Risk-Parity - The New Market Danger

News

|

Posted 15/09/2016

|

5582

Shares and bonds tend to be uncorrelated with one generally down when the other is up. It is to some extent the same for gold, though 2016 has seen a broader trend of both US shares and gold rising together apart from the crash in shares and surge in gold at the beginning of the year. We have surmised this is investors taking an uneasy punt on the Fed continuing to prop up US Shares (the ‘don’t fight the Fed bet’) but having their hedge in place with gold. Moreover though, share prices have been driven not by ‘investors’ but rather company share buy backs.

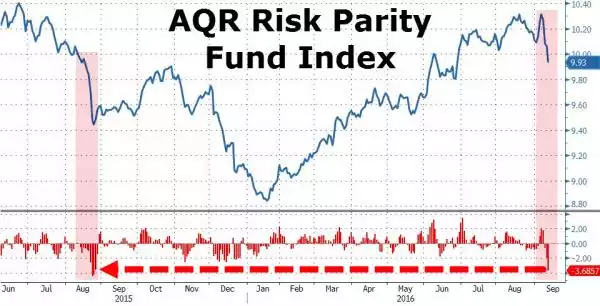

Rarely do you see what we’ve witnessed recently, and especially to extent of the last few days, where both shares and bonds fall and rise in unison to the extent depicted in the chart below (remembering falling bond price means higher yield).

There are a relatively new breed of fund that promise gains on using the traditional lack of correlation between shares and bonds and extensive use of leverage. These are called risk parity funds. From The Wall Street Journal:

“So-called risk-parity funds seek to produce above-market gains with lower risk by using futures or other derivatives to increase their returns on safer assets such as bonds. This leverage has at times resulted in strong performance by the funds, which analysts estimate control tens of billions of dollars of assets. But it also leaves them vulnerable when stock and bond prices fall suddenly, as happened both on Friday and Tuesday.

Broadly speaking, risk-parity funds try to equalize the potential volatility in a portfolio of stocks, bonds and assets like commodities by applying leverage to lower-risk, lower-returning investments such as government bonds….

During a period of damped volatility, risk-parity funds are able to push up their equity holdings and still maintain a low-volatility profile. The danger, some analysts say, is if bonds and stocks both fall for a prolonged period, the funds can be forced to deleverage by selling investments, amplifying an already negative market environment.”

This forced dumping into an already falling market when “tens of billions of dollars of assets” are held is one of the many elephants in the room at the moment. The AQR Risk Parity Fund Index is one of the larger such funds and the chart below shows an unsettling similarity to the crash last August….