Paradox at Play

News

|

Posted 25/03/2015

|

3821

There are a number of ‘paradox’s’ at play in this global economy.

Governments are racking up debt as they spend or print money to try and stimulate the economy. The problem is, as we’ve reported many times, debt to GDP ratios are through the roof around the world, and all that debt is a burden that eventually drags economies down as they need to service the interest.

Whilst governments and corporations are embracing new debt, many individuals are actually saving as they try to deleverage having learned the lessons of the GFC. When you refer to the table in the link above you can see that this is the case in the US, but our love affair with overpriced property in Australia has seen the opposite, meaning Australia has one of the highest personal debt levels in the world. You can understand the RBA’s dilemma in reducing rates further…

The Paradox of Thrift is the phenomenon where saving may be good for an individual, but it is bad for an economy as a whole. This is certainly the case for the US (when combined with a near 40 year low labour market participation rate… but don’t call it unemployment…)

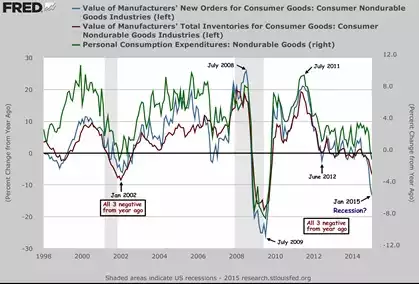

When a single person saves, he improves his personal finances. But when many people save, consumer spending goes down. Then sales go down...profits go down...and the entire economy goes into recession. The graph below shows this may not be far away for the US.

This and the various other graphs of the ‘real economy’ lately are not scare mongering. We are demonstrating that financial markets are inflated by stimulus not fundamentals. That simply can’t last forever, and some argue, much longer at all. We are simply suggesting it may be time to increase your “insurance” against that crash. And as of today, it’s even cheaper to have it shipped to you!