Silver Industrial Demand to Set New High in 2021

News

|

Posted 04/01/2022

|

5257

Happy New Year to all our customers and regular readers of our daily news. As we discussed last year, there appears to be wide consensus that 2022 promises to be a volatile ride in financial markets. Who will be winners and losers may be one of timing of entry and exit points OR for those without such luck, BALANCE or diversification in uncorrelated assets.

One asset that presents as a rounded diversifier is silver. Half industrial metal and half monetary asset, silver wears two uncorrelated hats within the one asset. As usual we will summarise the annual review for 2021 by the Silver Institute when it comes out but as a teaser they have provide the following projections on evidence thus far.

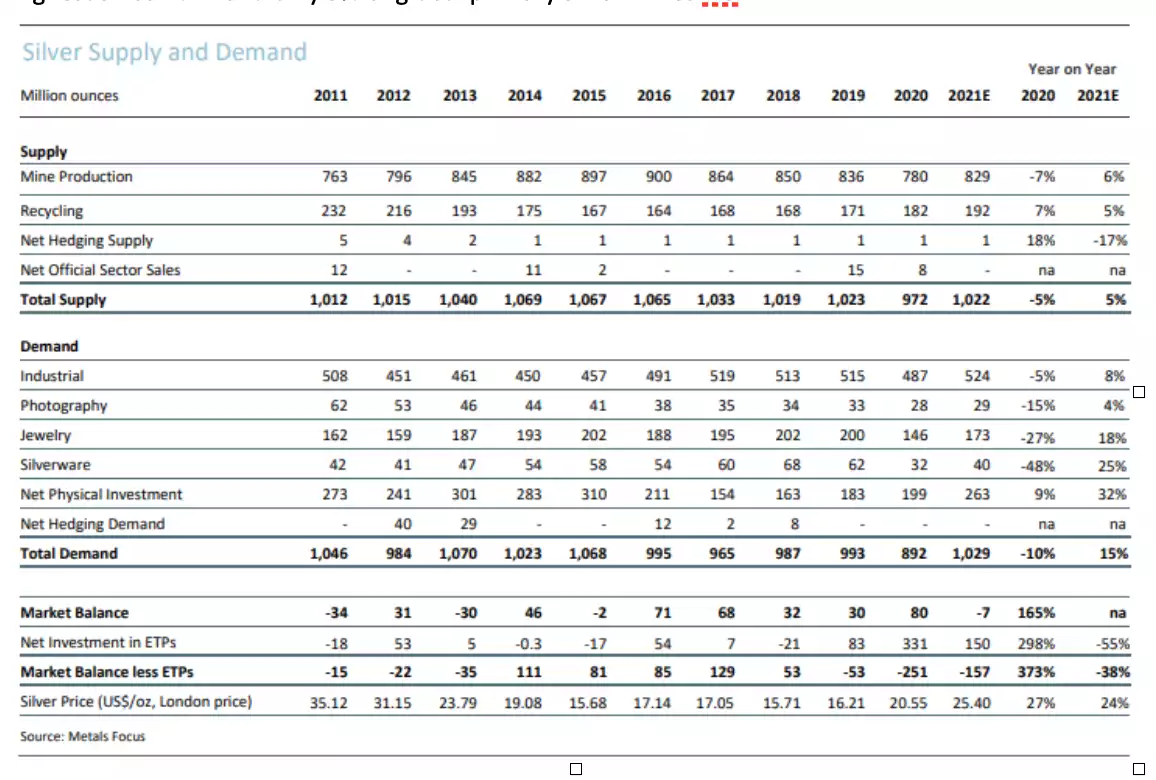

“Every key area of silver demand is forecast to rise in 2021, including a record total for overall demand -- 1.029 billion ounces -- the first time it has exceeded 1 billion ounces since 2015. In addition, physical silver investment is forecast to jump by 32% in 2021 for a 6-year high…

• The recovery in silver industrial demand from the pandemic will see this segment achieve a new high of 524 million ounces (Moz). In terms of some of the key segments, we estimate that photovoltaic demand will rise by 13% to over 110 Moz, a new high and highlighting silver’s key role in the green economy. This will also underpin much of the forecast 10% gain in electrical/electronics offtake. Finally, brazing alloy & solder demand is set to improve by 10% in 2021, helped by a recovery in housing and construction, although this will still fall short of pre-pandemic levels.

• Physical investment in 2021 is on course to increase by 32%, or 64 Moz, year-on-year to a six-year high of 263 Moz. The strength will be driven by the US and India. Building on solid gains last year, US coin and bar demand is expected to surpass 100 Moz for the first time since 2015. Growth began with the social media buying frenzy before spreading to more traditional silver investors. Indian demand reflects improved sentiment towards the silver price and a recovering economy. Overall, physical investment in India is forecast to surge almost three-fold this year, having collapsed in 2020.

• Exchange-traded products are forecast to see total holdings rise by 150 Moz this year. As a result, combined holdings will have risen by a dramatic 564 Moz over the past three years. During 2021 and through to November 10, holdings rose by 83 Moz, taking the global total to 1.15 billion ounces, close to its record high of 1.21 billion ounces which occurred on February 2, at the height of the social media storm.

• This year, the silver price has built on its 2020 gains and has continued to strengthen. Through to November 10, prices have risen by 28% year-on-year. This follows a 27% rise for the annual average price in 2020. The upside reflects healthy investor inflows into silver, on the back of supportive macroeconomic conditions, notably the persistence of exceptionally low interest rates, concerns about uncontrolled fiscal expansion and, most recently, growing concerns about rising inflationary pressures. The gold:silver ratio fell to 62 in early February, its lowest since July 2014. However, since then it has risen, to stand at around 74 in early November. Even so, this still compares favorably with last year when the ratio averaged 89. In terms of the full year price average, Metals Focus expect silver to rise by 24% year-on-year to $25.40. This would achieve the highest annual average since 2012’s $31.15.

• In 2021, mined silver production is expected to rise by 6% year-on-year to 829 Moz. This recovery is largely the result of most mines being able to operate at full production rates throughout the year following enforced stoppages in 2020 due to the pandemic. Those countries where output was most heavily impacted last year, such as Peru, Mexico and Bolivia, will have the biggest increases. Meanwhile, strong silver and byproduct metal prices this year have improved profitability in the silver mining sector despite rising input costs. Average margins in the industry are currently at their highest since 2012 and only 5% of global primary silver mines were operating with costs above the silver price in the first half of the year.

• Silver jewelry and silverware fabrication are expected to partially recover from 2020’s depressed totals, rising by 18% and 25% respectively, to 173 Moz and 40 Moz. Both markets will benefit from a marked upturn in all key countries, especially in India as the economy and consumer sentiment have bounced back more quickly than expected, and as restrictions ended in time for the all important wedding and festive season.

• Overall, the silver market is expected to record a physical deficit in 2021, albeit modestly. At 7 Moz, this will mark the first deficit since 2015.”