Record Silver COMEX Claims Per Oz Available

News

|

Posted 09/06/2016

|

6094

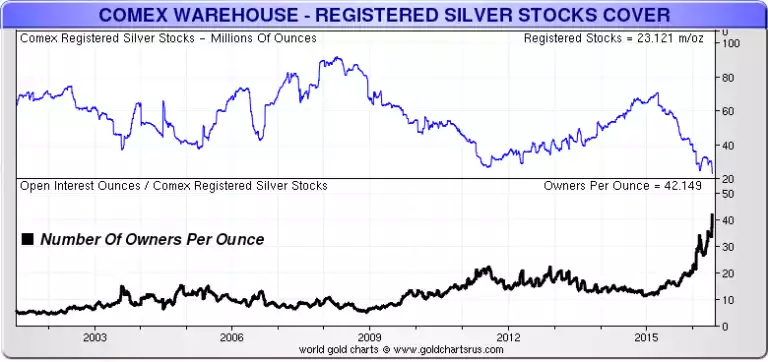

Yesterday we spoke mainly of the ETF side of the ‘paper’ or ‘digital’ trades in gold. Topically, this week also saw a new record reached in the silver COMEX futures market. We now have the epic setup of 42 contractual claims for every 1oz of registered physical silver. This is on the back of Registered silver inventories hitting an over 15 year low as this last week saw a massive 7 million oz removed to leave just 23m oz as you can see in the graph below:

You will note from the chart that the last time registered inventories got this low coincided with silver peaking at $49 in mid 2011. Now there will be the usual responses to this so let’s address them.

Firstly, yes there are also the Eligible inventories on COMEX (from which metal moves into Registered for possible delivery) but as we’ve reported before many an expert believes that at times of particular tightness in the physical market, the COMEX participants move their metal into Eligible so that should the big squeeze occur, they have access to it by simply withdrawing it. The 2011 price spike to $49 saw exactly that. Even counting Eligible inventories we still have nearly 7.5 claims per ounce available. But be clear, those Eligible inventories are not automatically available so right now that 42:1 is more relevant.

Secondly, there’s the “yeah but they will just be paid out in cash” crowd. Yes that is absolutely true, but can you just imagine the price action when word got out that there wasn’t enough silver to satisfy a contractual claim on the worlds biggest futures exhange. Look what happened in 2011 when it just got a little tight! We are talking about very big numbers and very big players… How big?

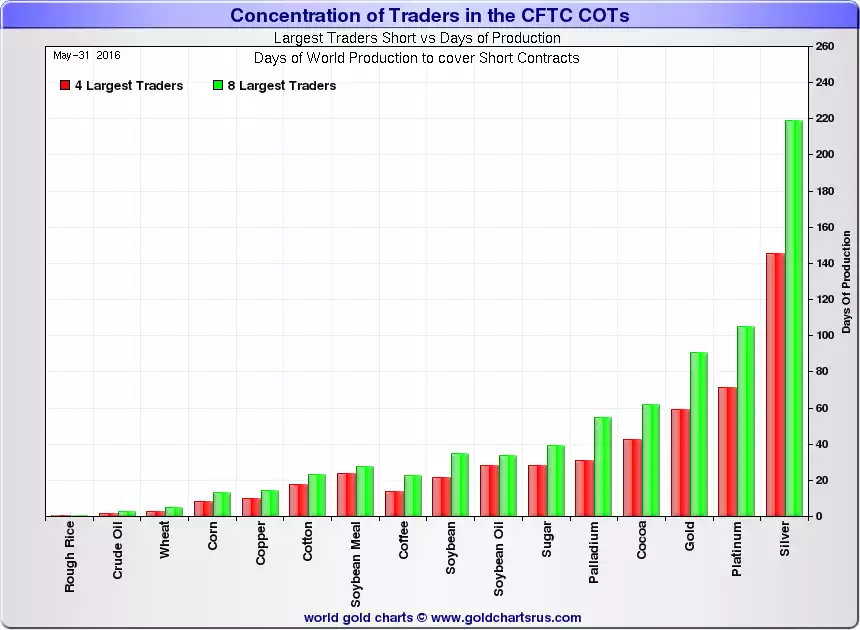

The two largest silver shorts on COMEX, JPMorgan and Scotiabank, are collectively short around 104 days of world silver production, or almost three quarters of the length of the red bar in chart below. The top 8 traders are collectively short nearly 220 days or 60% of entire world annual production.

For Gold investors, you can see it is the 3rd most strung out commodity traded on the futures market.

Whilst these guys play their precarious game, you have the opportunity to very easily buy physical silver bars and coins at the bargain price all this futures shorting has delivered on a (silver) plate…