Shorts covering rally close?

News

|

Posted 30/09/2014

|

3239

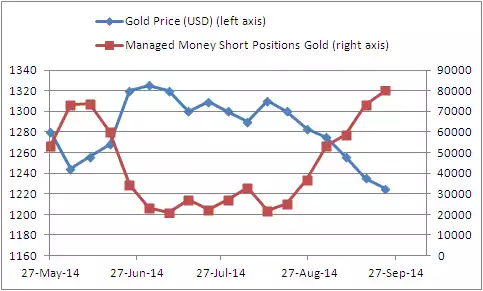

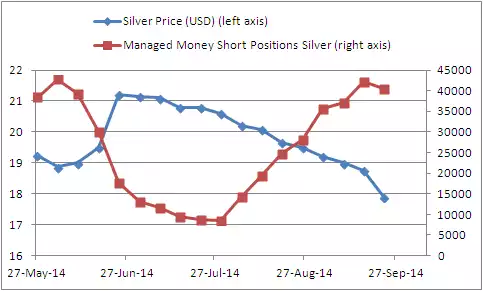

The charts below show the extent of the growth in short positions by Managed Money on both gold and silver since the middle of this year. As these bets on lower prices escalate and the price is driven down we are also seeing growing physical demand of late through the ‘demand barometers’ of the Shanghai Futures Exchange seeing record low silver inventories (now down to only 80.5t), huge inflows into the SLV ETF, the highest 2014 gold imports into China (this week hitting 50.3t), a strong rebound of gold imports to India and continued silver demand, US Eagle coins sharply rebounding, and Perth Mint sales of both gold and silver rebounding strongly in August. It is starting to get the feeling of a short covering rally being close…