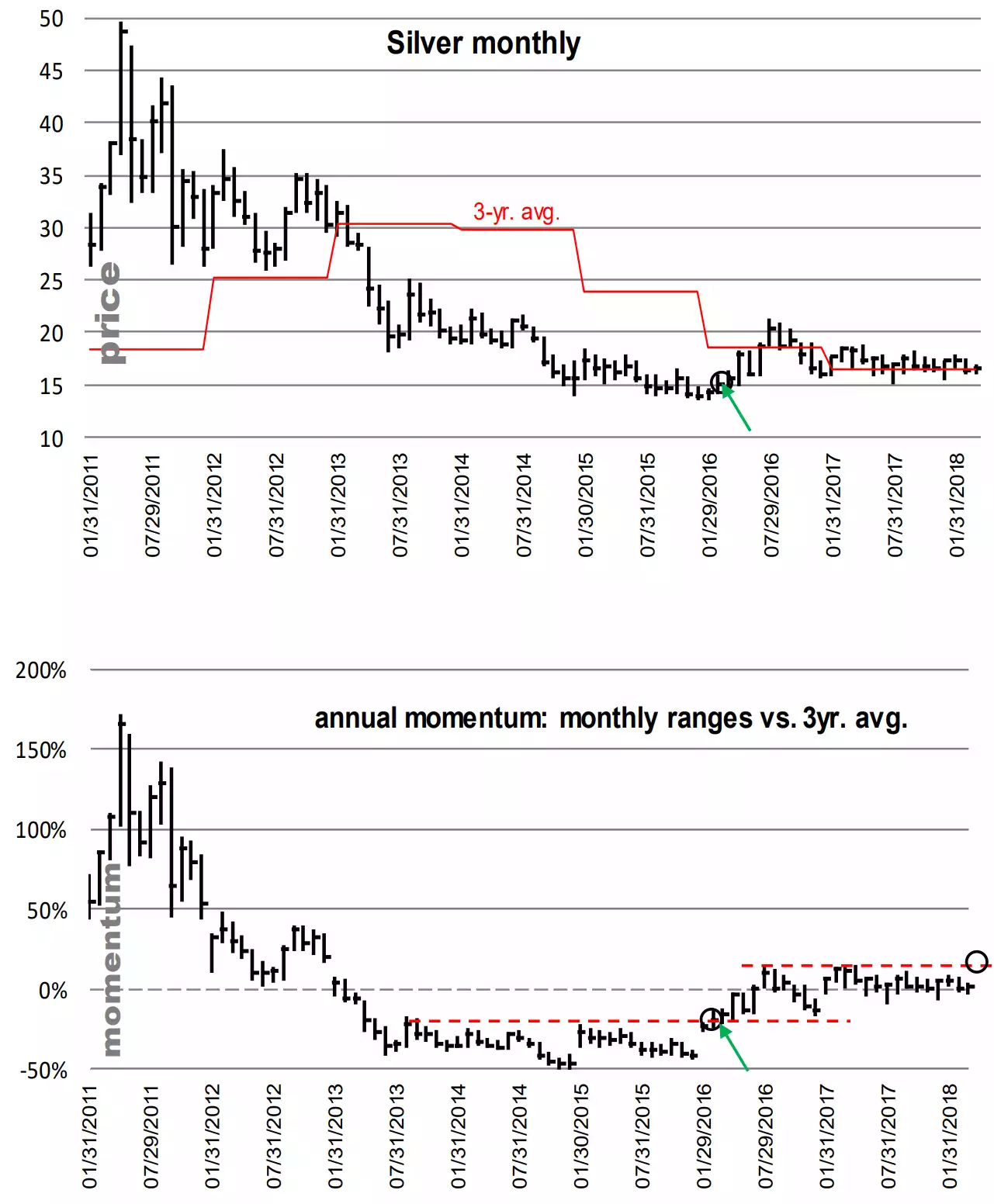

Annual Momentum

From the broader, annual, perspective momentum is setting up to continue the primary move that began in February 2016 when the price rallied up from $14.90 (USD), noted by the green arrow.

The price action of the past few years has created a new horizontal target. MSA believes that if the price trades up to $18.60 (USD) at any stage this year there will be a triple top breakout for momentum, which will then see the price follow higher (potentially much higher). If that is achieved, they believe the next leg (which they do not see as the final leg) will reach a minimum of $25 (USD) before encountering any serious resistance.

Silver continues to offer a fundamental value proposition that is hard to beat, especially while the gold:silver ratio remains over 80 as it is currently. When you add in technical analysis like this, the opportunity to stock up on some more physical silver seems too good to miss.