Secular Bull Market – Gold & Silver

News

|

Posted 12/10/2016

|

4610

We attended the Precious Metals Investment Symposium in Sydney yesterday. There were a range of speakers but a common conclusion. Gold is in a secular bull market. Before you think it’s an obvious conclusion for a gold and silver ‘love in’, that has certainly not been the conclusion of the last couple of years. These conclusions were based on well reasoned analysis on a market that has turned in a consolidated manner.

For us last week was quite instructive too. Gold and silver saw their biggest weekly drop in around 3 years. That sort of ‘shaking of the tree’ would normally see a number of speculative investors fall out and sell in panic. It was the opposite with an extraordinary amount of people ‘buying the dip’ and hardly any sellers.

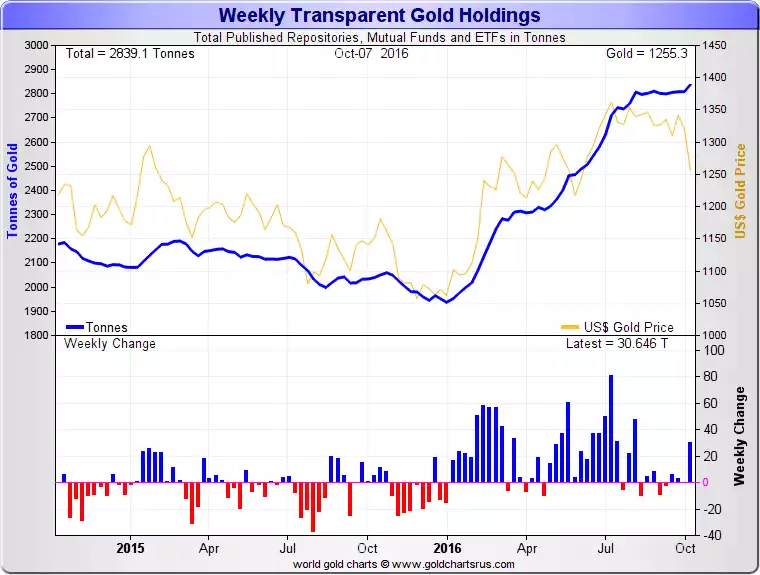

Last week was also notable for the amount of gold and silver that piled INTO the physical backed paper investment vehicles such as ETF’s. From Bloomberg:

“Holdings of ETFs backed by gold rose by 9.1 metric tons to 2,046.4 tons on Friday. Assets in SPDR Gold Shares, the world’s biggest gold ETF backed, surged to the highest since mid-August.”

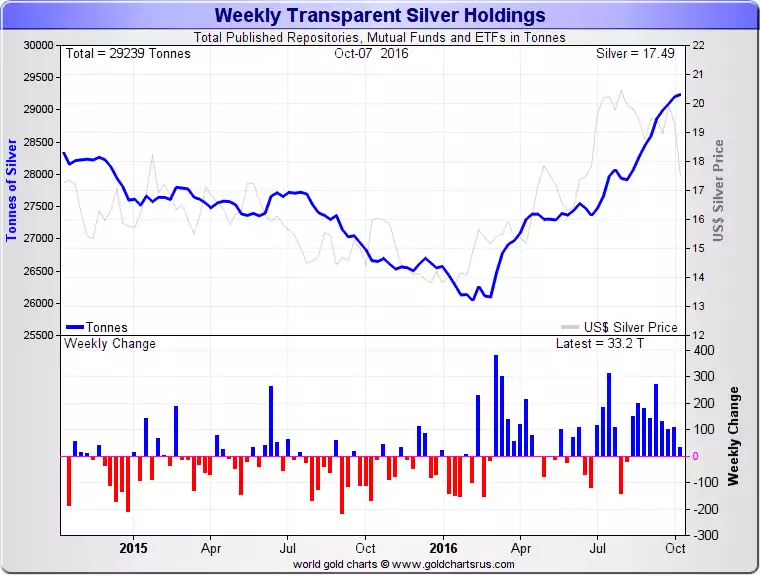

In total the ETF’s holdings rose to their highest level since 2013. The story was the same for silver and the following charts show total weekly transparent holdings for both metals:

The key takeaway is that holdings ROSE on a price decline and it speaks volumes for the secular bull market thesis and that the sell-off was largely paper futures trades on COMEX that can have little to do with physical fundamentals.

By its nature a secular bull market has its big corrections on the way up, nothing goes up smoothly. The smart ones buy the dips on the way up.