This Is What Bitcoin Does

News

|

Posted 02/03/2021

|

5740

Wow… what a week for crypto. Last Monday we say the largest single day pullback in Bitcoin’s already volatile history. Bitcoin was down 24% in the seven days through Sunday. It's also the worst weekly performance since March 2020. Prices have declined on six of the past seven days.

Bitcoin’s price move appears to be a continuation of last week's trend, when bitcoin fell amid concerns that rising U.S. Treasury bond yields might prompt the Federal Reserve to tighten monetary policy sooner rather than later to keep inflation from rising out of control; analysts have said such a move could prompt a sell-off in risky assets including stocks and bitcoin with the latter coming out the other side.

Bitcoin failed to get a lift last week from seemingly bullish news including Coinbase's march toward a public stock listing and a report from JPMorgan, the biggest U.S. bank, arguing that investors could allocate 1% of their portfolios to the largest cryptocurrency.

On the upside, a close above US$45,000 looks to reverse Bitcoin’s trajectory over the last week. US$48,200 will be the first target to be chased down, and back above US$50,000, everyone will forget last week ever happened and will be shouting for a return to the all-time highs… its funny how quickly sentiment changes like that.

The question now for BTC in the medium-term is whether the HODLers can withstand a further drawdown, and at which point the longs will start to feel the pain.

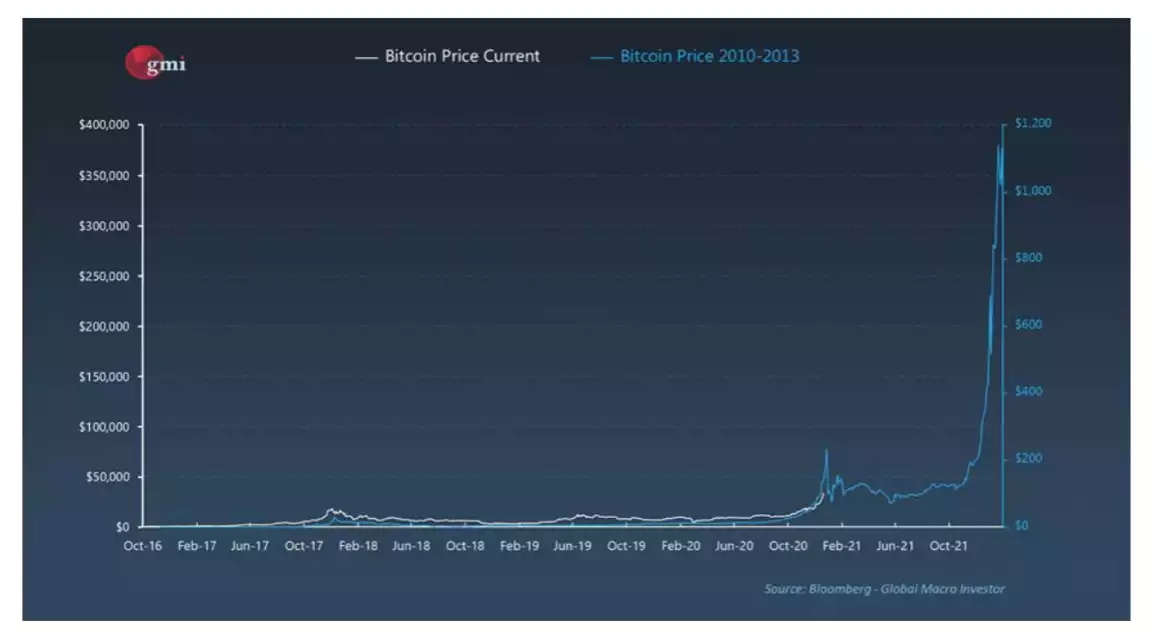

The pull backs we have been experiencing so far this year have been like clockwork. You can overlap previous bull runs and the timing lines up almost spot on. This is what bitcoin does. Bitcoin, during a bull market, WILL pull back 20-30% and then quickly rocket to new all-time highs, wiping the floor with those who sold. As we’ve discussed previously, on average a 30% pullback is followed by a 150% rally.

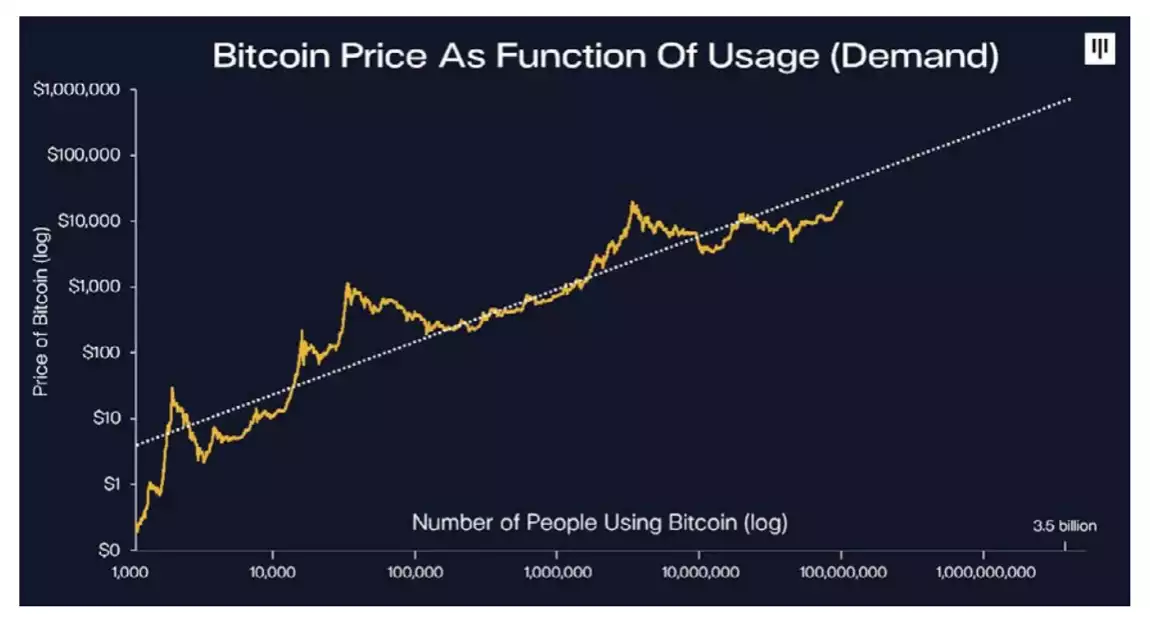

All these price movements are mush if you are a long-term believer in what the crypto revolution means. Whether you believe Bitcoin will be the world’s reserve currency or you just see it as a promising emerging asset, the correlation between users and price is undeniable. The chart below says it all…

What’s even more exciting is comparing our current run to previous bull markets. As we said, the overlays are remarkably similar…

As exciting as those charts are, Bitcoin is long overdue for some consolidating price action. After such a heated run up, a consolidation phase of 3-4 weeks is healthy. Bear in mind that the last pull back (8th-22nd Jan) was only 2-weeks long before the market started printing new high’s all over again.

While history tends to be a good indicator of what to expect going forward, each bull market will be different. Especially now that holding BTC as a “macro play” is becoming more and more prevalent. Let’s see what the experts are saying;

"I've held a price target of $100,000 per bitcoin by the end of 2021 since I publicly wrote about it in 2019," says Anthony Pompliano, partner at digital asset hedge fund Morgan Creek Digital, speaking over email. "[I'm] sticking with that, yet somehow have become the most conservative person in the room."

"Bitcoin has already had a fantastic year and any further gains would indeed be a blessing. The main driver lately has been the rush from multinational corporations to diversify out of fiat money and into crypto—a trend that we see as just getting started now " says Mati Greenspan, the founder of market analysis company Quantum Economics, speaking via Telegram.

"One major driver of demand is a spectacular increase in high quality bitcoin education breaking through the noise created by altcoin founders and fund managers with the incentive to spread misinformation. [And] the continued development and many new launches of retail platforms, funds, and trading venues are making it even easier for people everywhere to purchase bitcoin."

One of Bitcoin’s biggest cheerleaders, MicroStrategy’s Michael Saylor, has an even greater prediction, saying “[Bitcoin is] going to subsume negative-yielding sovereign debt and other monetary indexes until it grows to $100 trillion,” going on to add that he believes BTC volatility will ease as the market cap exceeds $12 trillion.

Despite these expected "bumps," most in the bitcoin and cryptocurrency space are predicting the bitcoin price will continue to rise over the long term. Regardless of price, the value of bitcoin in the long-term is almost guaranteed to rise due to limited supply, which makes it attractive for underbanked populations and any other traditional investors, especially when compared to fiat currencies subject to crippling inflation and unlimited supply.