Psychology of a Crash

News

|

Posted 30/06/2017

|

6647

Yesterday we talked of the psychology of markets and last night’s sharemarket action was a little instructive in regard to yesterday’s article.

Wall St saw more losses and a spike in the VIX (volatility index) last night on the back of growing statements not just from the US Fed but other central banks around the world posturing toward tightening the very easy monetary policies that have fuelled this 9 year party. We wrote of this recently here.

It’s not entirely reassuring either when US Fed member Bullard last night said publicly they have been raising rates against a backdrop of relatively weak growth with downside inflation surprises, and that the market reaction to the March tightening has not been good; he would have expected yields to rise with the policy rate. Shares sold off…

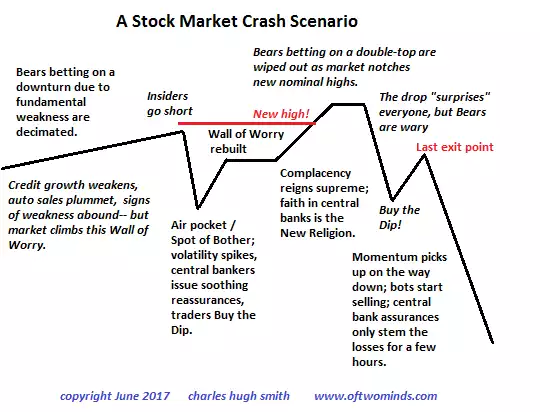

But where to from here? Continuing the market psychology theme of yesterday we came across the following from Charles Hugh Smith from OfTwoMinds. Charles provides his scenario of how share market crashes play out “based not on cycles or technicals or fundamentals, but on the psychology of the topping process, which tends to follow this basic script:”

Some may think we are always ‘crying wolf’ in our daily articles and the attack has still not occurred. On the contrary, we never tell you when the attack will occur, we are simply reminding you that the wolf is still out there and Little Miss Riding Hood is getting fatter and juicier maxing out her credit card on her voracious appetite and the Little Pigs have mortgaged the brick house to build a two straw based blocks of apartments in the CBD…. Anyway… as Charles puts it:

“When there are too many bearish [aka wolf] reports of gloomy data, and too many calls to go long volatility or go to cash, the market perversely goes up, not down.

Why? This negativity creates a classic Wall of Worry that markets can continue climbing. (Central banks buying $300 billion of assets a month helps power this gradual ascent most admirably.) The Bears betting on a decline based on deteriorating fundamentals are crushed by the steady advance.

As Bears give up, the window for a Spot of Bother decline creaks open, however grudgingly, as central banks make noises about ending their extraordinary monetary policies by raising interest rates a bit (so they can lower them when the next recession grabs the global economy by the throat).

As bearish short interest and bets on higher volatility fade, insiders go short.

A sudden air pocket takes the market down, triggered by some bit of "news." (Nothing like a well-engineered bout of panic selling to set up a profitable Buy the Dip opportunity.)

And since traders have been well-trained to Buy the Dips, the Spot of Bother is quickly retraced.

Nonetheless, doubts remain and fundamental data is still weak; this overhang of negativity rebuilds the wall of Worry.

Some Bears will reckon the weakened market will double-top, i.e. be unable to break out to new highs given the poor fundamentals, and as a result we can anticipate a nominal new high after the Wall of Worry has been rebuilt, just to destroy all those who reckoned a double-top would mark The Top.

Mr. Market (and the central banks) won't make it that easy to reap a fortune by going short.

As the market lofts to new nominal highs, the remaining Bears will be hesitant to go short, and Bulls will note that despite the dire warnings of analysts and the gloomy data on auto sales, credit expansion, productivity, wages, etc., the market keeps chugging higher.

This will infuse participants with complacency and a general sense that the market has weathered the worst than could be thrown at it.

When the surviving Bears have become wary, and the market's resilience in the tide of negative news seems to point to further gains--at that point, the market finally rolls over and "surprises" everyone.”

Quite the turbulent ride huh… Having some of your wealth in gold will make that a whole lot more relaxing, and you potentially then jump in at the bottom of that real dip at the end; the 50-80% type ‘dip’….