Silver ETF’s Defy The Trend

News

|

Posted 26/07/2018

|

6583

Apparently there was some confusion over yesterday’s article that we somehow endorse ETF’s. We don’t. The thrust of yesterday’s article was that like them or distrust them, ETF’s account for a large proportion of gold and silver demand which is influential on the price of each. We made the point they don’t really make sense when you can so easily trade the physical metal without counterparty risk. Bitcoin, however, is viewed by many as not so easy and hence the potential for price influence by an ETF is even greater.

We outlined our views on ETF’s very clearly in “Beware Gold ETF’s” last year (click the link within as well) and more recently gave an update here in March. In essence you are buying a paper promise and that promise, as outlined in their PDS, is riddled with ‘vomit clauses’ obviating them from any liability. Physical metal, or bitcoin in your own cold wallet, have absolutely no such counterparty risk and are easy to trade through us. So whilst on the topic let’s look at an update on total holdings by such parties as it is a very interesting setup at present.

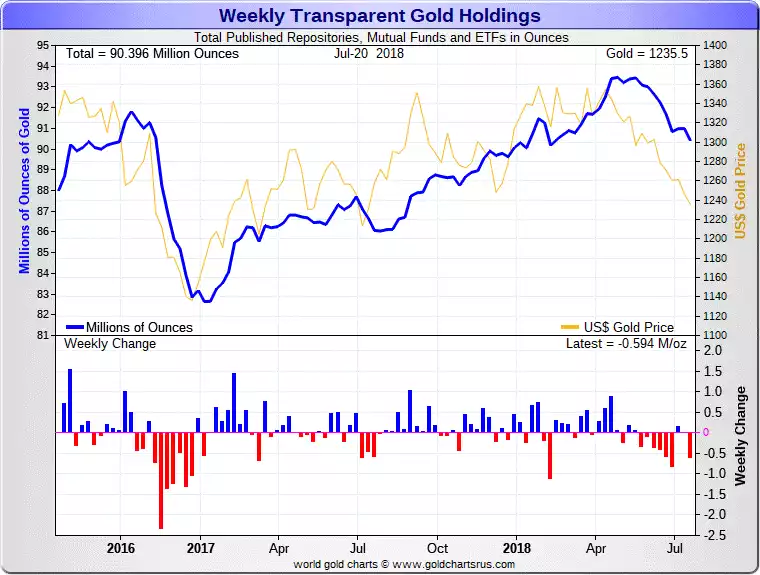

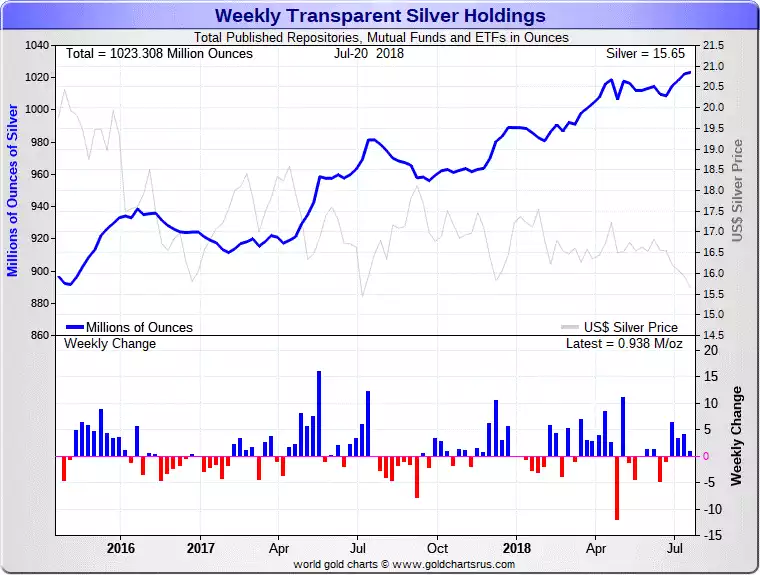

Below are the total transparent holdings for Mutual Funds and ETF’s for each metal over the last 2 years.

As you’d expect with the flighty money of ETF’s, the price is down and so are holdings. But take a look at silver….

Despite similar price declines in silver this has not affected the continual growth in silver holdings by these funds. That is potentially a very bullish sign and one in line with an insightful view by the market looking at a Gold:Silver ratio of 79 against a 100 year average of around 45….

What’s not ‘insightful’ is that they are relaxed being in a paper promise for said silver…