A Critical Time for Crypto

News

|

Posted 08/03/2022

|

6687

Bitcoin prices have traded within a volatile consolidation range this week, opening at a weekly low of $37,333 US, rallying to a high of $45,039, and then giving back the majority of the gains, closing at $39,220. As the global macro and geopolitical stage continue to create uncertainty in markets, Bitcoin bulls attempt to set a price floor. The bulls have been absorbing a modest but persistent sell-side pressure for over two months now, largely sourced from by short-term holder divestment.

With prices trading sideways in recent weeks, a relative equilibrium has been established. However, given the limited incoming fresh demand, this delicate balance can be disrupted by any significant degree of seller exhaustion, or conversely a re-invigoration of sellers.

Thus, the question to be answered is whether the capital support being provided by the bulls will be sufficient to keep the bears at bay. We can assess the current on-chain volume space, with a specific focus on flows into exchanges to best find the magnitude of sell-side pressure and investor divestment.

Monitoring of exchange activity is a powerful strategy within on-chain analysis, although it does require an appreciation of data mutability. The tracking of aggregate exchange flows, especially over longer periods (months), provides useful insight into the balance of supply and demand. To start, there are high-level nuances for interpreting exchange balance metrics:

- Bitcoin HODLers (of all wallet sizes) tend to be fairly religious regarding self-custody, and are thus the most likely cohort to withdraw their coins.

- Newer retail level market entrants are far less likely to withdraw coins, preferring the simplicity of custody solutions, and trading options provided by exchanges.

- Institutional treasuries are similarly likely to take advantage of exchange custody solutions or similar), preferring the expertise and risk management offered by such firms. These coins are also more likely to be traded via OTC desks and held in specialised multi-signature arrangements.

- With the proliferation of derivatives markets, Bitcoin units can also be used as collateral, and thus exchange inflows may also be a result of providing additional coin margin.

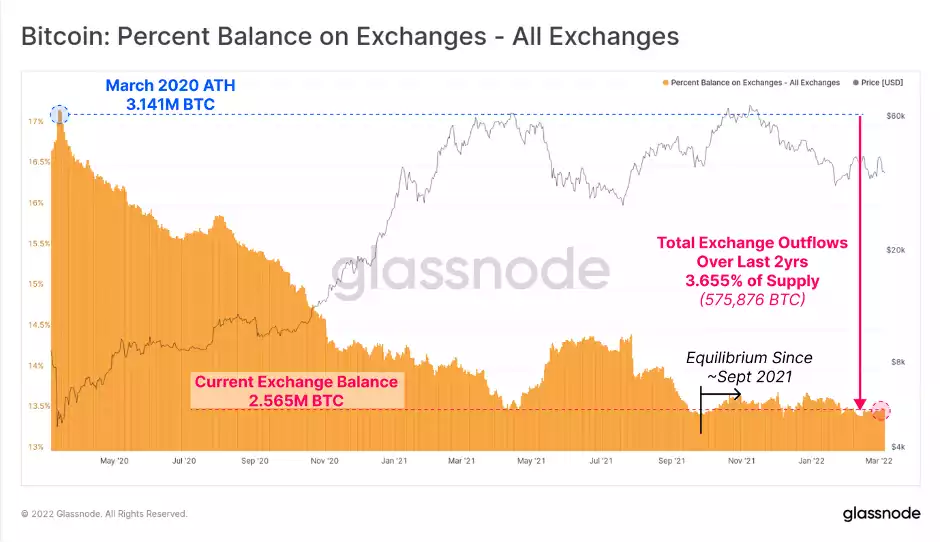

Note that 3-of-4 of the above characteristics have a skew towards exchange inflows. This is in part what makes the aggregate outflow of 575,876 BTC from exchanges (3.655% of supply) since the March 2020 sell-off so impressive. Note also how a relative equilibrium has been established since September 2021.

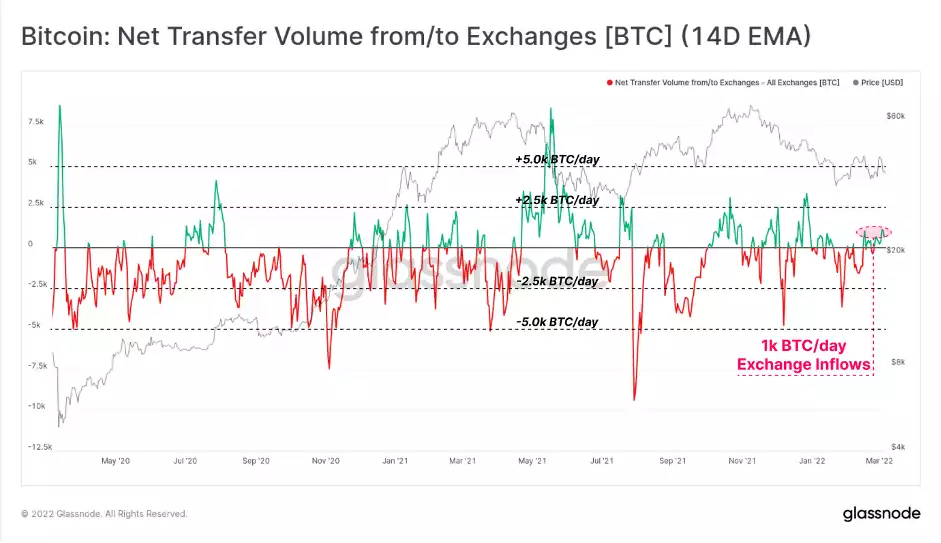

During the highly volatile macro and geopolitical events of the last few weeks, exchange net-flow volumes are also reasonably stable, despite a slight bias towards inflows this week. Around 1k BTC per day in net inflows deposited to exchanges this week. This magnitude presumes sell-side supply remains fairly modest, particularly given the global macro context.

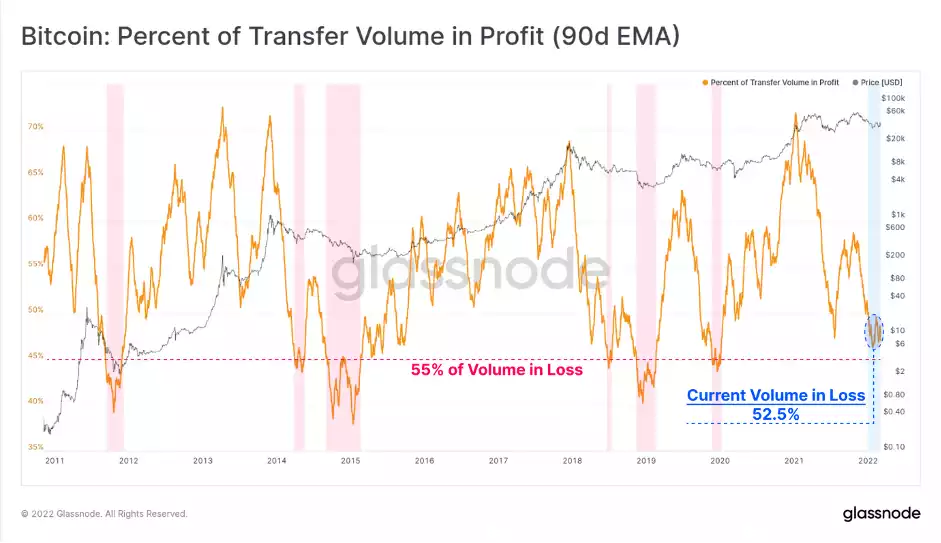

The proportion of on-chain volume that is in profit is also near historically low levels, reaching 47.5% this week. Flipping this observation around, we can observe that over half (52.5%) of all transaction volume is currently spent at a loss. For context, the final stages of previous bear cycles (marked in red) were interrupted by over 55% of all transfer volume being in loss (capitulation events).

The current drawdown is historically significant across several on-chain metrics and measures, despite being shallower (-50%) than past bear markets (-85%). This describes characteristics that are similar to previous late-stage bear market trends. However, whilst the degree of on-chain 'panic selling' is significant on a statistical basis, it is notably lower relative to market size – this is a result of a maturing market.

Investors who are divesting are preferring to sell coins that are held at a loss, an activity that has been dominated by Short-Term Holders. Meanwhile, the Long-Term Holder sell-side has continued to decline since Jan 2021 a signal of growing conviction in the face of high macro uncertainty. We're certainly operating on a delicate equilibrium in the crypto market, making it an incredibly critical time for this market.