Property Crash Predicted

News

|

Posted 31/07/2020

|

11403

You can sense the growing realisation in Australia that a V shaped recovery is simply not on the cards as many people started to believe when ‘everything was awesome’ again after that initial lockdown. Our packed waiting room every day is a good anecdotal indicator. The second wave is upon us with Victoria getting worse not better and a feeling of inevitability that it will spread with the sort of selfish stupidity we saw in those young girls sneaking into Queensland this week.

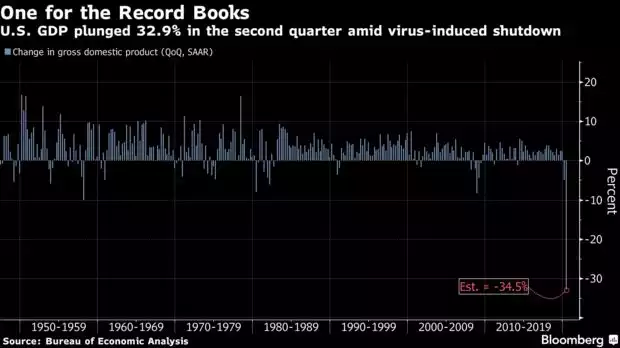

Last night we saw a record fall in GDP for the US of 32.9%. Again we keep using the word unprecedented when looking at the economic impacts of COVID-19 and the chart from Bloomberg below illustrates just how unprecedentedly bad this is in an historical context…

On the same night of this print we also saw a second straight week of initial jobless claims getting worse, another 1.43m Americans filing for the dole and taking the ongoing total to 17m. To make matters worse there is no sign of an imminent agreement to extend the government relief package for businesses and individuals alike as the Republicans and Democrats can’t agree.

At home the AFR ran a story yesterday on Macquarie Bank’s dire view of the Australian economy and their inability to give any sort of guidance amid such uncertainty, leading with:

“Macquarie Group has warned current levels of government support have likely "masked" higher unemployment and a deeper economic slump, and says it is unable to provide earnings guidance for the first time since the 2008 global financial crisis.”

What guidance they did give must be cause for considerable concern, particularly for property investors:

“Chief financial officer Alex Harvey said the company’s base case – with a likelihood of slightly more than 50 per cent – was for a 9 per cent fall in GDP by mid-year sparking a surge in unemployment to 9 per cent and a 15 per cent slide in house prices.

There was slightly less than even chance of a less optimistic scenario – a jobless rate of 11 per cent and a 30 per cent crash in the property market – occurring.

Mr Harvey said the company wasn’t betting on an economic snapback. “I’m not saying it’s zero [per cent chance] – it’s unlikely,” he said. The company said it was “unable to provide meaningful guidance” for its earnings over the coming year.”

Reinforcing this concern was the release yesterday of the latest ABS figures for dwelling approvals for June which saw a 4th consecutive month of declines, the longest running decline since the GFC. After the 15.8% drop in May, June saw another 4.9% in June. ANZ economist Adelaide Timbrell doesn’t see this improving any time soon either:

“Slow population growth, elevated unemployment and rising vacancy rates are all slowing the demand for new housing……We expect more declines in approvals in the months ahead.”

Aussie have long had property as their ‘go to’ hard asset of choice. Bricks and mortar is in our blood. However, as we wrote most recently here, the fundamentals are looking decidedly worrisome. With shares elevated despite these economic conditions, property looking at losses ahead and no return on cash in the bank, it is no wonder gold and silver are becoming the asset of choice for so many.