Silver Jumps On Inflation Surge

News

|

Posted 14/04/2021

|

5747

There remains a lot of talk about whether or not we are going to get high inflation from analysts to mum and dad investors. The reality is, however, that high inflation is already here, it’s just being masked by official ‘CPI’ figures that have a basket of goods selected and manipulated by Governments together with decade long near stagnant wage growth.

Last night we saw a hotter than expected print of even the official US CPI figures, coming in at 2.6% annualised after a 0.5% month on month rise for March, the biggest jump since June 2009. Putting aside the obvious base effects as the economy recovers, in years past this would have seen the Fed start to taper its stimulus. However just this last weekend the Fed Chair Jerome Powell reiterated in a 60 Minutes interview “We can wait to see actual inflation before we raise interest rates”. Let’s be very clear, the Fed does not want to raise rates nor cut back QE as they are the only thing driving this market. 2018 will be fresh in their mind. Using geometric vs arithmetic means and outright or hedonic adjustments made to the CPI basket will allow them keep that CPI lower than we are all feeling but last night demonstrated there is only so much they can do.

Bringing it home to Australia, our last CPI print was at the end of January where we saw a 0.9% jump for the quarter but just 0.9% year on year. Now compare that to what you or someone you know just paid for a second hand car, fuelling up that car, buying a home or paying your rent. On the latter, talk to a builder or building supplier about the price rises already in play and what’s to come. There promises an ugly mix of construction price rises and builder insolvencies amid post contract price rises as our building boom loses control. Building insurers are pre-emptively reigning in cover; they know what’s coming.

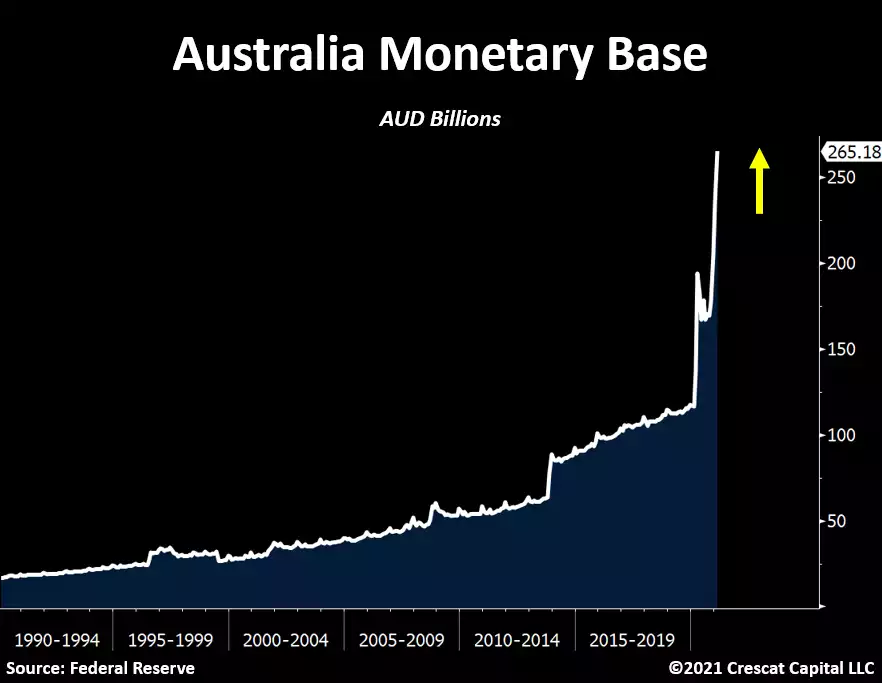

The reality is that the lowest interest rates in history mean people with means can borrow and buy like never before and hence inflation is playing out in shares and ‘assets’ rather than the usual basket of goods. Remember this is all by design. The following chart puts in to clear perspective what’s going on with the RBA and its Yield Curve Control program. What you are looking at is Australia’s central bank printing almost $100b in just 2 months. The next CPI print will be very interesting indeed….

The RBA’s YCC program is all about containing 3 year rates to just 0.1% so that banks can lend to you at ultra low rates (and still make money) and get you to borrow and spend and prop up the economy and increase inflation to reduce that very same debt burden they are blowing up to bubble like proportions. Irrespective of Ponzi scheme analogies, just ask yourself on what planet is that fundamentally sustainable.

I was in a big 4 bank yesterday doing some banking and was aggressively sold being able to refinance my home at just 1.89%. Setting aside what this obviously means for Australia’s property bubble, it begs the question why I wouldn’t use that to buy other assets that will perversely benefit in price growth in such an environment. The bank is virtually throwing money at me at a time when assets that will benefit from the inflation that is actually already here and looks only to go higher still are underpriced when viewed against this monetary expansion.

It is no coincidence then that silver jumped nearly 2% last night off the US CPI print. It presents the perfect value proposition of commodity in tight supply benefitting from this reflation drive and monetary metal benefitting from rampant currency debasement up to and including the inevitable reckoning that must come at the end of all this.

As the market realises that high inflation is already here, just not where we are used to or told to look, assets such as silver and gold are set to truly shine.