Heading to “New World Order”

News

|

Posted 04/12/2020

|

7883

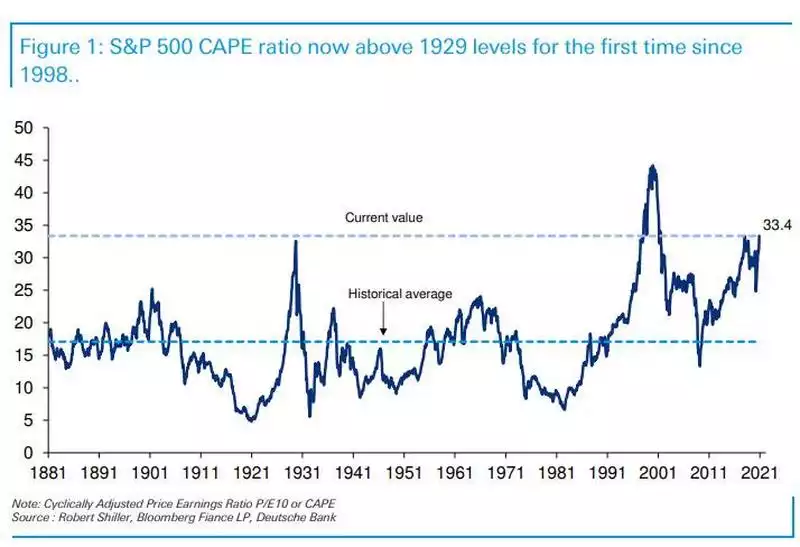

Last night saw Wall St hit new all time highs before a late hour plunge on news that this year’s vaccine rollout will be halved due to supply chain issues. We are now officially in the 2nd highest valued market in all history having surpassed the eve of the Great Depression in 1929 on the most widely respected valuation metric the CAPE, or the cyclically adjusted price earnings measure. CAPE smooths things out, looking at 10 years of earnings not just this moment. Looking at data since 1881, only the epic dot.com bubble has seen a higher measure than that now per the chart below. It’s author, Robert Shiller coined the phrase “Irrational Exuberance”, and you couldn’t pen a better description of what is going on now with valuations now twice the 140 year average…

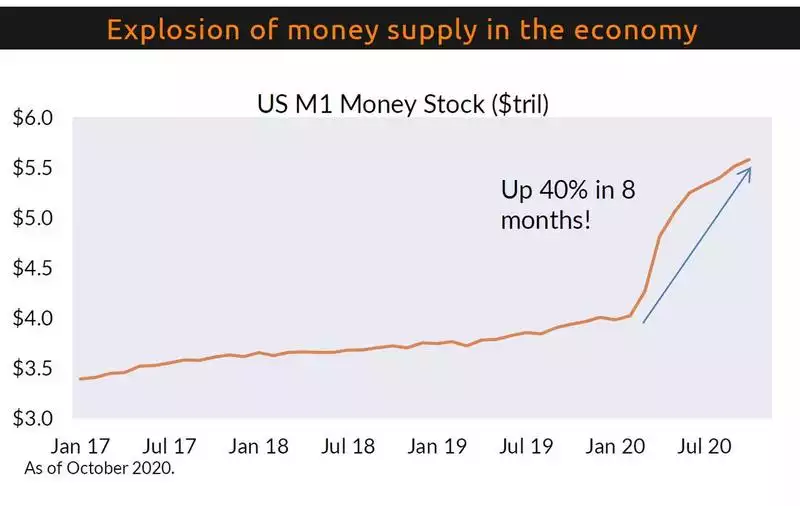

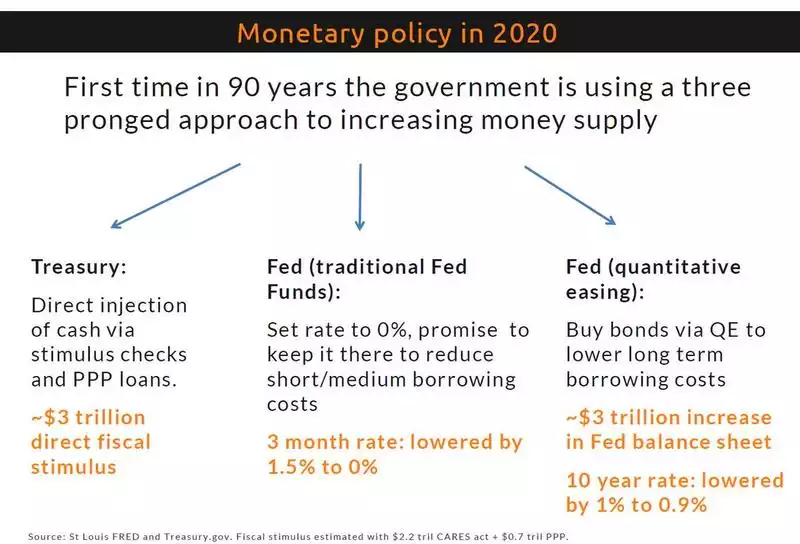

How this happened is no surprise to regular readers. The US has created an unprecedented amount of new money. The chart below puts that into perspective, showing that M1 has increased 40% in just 8 months this year. In June alone they printed more money than in the first 2 centuries after its founding in 1776. Just digest that.

Whilst trying to cause inflation all it has done is inflate financial asset prices and lower the USD.

In other words, not since the Great Depression have they employed all the canons like that now.

That falling USD is seeing our AUD rise, now at 74.4c, a high not seen since July 2018. That of course has taken some of the shine off the rising gold and silver prices of late in local terms, but one would have to question how this can stay elevated as the China trade war with Australia intensifies regardless of the USD denominator falling.

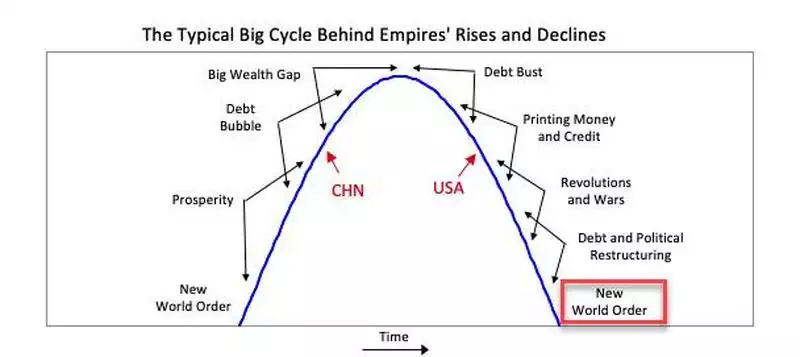

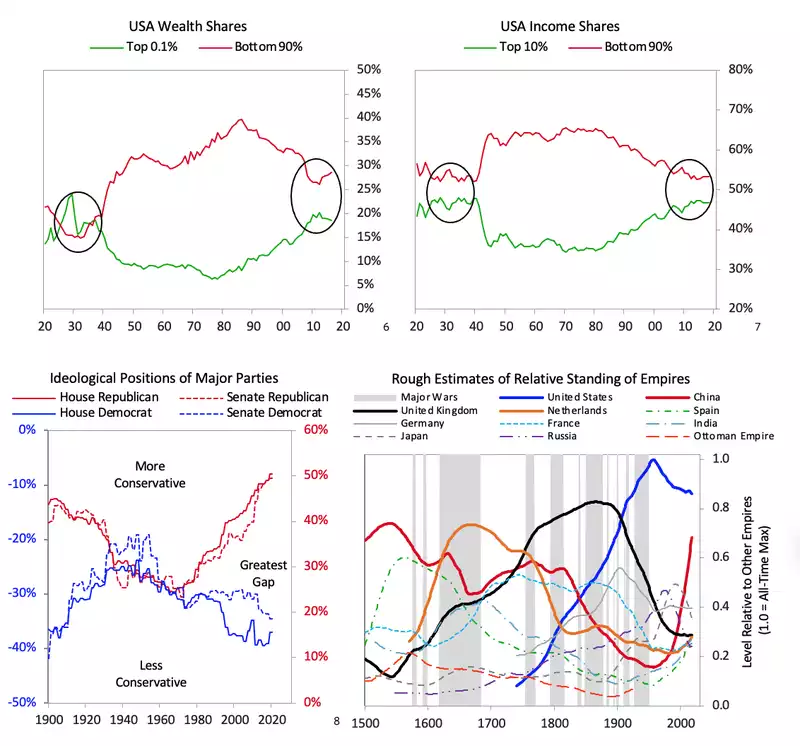

Such major historic instances are topical as we head toward what has all the hallmarks of an ‘end of debt cycle’ nadir. Ray Dalio, head of the world’s largest hedge fund Bridgewater, wrote to this earlier this year. If you haven’t read them yet, our 2 part coverage is a must read here and here.

At a time when the US is printing and stimulating with reckless abandon, China has been strategically amassing gold holdings, reducing US Treasury holdings, and implementing tighter economic policy. From Bloomberg:

“The fact that U.S. policy makers are still pedal-to-the-metal with monetary stimulus stands in sharp contrast to China, where officials have set their sights on an exit from loose policy. Consider recent events:

- Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, described China’s property market as the biggest “gray rhino” - an obvious yet ignored financial risk.

- Guo also pledged to impose “special and innovative regulatory measures” on financial technology behemoths such as Jack Ma’s Ant Group. The recent regulation changes have essentially put these fin-tech companies under the similar supervision umbrella as traditional banks to avoid excessive leverage.

- Beijing has allowed a number of SOEs to default, breaking the implicit government guarantee.

- PBOC Governor Yi Gang vowed to avoid monetizing government debt. In addition, officials have said low interest rates contributed to social inequality.

Clearly, there’s a sense of urgency to address financial risks and close the gap between markets and the economy. In the meantime, the buzz in Beijing is that the financial industry should serve the real economy and people.

What China is doing makes perfect sense in the context of the big economic cycle described by Ray Dalio. In his latest essay published Tuesday, Bridgewater’s founder showed that China is in the midst of a debt bubble and the beginning of widening wealth gap. Apparently, China wants to tackle both before it’s too late.

In contrast, the U.S. has passed the peak of its economic power, settling into the stage of money printing after the burst of the debt bubble, according to Dalio.

"It is in this stage when there are bad financial conditions and intensifying conflict,” wrote Dalio. “Classically this stage comes after periods of great excesses in spending and debt and the widening of wealth and political gaps and before there are revolutions and civil wars. United States is at a tipping point in which it could go from manageable internal tension to revolution and/or civil war."”

No one ever thinks such monumental historical events can happen in their lifetime. By definition they always do in someone’s….