WGC – Gold Demand Trends Q1 2019

News

|

Posted 07/05/2019

|

6222

It’s that time again when we see the World Gold Council release the first of its quarterly Gold Demand Trend reports for the year. As usual we summarise for you.

Central Banks

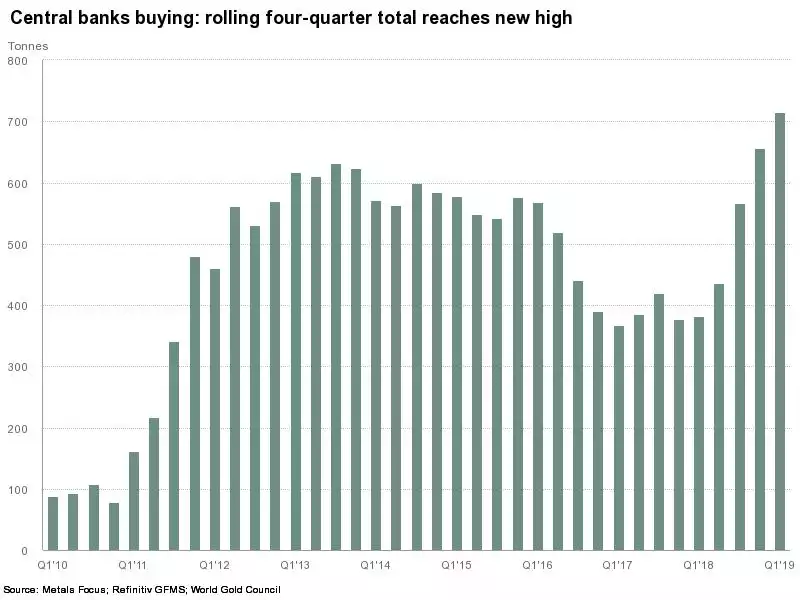

Central banks bought 145.5t of gold, the largest Q1 increase in global reserves since 2013. Diversification and a desire for safe, liquid assets were the main drivers of buying here. On a rolling four-quarter basis, gold buying reached a record high for our data series of 715.7t.

Jewellery

Q1 jewellery demand up 1%, boosted by India. A lower rupee gold price in late February/early March coincided with the traditional gold-buying wedding season, lifting jewellery demand in India to 125.4t (+5% y-o-y) – the highest Q1 since 2015.

Exchange Traded Funds

ETFs and similar products added 40.3t in Q1. Funds listed in the US and Europe benefitted from inflows, although the former were relatively erratic, while the latter were underpinned by continued geopolitical instability. That this occurred in the US amid the strongest sharemarket quarterly rally seen in 10 years possibly speaks volumes to the fundamental ‘belief’ (or more pointedly, lack thereof) in that same rally.

That aforementioned European ‘geopolitical instability’ remains a key driver of investment in the region, with investors prizing gold’s safe haven status amid the background of low/negative yields, financial market volatility and geopolitical worries. The forthcoming European parliamentary elections and the possibility that right-wing, populist parties will gain more of a foothold in the region, are a looming concern. As are Italy’s burgeoning budget deficit and the ongoing Brexit saga. The latter helps to explain why holdings in UK-listed funds remained near all-time highs in Q1.

Bar and Coin Investment (Bullion)

Bar and coin investment softened a touch – 1% down to 257.8t. China and Japan were the main contributors to the decline. Japan saw net disinvestment, driven by profit-taking as the local price surged in February. In China many retail investors were more focused on the surging stock market – the Shanghai Shenzhen CSI 300 was up a staggering 30% in Q1 [but has fallen in Q2] – and stronger currency, both of which were aided by recent fiscal and monetary policies designed to boost domestic economic growth. This collectively pushed global bar demand down 5% y-o-y. Official coin demand, however, had its best start since 2014, rising 12% y-o-y to reach 56.1t. Iran, Turkey, South Africa, the UK and US accounted for most of this growth. The US saw bar and coin demand rise 38% y-o-y and Europe up 10% highlighting the dominance of what happens in China overall. Interestingly, amongst all the Brexit uncertainty, bullion demand rose a staggering 58% in the UK.

Industrial

Gold used in applications such as electronics, wireless and LED lighting fell 3% to 79.3t. Trade frictions, sluggish sales of consumer electronics and global economic headwinds hit the technology sector.

Supply

Total supply was virtually flat at 1,150t (-0.3% y-o-y). Modest growth in mine production (1%) and recycling (5%) was supported by a second consecutive quarter of net hedging (10t).

Looking at the top 3 producers, Russian production grew by 4% y-o-y in Q1, primarily due to the ramp-up of the Natalka open-pit mine. This was also supported by growth at several other projects, particularly in the far east of the country. Australian output rose by 3% y-o-y, thanks to the ramp-up of Mount Morgans and Cadia Valley. Both are dwarfed by the biggest producer China where production fell but the impact of stringent environmental regulations was more muted: national gold production fell 2% y-o-y in Q1, compared with y-o-y declines of up to 8% since 2016.1 Most of the major mining companies within the country are now compliant with the regulations after a tough adjustment period.