Russia’s golden positioning

News

|

Posted 22/05/2014

|

2827

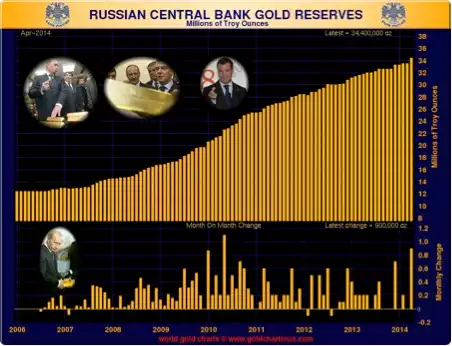

It’s been an interesting couple of days with firstly the monthly release of Russia’s central bank gold purchases showing 900,000 ounces added in April, the second largest monthly purchase in history. News broke of a non USD settlement exchange deal between China and Russia’s largest bank, and then last night the signing of the $400billion natural gas deal between the world’s largest gas producer, Russia and the world’s largest consumer China with not a USD to be seen. There will be inevitable cries today of this being one of the final steps toward the death of the USD hegemony (and rise of gold) but we’d suggest that is a little premature and doesn’t fully consider that even after Russia dumped 20% of its US Treasuries last week, both countries hold a very large amount of USD denominated debt. That said, they are certainly not alone in wanting to remove the USD as the world reserve currency and that should surely be good for gold….