Chinese & Indian Gold Demand Surge

News

|

Posted 22/10/2021

|

7465

The world’s biggest consumers of gold, China and India are both showing early signs of a big rebound in demand.

In China, the worlds biggest consumer and producer of gold, falling gold production is exacerbated by steeply rising demand. Last month saw withdrawals from the Shanghai Gold Exchange (SGE) of 191 tonne, an increase of 27% month-on-month and 63% higher year-on-year. Whilst the world’s biggest producer*, China had to import another 77 tonne in August, up 10 tonne on July. This tightness of supply amid growing demand saw premiums paid over spot rise 29%. Whilst the Chinese famously prefer the real thing, ETF inflows have also surged with September seeing the 4th consecutive month of gold inflows taking the total of inflows this year to 11 tonne and currently sitting at a total of 72 tonne, the 2nd highest level on record.

All up, the World Gold Council say demand in the first half of this year was up 69% with 547 tonne of gold consumed. WGC are notoriously conservative in their Chinese gold consumption estimates taking what the Chinese provide them. Most Chinese gold experts believe SGE withdrawals are the most accurate record of overall Chinese consumption and that sits at 804 tonne for the first half of the year. To the end of August that grows to 1006 tonne which is 51% higher than 2020 year-on-year. When set against a 10% drop in Chinese mine output the pressure on global supply becomes apparent.

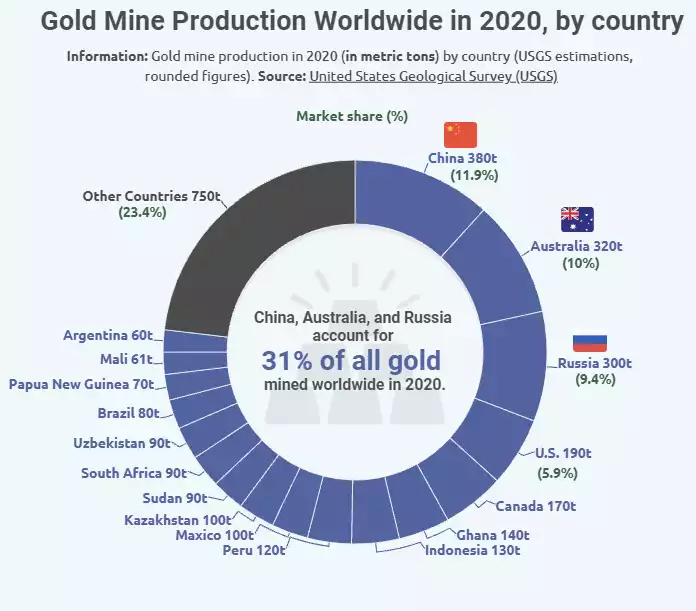

2020 already saw a big drop in Chinese mine supply, and at 153 tonne for the first half of 2021 it both pales against demand but also annualises as a further drop again on the 2020 380 tonne total per the chart below. Should Australia maintain output, as it is predicted to do, and China maintain their year to date rate, it would see Australia claim the crown of biggest producer in the world as Russia continues to struggle.

At just a little over a week out from the Indian festival of Diwali, India too is showing signs of increasing demand. Gold imports in August of 121 tonne nearly doubled year on year to the highest level in 5 months. At 687 tonne for the year to August, India has tripled the amount imported over the same period in 2020. Like China, Indians usually prefer the physical form, but they too have dramatically increased their ETF exposure with $60m on inflows in September, 20 times higher than August. From The Economic Times in July:

“According to a World Gold Council report released on Thursday, gold demand in India in the quarter to June was up 19.2% year-on-year to 76.1 tonnes while total jewellery demand increased 25% to 55.1 tonnes.

Total Investment demand increased 6% year-on-year during the quarter to 21 tonnes. Total gold recycled in India was 19.7 tonnes, as compared to 13.8 tonnes a year ago, an increase of 43%. Total gold imports in India surged 1,004% to 120.4 tonnes, from 10.9 tonnes in the year-ago period.”

Ainslie have Perth Mint’s beautiful Silver and gold Gilded Diwali medallions available now for sale in readiness for Diwali in a little over a week’s time. We also have ample stock of traditional gold Diwali favourites like the 5g, 10g, 20g and 1oz Perth Mint minted gold bars available with special Diwali themed sleeves for the ultimate gift.