Plummeting Silver Production Demonstrates Alluring Property of Silver & Bitcoin Mining Alike

News

|

Posted 07/08/2017

|

6251

Exactly one week ago we posted an article entitled “Share Trading Versus Gold Panning: Where Effort Produces Value”. The piece related to the inherent value in the effort required to mine gold. Mining is a large scale, long term endeavour requiring allocation of capital and the adoption of financial and political risk to be at all viable.

Consequently, mining is a process that cannot be significantly altered in the short term. Coeur D’alene for example, a major silver miner, managed to reduce its costs by 26% from 2014 to the first quarter of 2017. Although an impressive reduction, the amount of time required to do that (especially when considering that the silver bear market started in 2011) is quite obvious.

We’ve noted previously that “mines are complicated and capital intensive. You can’t cut 26% costs in a mine overnight. There are a lot of moving parts and there are dozens of things that can go wrong”. A desirable result of this mining inertia is the fact that the commodities produced by mining operations are both limited in terms of supply and variable in terms of supply rate. These properties are interestingly also common to bitcoin mining, which is the analogous process by which bitcoins come into existence.

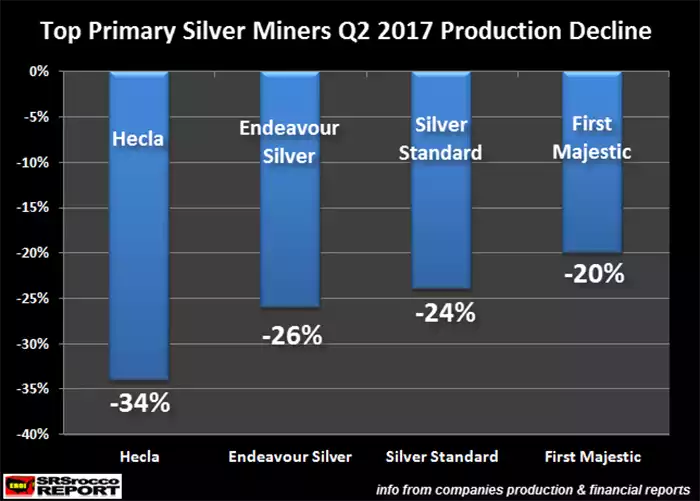

Topically, mining output restraint is very well exemplified by an SRS Rocco article posted on Friday. As pictured below, the article reveals that 2017 Q2 saw extraordinary falls in silver output from four of the top primary silver miners; Hecla, Endeavour Silver, Silver Standard and First Majestic.

Figures compiled from recently released company data show silver production reductions in the range of 20% to 34%; figures that fall “well beyond normal fluctuations in mining company production figures” and hence demonstrate fundamental supply side pressures.

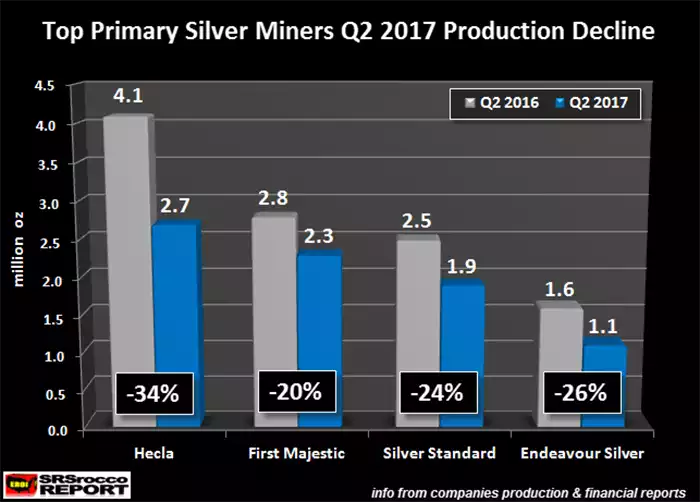

This trend is perhaps even more obvious when the breakdown is viewed in terms of ounces as pictured below

The reasons for these falls are an effective way of demonstrating the difficulties native to mining operations. Hecla’s silver output for example was hindered by a labour strike at their Lucky Friday mine in Idaho. Endeavour Silver experienced output declines due to “narrowing veins, falling ore grades and less ore production due to reduced capital expenditures in the beginning of 2016” along with reduced access to mine areas “as pump failures due to power overloading caused flooding in some portions of the mines”.

Silver Standard’s mining output suffered from the closure of their Pirquitas open-pit operations coupled with the fact that their Chinchillas underground project which was intended to accommodate this closure won’t begin production until the second half of next year. Experiencing issues similar to Hecla was First Majestic which saw silver output impacted by an 8% drop in ore yield over the last 12 months and union related labour disruptions.

Far from an isolated set of coincides however, the article cites low silver prices as an overarching common factor in the declines experienced by these silver miners; something that fails to accurately price in costs of risk and costs of production.

This revelation plays out well in the wake of our article posted exactly 4 weeks ago entitled “Silver’s Flash Crash & The Real World Problems Low Prices Create”. In it we note that the between Coeur and Hecla, there could be a lot more than 30 million ounces of silver production a year in major trouble at current silver prices and this puts the supply side at further risk in an already high physical demand environment.

Owning an asset that can only be produced through an arduous process is an alluring proposition to investors and it is partly the difficulty inherent in mining that makes the decision to own that which is mined so easy.